Decoding The Hammer: A Complete Information To This Highly effective Chart Sample

Decoding the Hammer: A Complete Information to This Highly effective Chart Sample

Associated Articles: Decoding the Hammer: A Complete Information to This Highly effective Chart Sample

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Hammer: A Complete Information to This Highly effective Chart Sample. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Hammer: A Complete Information to This Highly effective Chart Sample

The world of technical evaluation is wealthy with patterns, every whispering potential insights into market conduct. Amongst these, the hammer stands out as a visually distinct and sometimes dependable reversal sample. Whereas seemingly easy in its construction, understanding the nuances of the hammer – its formation, variations, affirmation, and limitations – is essential for any dealer aiming to leverage its predictive energy. This text delves deep into the hammer candlestick sample, equipping you with the data to establish, interpret, and successfully make the most of this highly effective device in your buying and selling technique.

Understanding Candlestick Charts: The Basis of the Hammer

Earlier than exploring the hammer itself, it is important to understand the fundamentals of candlestick charting. Candlesticks characterize worth motion over a particular interval (e.g., day by day, hourly, and so forth.). Every candlestick includes a physique (representing the distinction between the opening and shutting costs) and wicks (or shadows) extending above and beneath the physique (representing the excessive and low costs for the interval).

The colour of the candlestick physique sometimes signifies whether or not the worth closed increased (inexperienced or white, typically bullish) or decrease (purple or black, typically bearish) than it opened. These visible representations present a concise abstract of worth motion, making it simpler to establish patterns and traits.

Figuring out the Hammer: A Bullish Reversal Sign

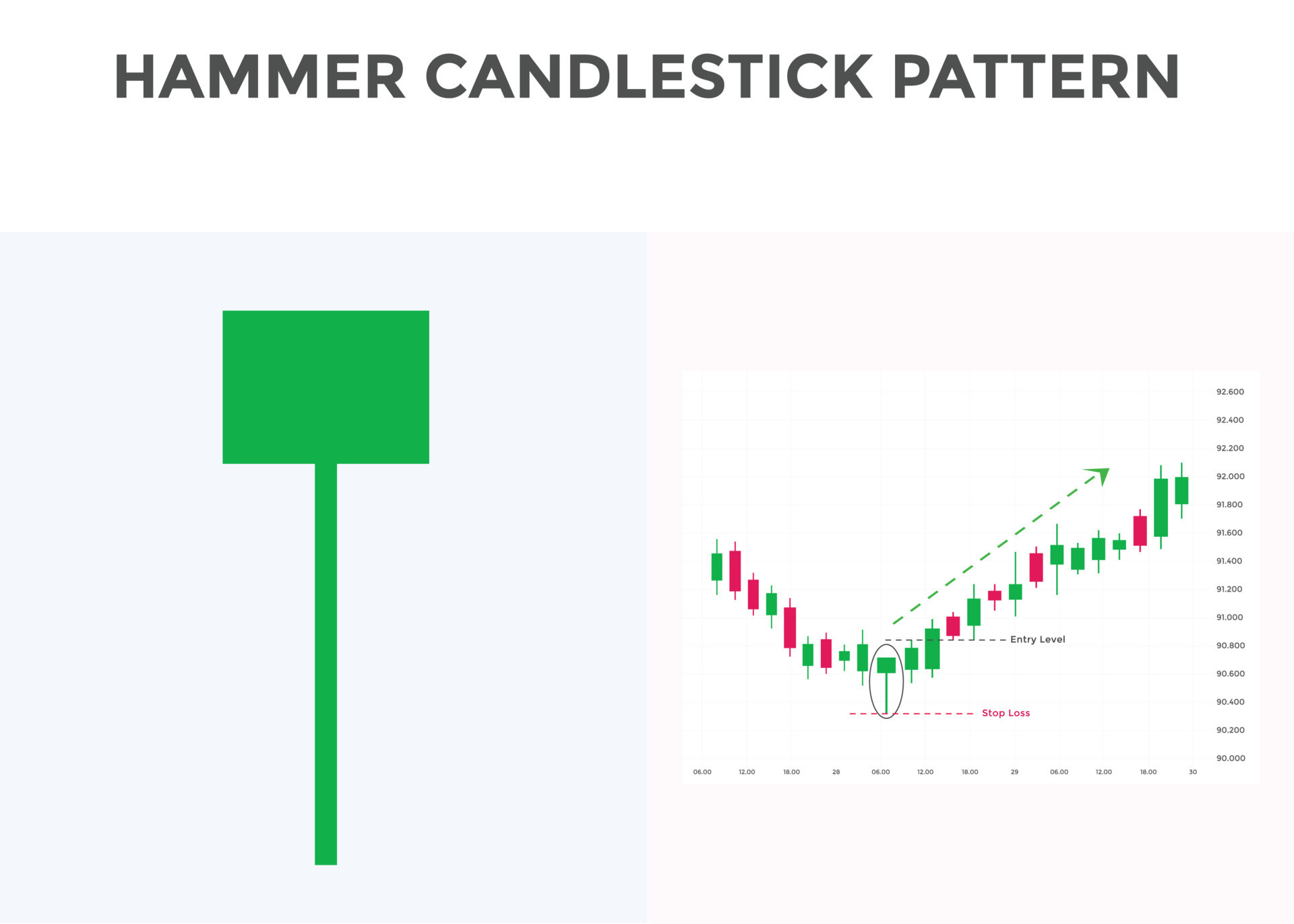

The hammer candlestick sample is characterised by its distinctive form:

-

Small Actual Physique: The physique of the hammer is comparatively quick, indicating indecisiveness available in the market. It may be both bullish (inexperienced/white) or bearish (purple/black), though a bullish hammer is mostly thought of stronger.

