Decoding The Eurozone GDP Chart: A Two-Decade Journey Of Progress, Disaster, And Restoration

Decoding the Eurozone GDP Chart: A Two-Decade Journey of Progress, Disaster, and Restoration

Associated Articles: Decoding the Eurozone GDP Chart: A Two-Decade Journey of Progress, Disaster, and Restoration

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Eurozone GDP Chart: A Two-Decade Journey of Progress, Disaster, and Restoration. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Eurozone GDP Chart: A Two-Decade Journey of Progress, Disaster, and Restoration

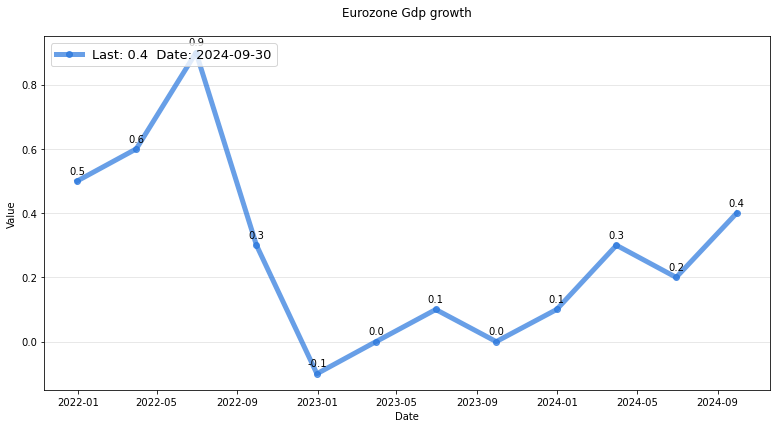

The Eurozone’s Gross Home Product (GDP) chart, spanning the previous 20 years, tells a compelling story of financial integration, resilience, and vulnerability. It is a visible illustration of a posh tapestry woven from durations of sturdy progress, devastating crises, and uneven recoveries, formed by components starting from world financial shocks to inside structural weaknesses. Analyzing this chart reveals essential insights into the Eurozone’s financial well being, its challenges, and its potential for future progress.

The Early Years (2000-2007): A Interval of Regular Enlargement

The early 2000s witnessed a interval of comparatively steady and constant GDP progress throughout the Eurozone. The chart reveals a gradual upward pattern, reflecting the advantages of financial union. The one forex eradicated trade price fluctuations between member states, fostering elevated commerce and funding. This era additionally noticed vital financial convergence, with beforehand lagging economies catching as much as wealthier members. The introduction of the euro itself spurred financial exercise as companies and customers benefited from diminished transaction prices and elevated value transparency. Nevertheless, this era of prosperity masked underlying vulnerabilities that will later contribute to the Eurozone disaster. These included imbalances in present accounts, with some international locations accumulating giant exterior money owed, and a build-up of unsustainable ranges of personal and public debt, notably within the peripheral economies.

The Nice Recession and the Eurozone Disaster (2008-2014): A Interval of Sharp Contraction and Deep Uncertainty

The worldwide monetary disaster of 2008 dealt a extreme blow to the Eurozone. The chart dramatically illustrates a pointy contraction in GDP, with a number of member states experiencing deep recessions. The disaster uncovered the fragility of the Eurozone’s structure, notably the dearth of efficient mechanisms for coping with sovereign debt crises. The disaster wasn’t merely a monetary one; it morphed right into a sovereign debt disaster as a number of peripheral international locations (Greece, Eire, Portugal, Spain, and Cyprus) confronted unsustainable ranges of public debt, resulting in issues about their capacity to repay their obligations. This triggered a cascade of occasions:

- Sovereign debt downgrades: Credit standing companies downgraded the sovereign debt of a number of international locations, rising borrowing prices and exacerbating their fiscal issues.

- Banking crises: The interconnectedness of European banks amplified the disaster, as banks holding giant quantities of sovereign debt confronted vital losses, resulting in liquidity shortages and banking crises in a number of international locations.

- Austerity measures: In an try to revive fiscal stability, many international locations carried out harsh austerity measures, together with spending cuts and tax will increase. These measures, whereas vital in some circumstances, contributed to extended recessions and social unrest.

