Decoding The Nifty 50 Chart On Moneycontrol: A Complete Information For Traders

Decoding the Nifty 50 Chart on Moneycontrol: A Complete Information for Traders

Associated Articles: Decoding the Nifty 50 Chart on Moneycontrol: A Complete Information for Traders

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Nifty 50 Chart on Moneycontrol: A Complete Information for Traders. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Nifty 50 Chart on Moneycontrol: A Complete Information for Traders

The Nifty 50 index, a benchmark for Indian equities, is a vital instrument for traders navigating the dynamic panorama of the Indian inventory market. Moneycontrol, a number one monetary web site, supplies a complete and user-friendly interface for accessing and analyzing the Nifty 50 chart. Understanding the right way to interpret this chart successfully is paramount for knowledgeable funding choices. This text delves into the assorted features of the Nifty 50 chart on Moneycontrol, explaining its options, functionalities, and the right way to put it to use for strategic buying and selling and investing.

Understanding the Fundamentals: What the Nifty 50 Chart Represents

The Nifty 50 chart on Moneycontrol shows the historic and real-time worth actions of the Nifty 50 index. It visually represents the weighted common of the 50 largest firms listed on the Nationwide Inventory Alternate of India (NSE). These firms signify a good portion of the Indian financial system throughout numerous sectors. The chart usually reveals the index’s worth over a selected time interval, starting from intraday to a number of years. Completely different chart sorts, mentioned later, supply numerous views on worth motion and traits.

Navigating the Moneycontrol Nifty 50 Chart Interface:

Moneycontrol’s Nifty 50 chart interface is usually intuitive, providing a number of customizable options:

-

Timeframe Choice: Customers can select the timeframe for the chart, starting from 1 minute to a number of years. This permits for evaluation of short-term worth fluctuations (intraday buying and selling) or long-term traits (funding methods). Choices usually embody 1m, 5m, 15m, 30m, 1h, 1d, 1w, 1m (month), 3m, 6m, 1y, 5y, and Max.

-

Chart Kind Choice: Moneycontrol normally supplies numerous chart sorts, every providing a singular perspective:

- Candlestick Chart: This fashionable chart sort shows the opening, closing, excessive, and low costs for a particular interval, offering insights into worth momentum and potential reversal factors.

- Line Chart: A easy chart connecting closing costs, helpful for visualizing long-term traits.

- Bar Chart: Just like candlestick charts, however with out the visible illustration of the opening and shutting costs inside the bar.

- Space Chart: Illustrates the cumulative worth motion over time.

-

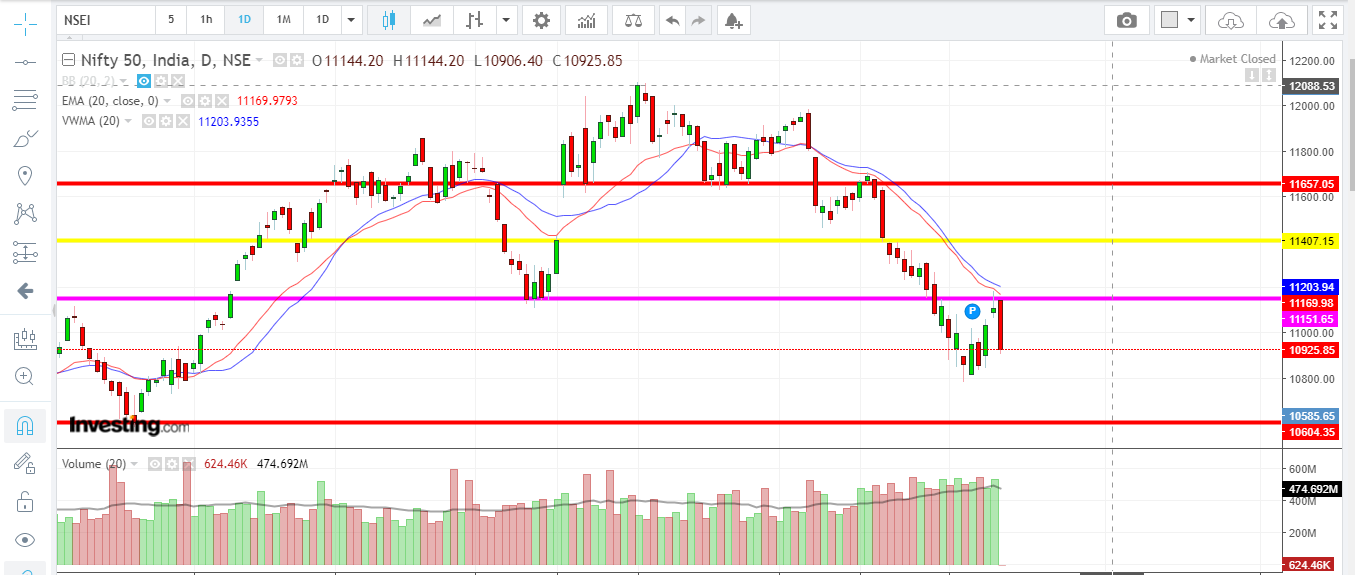

Technical Indicators: Moneycontrol permits customers to overlay technical indicators onto the chart. These indicators, calculated utilizing mathematical formulation, present indicators about potential worth actions. In style indicators embody:

- Transferring Averages (MA): Smooths out worth fluctuations to establish traits (e.g., 20-day MA, 50-day MA, 200-day MA).

