Decoding The Fluctuations: A Deep Dive Into Month-to-month Common Gasoline Costs

Decoding the Fluctuations: A Deep Dive into Month-to-month Common Gasoline Costs

Associated Articles: Decoding the Fluctuations: A Deep Dive into Month-to-month Common Gasoline Costs

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Fluctuations: A Deep Dive into Month-to-month Common Gasoline Costs. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Fluctuations: A Deep Dive into Month-to-month Common Gasoline Costs

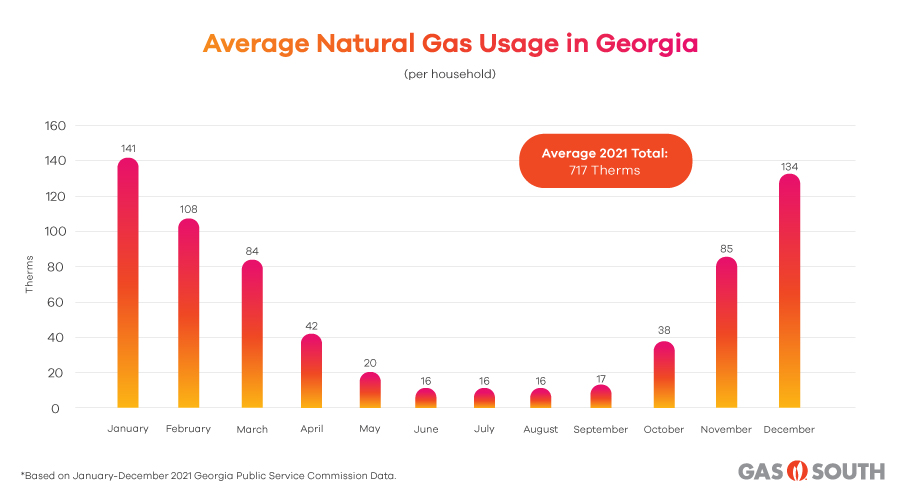

The value of gasoline, a seemingly ubiquitous and mundane facet of contemporary life, exerts a surprisingly highly effective affect on our economies and each day routines. Fluctuations in fuel costs ripple outwards, affecting every little thing from shopper spending and inflation to geopolitical stability and environmental coverage. Understanding these fluctuations requires extra than simply glancing on the value on the pump; it calls for a complete evaluation of the elements driving month-to-month common fuel costs, typically finest visualized by way of a chart monitoring these adjustments over time.

This text will delve into the complexities of month-to-month common fuel value charts, analyzing their development, interpretation, and the essential financial, political, and environmental elements that form the information they symbolize. We are going to discover historic developments, differences due to the season, and the influence of sudden occasions, in the end aiming to offer a clearer understanding of this important financial indicator.

Setting up the Chart: Information Sources and Methodology

A dependable month-to-month common fuel value chart depends on correct and persistently collected knowledge. A number of key sources present this data, together with:

-

The Vitality Data Administration (EIA): In the USA, the EIA, part of the Division of Vitality, is the first supply for complete power knowledge, together with gasoline costs. Their knowledge is usually collected from a nationwide community of fuel stations, offering a consultant pattern. The EIA’s methodology entails weighting costs primarily based on the quantity of gasoline bought at every station, guaranteeing a extra correct reflection of the common value paid by customers.

-

AAA (American Car Affiliation): AAA additionally tracks fuel costs, typically offering extra localized knowledge and evaluation, complementing the nationwide image painted by the EIA. Their knowledge assortment strategies might differ barely, however usually align with the EIA’s findings.

-

Worldwide Vitality Company (IEA): For a worldwide perspective, the IEA supplies knowledge on gasoline costs in varied international locations, permitting for worldwide comparisons and analyses. Nevertheless, knowledge consistency and assortment methodologies can differ throughout nations, requiring cautious consideration when deciphering worldwide comparisons.

The development of the chart itself sometimes entails plotting the month-to-month common value on the vertical axis (y-axis) towards the time interval (months or years) on the horizontal axis (x-axis). This creates a line graph, successfully illustrating the pattern of fuel costs over the chosen timeframe. The chart may additionally embody extra components, comparable to:

- Transferring averages: Smoothing out short-term fluctuations to disclose underlying developments.

- Seasonal changes: Accounting for predictable seasonal value variations.

- Information annotations: Highlighting vital occasions or coverage adjustments that impacted fuel costs.