- Capital flight: Traders withdrew capital from weak international locations, additional weakening their economies.

The chart vividly shows the depth and length of the recession in these international locations, highlighting the numerous human and financial prices of the disaster. The response to the disaster, whereas finally profitable in stopping the collapse of the Eurozone, was gradual and infrequently painful, leaving lasting scars on the affected economies.

The Restoration and Consolidation (2015-2019): A Gradual Climb Again

Following the depths of the disaster, the Eurozone launched into a gradual restoration. The chart reveals a gradual however regular enhance in GDP progress, albeit at a slower tempo than within the pre-crisis years. A number of components contributed to this restoration:

- Structural reforms: Many international locations carried out structural reforms geared toward enhancing their competitiveness, corresponding to labor market reforms and deregulation.

- Financial coverage: The European Central Financial institution (ECB) carried out an expansive financial coverage, together with quantitative easing, to stimulate financial exercise and decrease borrowing prices.

- Improved fiscal circumstances: Progressively, the fiscal state of affairs in lots of international locations improved, decreasing the chance of additional sovereign debt crises.

Nevertheless, the restoration was uneven throughout the Eurozone. Whereas some international locations skilled strong progress, others remained caught in a low-growth entice, going through excessive unemployment and protracted financial challenges. The restoration additionally masked underlying weaknesses, corresponding to excessive ranges of personal debt and sluggish productiveness progress in a number of member states.

The COVID-19 Pandemic and Past (2020-Current): Navigating Unprecedented Challenges

The COVID-19 pandemic delivered one other vital shock to the Eurozone economic system. The chart reveals a pointy contraction in GDP in 2020, as lockdowns and restrictions introduced financial exercise to a standstill. The response to the pandemic concerned unprecedented ranges of fiscal and financial stimulus, geared toward mitigating the financial fallout. The ECB carried out additional quantitative easing and offered vital liquidity help to banks. Nationwide governments carried out large-scale fiscal help applications, together with wage subsidies and direct funds to companies and households.

The restoration from the pandemic has been quicker than anticipated in some areas, however the chart additionally reveals ongoing challenges. Provide chain disruptions, inflation, and the battle in Ukraine have created new headwinds for the Eurozone economic system. The power disaster, notably acute in Europe on account of its reliance on Russian gasoline, has considerably impacted financial progress and inflation.

Analyzing the Chart: Key Takeaways and Future Outlook

The Eurozone GDP chart supplies a number of key takeaways:

- Resilience: Regardless of going through a number of crises, the Eurozone has demonstrated exceptional resilience. The financial union has survived, albeit with vital challenges.

- Vulnerability: The chart additionally highlights the Eurozone’s vulnerability to exterior shocks and inside weaknesses. The shortage of fiscal integration stays a serious problem.

- Uneven restoration: Progress has been uneven throughout the Eurozone, with some international locations lagging behind others. Addressing regional disparities stays a vital coverage goal.

- The necessity for reform: The crises have uncovered the necessity for ongoing structural reforms to enhance competitiveness and resilience.

The long run outlook for the Eurozone economic system is unsure. A number of components will form its trajectory, together with:

- Geopolitical dangers: The battle in Ukraine and rising geopolitical tensions pose vital dangers to the Eurozone economic system.

- Inflation: Excessive inflation poses a serious problem, requiring cautious financial coverage administration.

- Power safety: Diversifying power sources and decreasing reliance on Russian gasoline are essential for long-term financial stability.

- Structural reforms: Additional structural reforms are wanted to spice up productiveness and tackle regional disparities.

- Fiscal integration: Strengthening fiscal integration throughout the Eurozone may improve its resilience to future shocks.

The Eurozone GDP chart is not only a historic file; it is a roadmap for the longer term. By fastidiously analyzing its patterns and traits, policymakers and economists can achieve precious insights into the challenges and alternatives going through the Eurozone, informing coverage choices geared toward fostering sustainable and inclusive progress. The journey depicted within the chart is much from over, and the subsequent chapter will rely upon the alternatives made immediately.

Closure

Thus, we hope this text has offered precious insights into Decoding the Eurozone GDP Chart: A Two-Decade Journey of Progress, Disaster, and Restoration. We thanks for taking the time to learn this text. See you in our subsequent article!