- Relative Energy Index (RSI): Measures the magnitude of latest worth modifications to judge overbought or oversold circumstances.

- MACD (Transferring Common Convergence Divergence): Identifies modifications in momentum by evaluating two shifting averages.

- Bollinger Bands: Exhibits worth volatility and potential reversal factors.

- Fibonacci Retracements: Identifies potential assist and resistance ranges based mostly on Fibonacci ratios.

-

Drawing Instruments: Moneycontrol normally supplies drawing instruments to assist customers establish assist and resistance ranges, trendlines, and different chart patterns. These instruments permit for a extra personalised evaluation of the chart.

-

Quantity Information: The chart usually consists of quantity information, exhibiting the variety of shares traded throughout every interval. Excessive quantity usually accompanies vital worth actions.

-

Information Export: The flexibility to export chart information in numerous codecs (e.g., CSV) permits for additional evaluation utilizing spreadsheet software program or different analytical instruments.

Deciphering the Nifty 50 Chart: Sensible Functions

The Nifty 50 chart on Moneycontrol is a strong instrument for numerous funding methods:

-

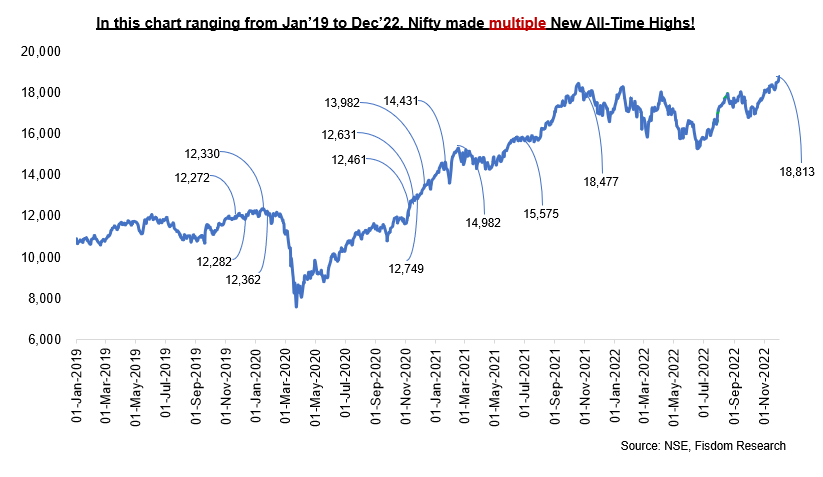

Pattern Identification: By analyzing the chart’s long-term motion, traders can establish prevailing traits (uptrend, downtrend, or sideways). This helps in making knowledgeable purchase or promote choices aligned with the general market course.

-

Assist and Resistance Ranges: Figuring out assist (worth ranges the place shopping for strain exceeds promoting strain) and resistance (worth ranges the place promoting strain exceeds shopping for strain) ranges is essential. These ranges can point out potential worth reversals or continuation of traits.

-

Technical Indicator Evaluation: Technical indicators present indicators that may affirm or contradict the visible interpretation of the chart. For instance, a bullish crossover of shifting averages would possibly sign a possible uptrend.

-

Chart Sample Recognition: Skilled merchants usually establish chart patterns (e.g., head and shoulders, double tops/bottoms, triangles) that predict future worth actions. These patterns require apply and expertise to establish precisely.

-

Danger Administration: The chart helps in setting stop-loss orders to restrict potential losses. Cease-loss orders routinely promote an asset when it reaches a predefined worth, minimizing potential losses throughout antagonistic market circumstances.

-

Timing Market Entry and Exit: By combining chart evaluation with basic evaluation and different market indicators, traders can try and time their market entry and exit factors to maximise returns and decrease dangers.

Limitations and Issues:

Whereas the Nifty 50 chart on Moneycontrol gives useful insights, it is essential to acknowledge its limitations:

-

Previous Efficiency is Not Indicative of Future Outcomes: Chart patterns and previous worth actions don’t assure future worth actions. Market circumstances are consistently evolving, influenced by numerous components past technical evaluation.

-

Subjectivity in Interpretation: Technical evaluation includes a level of subjectivity. Completely different analysts could interpret the identical chart in a different way, resulting in various conclusions.

-

Overreliance on Technical Evaluation: Relying solely on technical evaluation with out contemplating basic components (firm financials, financial indicators, and so forth.) might be dangerous. A holistic strategy combining each technical and basic evaluation is usually advisable.

-

Market Sentiment and Information Occasions: Surprising information occasions or modifications in market sentiment can considerably influence the Nifty 50 index, no matter technical indicators or chart patterns.

Conclusion:

The Nifty 50 chart on Moneycontrol supplies a strong instrument for traders and merchants to investigate the Indian fairness market. By understanding the chart’s options, using its functionalities successfully, and mixing technical evaluation with basic evaluation and a sound threat administration technique, traders can improve their decision-making course of and probably enhance their funding outcomes. Nevertheless, it’s essential to do not forget that no analytical instrument ensures success within the inventory market, and prudent threat administration is all the time paramount. Steady studying, apply, and a balanced strategy are key to profitable investing utilizing the Nifty 50 chart and different market information sources.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Nifty 50 Chart on Moneycontrol: A Complete Information for Traders. We admire your consideration to our article. See you in our subsequent article!