-

Lengthy Decrease Wick: Essentially the most defining characteristic is a protracted decrease wick, not less than twice the size of the physique. This signifies that the worth skilled important promoting strain through the interval, pushing it all the way down to a low level. Nonetheless, shopping for strain emerged, driving the worth again as much as shut close to the opening worth.

-

Quick or No Higher Wick: Ideally, the higher wick is brief or absent altogether. A protracted higher wick weakens the bullish sign, suggesting continued promoting strain even after the worth rebounded.

Variations of the Hammer Sample:

Whereas the basic hammer has the options described above, variations exist, every with barely completely different interpretations:

-

Inverted Hammer: That is the bearish counterpart of the hammer. It contains a small actual physique with a protracted higher wick and a brief or no decrease wick. It alerts potential bearish reversal.

-

Hanging Man: Just like an inverted hammer, nevertheless it seems on the high of an uptrend. This sample signifies potential exhaustion of the bullish momentum and a attainable reversal.

-

Doji Star: A doji is a candlestick with just about no physique, indicating indecision. A doji showing after a downtrend, adopted by a bullish candlestick, may be interpreted as a bullish hammer variation.

Affirmation and Context are Key:

Figuring out a hammer sample is just step one. Affirmation is essential to extend the reliability of the sign. A number of elements ought to be thought of:

-

Quantity: Elevated quantity accompanying the hammer signifies stronger conviction behind the worth reversal. Low quantity would possibly counsel a weak sign.

-

Assist Ranges: If the low of the hammer coincides with a big help degree (e.g., earlier swing low, trendline, transferring common), the reversal sign turns into stronger.

-

Comply with-By: The next candlestick is essential. A robust bullish candlestick following the hammer confirms the reversal and will increase the likelihood of a worth enhance.

-

Total Market Development: A hammer is extra important in a downtrend. A hammer in an uptrend would possibly merely be a minor pause within the upward motion.

-

Technical Indicators: Combining the hammer with different technical indicators, equivalent to RSI, MACD, or transferring averages, can present further affirmation and filter out false alerts.

Utilizing the Hammer in Your Buying and selling Technique:

The hammer sample generally is a helpful addition to any buying and selling technique, nevertheless it shouldn’t be utilized in isolation. Here is the way to incorporate it successfully:

-

Determine Potential Reversal Factors: Search for hammers on the backside of downtrends, close to help ranges, or after important worth declines.

-

Affirm the Sign: Look forward to affirmation from quantity, subsequent worth motion, and different technical indicators earlier than coming into a commerce.

-

Set Cease-Loss Orders: At all times place a stop-loss order beneath the low of the hammer to restrict potential losses if the reversal fails.

-

Handle Danger: By no means danger greater than a small share of your buying and selling capital on any single commerce.

-

Contemplate Timeframe: The effectiveness of the hammer can fluctuate relying on the timeframe. A hammer on a day by day chart may need a longer-term implication than a hammer on a 5-minute chart.

Limitations and False Indicators:

Whereas the hammer sample generally is a highly effective device, it is essential to acknowledge its limitations:

-

False Indicators: Like all technical indicator, the hammer can generate false alerts. Not each hammer will result in a profitable reversal.

-

Subjectivity: Figuring out the size of the physique and wick may be subjective, resulting in completely different interpretations.

-

Context is Essential: The interpretation of a hammer relies upon closely on the general market context and pattern.

-

Affirmation is Important: Relying solely on the hammer sample with out affirmation is dangerous.

Conclusion:

The hammer candlestick sample is a helpful device for figuring out potential worth reversals. By understanding its formation, variations, affirmation strategies, and limitations, merchants can considerably enhance their skill to interpret market alerts and make knowledgeable buying and selling selections. Nonetheless, it is essential to keep in mind that no technical indicator is foolproof. Combining the hammer with different technical evaluation instruments, sound danger administration practices, and a radical understanding of market dynamics is crucial for profitable buying and selling. Constant follow and disciplined software are key to mastering the artwork of decoding this highly effective chart sample. At all times keep in mind to backtest your methods and adapt your strategy based mostly in your expertise and market situations. The hammer, when used properly, generally is a helpful asset in your buying and selling arsenal, serving to you navigate the complexities of the monetary markets.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Hammer: A Complete Information to This Highly effective Chart Sample. We respect your consideration to our article. See you in our subsequent article!