Deciphering the Chart: Developments, Seasonality, and Outliers

Analyzing a month-to-month common fuel value chart requires a nuanced strategy, going past merely observing the upward or downward route of the road. A number of key elements deserve consideration:

-

Lengthy-term developments: The chart reveals the general route of fuel costs over a number of years or many years. This long-term pattern is closely influenced by elements like technological developments in oil extraction, world financial progress, and geopolitical occasions.

-

Seasonal differences: Gasoline costs typically exhibit seasonal patterns, sometimes rising through the summer season driving season as a result of elevated demand and doubtlessly refinery upkeep schedules. Winter months may even see barely decrease costs, however this may be influenced by heating oil demand and different elements. Understanding these differences due to the season is essential to keep away from misinterpreting short-term fluctuations as vital long-term shifts.

-

Outliers and sudden occasions: Important occasions, comparable to hurricanes, geopolitical instability in oil-producing areas, or main financial shocks, could cause dramatic and sometimes unpredictable spikes or dips in fuel costs. These outliers are essential knowledge factors, highlighting the vulnerability of fuel costs to exterior elements. Analyzing these occasions and their influence on the chart helps perceive the interconnectedness of the power market with world occasions.

-

Correlation with different financial indicators: Gasoline costs are sometimes correlated with different financial indicators, comparable to inflation and shopper spending. A rising fuel value can contribute to inflation, doubtlessly impacting shopper confidence and spending patterns. Analyzing the chart along side different financial knowledge supplies a extra complete understanding of its implications.

Components Influencing Month-to-month Common Gasoline Costs

The value of gasoline is a fancy interaction of quite a few elements, making correct prediction difficult. Key influences embody:

-

Crude oil costs: Crude oil is the first uncooked materials for gasoline, and its value immediately impacts the ultimate value on the pump. International provide and demand dynamics, OPEC manufacturing quotas, geopolitical occasions, and hypothesis within the futures market all affect crude oil costs.

-

Refinery capability and utilization: The capability and effectivity of refineries play a big position in gasoline manufacturing and provide. Refinery outages or upkeep can result in value will increase, even when crude oil costs stay steady.

-

Distribution and transportation prices: The price of transporting gasoline from refineries to fuel stations contributes to the ultimate value. Gasoline costs for transportation, labor prices, and infrastructure limitations all affect this element.

-

Taxes and laws: Authorities taxes and laws, together with environmental laws and carbon taxes, can considerably influence fuel costs. These insurance policies can differ considerably throughout areas and international locations.

-

Demand: Seasonal adjustments, financial progress, and shopper conduct all affect gasoline demand. Increased demand sometimes results in larger costs, significantly throughout peak driving seasons.

-

Geopolitical elements: Political instability in oil-producing areas, sanctions, and worldwide conflicts can disrupt provide chains and considerably influence fuel costs. These occasions typically result in short-term value spikes and volatility.

The Significance of Analyzing Month-to-month Common Gasoline Costs

Understanding the developments and fluctuations in month-to-month common fuel costs is essential for a wide range of stakeholders:

-

Customers: Gasoline costs immediately influence family budgets and spending habits. Monitoring these costs permits customers to make knowledgeable choices about transportation and budgeting.

-

Companies: Companies, significantly these in transportation and logistics, are extremely delicate to fuel value fluctuations. Correct forecasting may also help mitigate dangers and optimize operations.

-

Governments: Governments use fuel value knowledge to formulate power insurance policies, assess financial situations, and tackle inflation issues. Understanding value developments helps in designing efficient interventions and laws.

-

Buyers: Buyers within the power sector depend on fuel value knowledge to make knowledgeable funding choices. Analyzing value developments and influencing elements permits for higher threat evaluation and portfolio administration.

Conclusion:

A month-to-month common fuel value chart, when interpreted appropriately along side an understanding of the underlying elements, supplies a useful instrument for understanding the complexities of the power market. By analyzing long-term developments, differences due to the season, outliers, and the interconnectedness of assorted financial and geopolitical elements, we are able to acquire a deeper appreciation for the profound affect of gasoline costs on our lives and the worldwide economic system. The chart shouldn’t be merely a visible illustration of numbers; it is a window into the dynamic interaction of provide, demand, politics, and world occasions that form the worth we pay on the pump every day. Steady monitoring and evaluation of this knowledge are important for navigating the ever-changing panorama of the power market.

.png)

Closure

Thus, we hope this text has offered useful insights into Decoding the Fluctuations: A Deep Dive into Month-to-month Common Gasoline Costs. We admire your consideration to our article. See you in our subsequent article!