Decoding The Dow Jones Index Chart On TradingView: A Complete Information

Decoding the Dow Jones Index Chart on TradingView: A Complete Information

Associated Articles: Decoding the Dow Jones Index Chart on TradingView: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Dow Jones Index Chart on TradingView: A Complete Information. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Dow Jones Index Chart on TradingView: A Complete Information

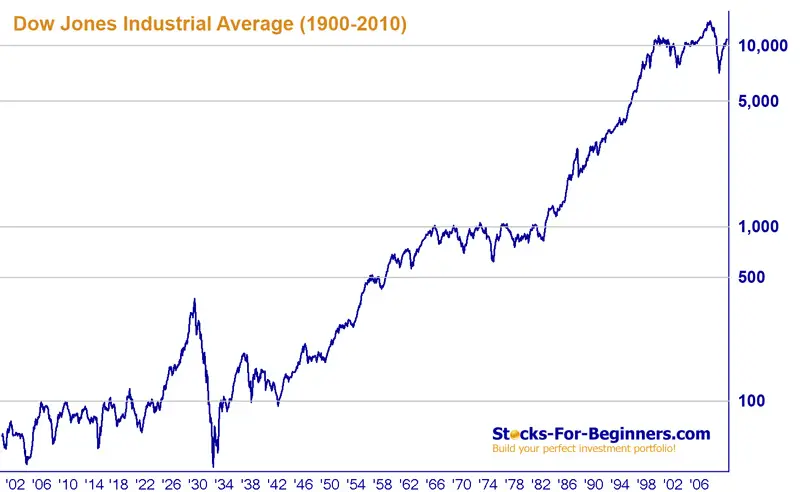

The Dow Jones Industrial Common (DJIA), usually merely known as the "Dow," is a inventory market index that tracks the efficiency of 30 giant, publicly owned firms in america. For merchants and traders, understanding its actions is essential, and TradingView supplies a wonderful platform for analyzing its chart. This text delves deep into using TradingView’s options to successfully interpret the Dow Jones index chart, incorporating technical evaluation, basic concerns, and threat administration methods.

I. Accessing and Navigating the Dow Jones Chart on TradingView:

Step one is accessing the chart itself. On TradingView, merely seek for "$DJI" (the ticker image for the Dow Jones Industrial Common) within the search bar. It will carry up the chart, displaying the index’s worth actions over a selected timeframe. TradingView gives a variety of customizable choices:

-

Timeframes: From intraday (1-minute, 5-minute, 15-minute, hourly, and so forth.) to day by day, weekly, and month-to-month charts, permitting evaluation throughout completely different time horizons. Selecting the suitable timeframe is essential; short-term merchants would possibly give attention to intraday charts, whereas long-term traders might desire month-to-month or yearly views.

-

Chart Sorts: TradingView gives varied chart sorts, together with candlestick, line, bar, Heikin Ashi, and Renko. Candlestick charts are the most typical, offering visible illustration of worth open, excessive, low, and shut for a given interval. Different chart sorts can filter out noise and spotlight tendencies extra successfully relying on particular person preferences.

-

Indicators: An unlimited library of technical indicators is accessible. These instruments assist establish tendencies, help and resistance ranges, momentum, and volatility. We’ll discover some key indicators later on this article.

-

Drawing Instruments: TradingView gives a complete suite of drawing instruments, together with pattern strains, Fibonacci retracements, horizontal strains, channels, and extra. These are invaluable for figuring out patterns and potential worth targets.

II. Technical Evaluation of the Dow Jones Chart:

Technical evaluation focuses on deciphering previous worth actions and patterns to foretell future worth motion. A number of key ideas are very important when analyzing the Dow Jones chart on TradingView:

-

Development Identification: Figuring out the general pattern (uptrend, downtrend, or sideways) is paramount. Uptrends are characterised by greater highs and better lows, whereas downtrends exhibit decrease highs and decrease lows. Sideways or ranging markets present worth consolidation inside an outlined vary. Development strains, transferring averages (mentioned beneath), and different indicators will help establish the dominant pattern.

-

Help and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt by means of. Help ranges signify areas the place shopping for strain is anticipated to outweigh promoting strain, stopping additional worth declines. Resistance ranges are the alternative, representing areas the place promoting strain is anticipated to outweigh shopping for strain, hindering worth will increase. Breaks above resistance or beneath help can sign vital worth actions.

-

Shifting Averages: These are broadly used indicators that clean out worth fluctuations, highlighting the underlying pattern. Widespread transferring averages embrace the easy transferring common (SMA) and the exponential transferring common (EMA). The 50-day and 200-day SMAs are steadily used to establish long-term tendencies. Crossovers between transferring averages (e.g., a 50-day SMA crossing above a 200-day SMA) can sign potential pattern modifications.

-

Relative Energy Index (RSI): This momentum oscillator measures the magnitude of latest worth modifications to guage overbought and oversold situations. An RSI above 70 is usually thought-about overbought, suggesting a possible worth correction, whereas an RSI beneath 30 suggests an oversold situation, doubtlessly indicating a worth reversal.

-

MACD (Shifting Common Convergence Divergence): This trend-following momentum indicator identifies modifications within the power, course, momentum, and period of a pattern. MACD crossovers (the MACD line crossing the sign line) can sign potential purchase or promote indicators.

-

Bollinger Bands: These bands plot commonplace deviations round a transferring common, exhibiting worth volatility. Value bouncing off the higher or decrease bands can sign potential reversals. Vast bands counsel excessive volatility, whereas slender bands point out low volatility.

III. Basic Evaluation and its Affect on the Dow Jones Chart:

Whereas technical evaluation focuses on worth motion, basic evaluation considers financial components influencing the underlying belongings inside the Dow Jones index. Components to contemplate embrace:

-

Financial Development: Robust financial development usually helps greater inventory costs, whereas weak development can result in declines. GDP development, inflation charges, employment information, and shopper confidence are key indicators.

-

Curiosity Charges: Rate of interest hikes by the Federal Reserve sometimes negatively influence inventory costs, as greater charges improve borrowing prices for firms and scale back investor urge for food for riskier belongings. Conversely, rate of interest cuts can stimulate the economic system and increase inventory costs.

-

Geopolitical Occasions: World occasions, equivalent to wars, political instability, and commerce disputes, can considerably influence market sentiment and the Dow Jones index.

-

Firm-Particular Information: Information associated to particular person firms inside the Dow can affect the index’s total efficiency. Robust earnings studies, optimistic product launches, or mergers and acquisitions can increase the index, whereas damaging information can result in declines.

Integrating basic evaluation with technical evaluation supplies a extra holistic view of the market and enhances buying and selling choices.

IV. Danger Administration Methods when Buying and selling the Dow Jones Index:

Buying and selling the Dow Jones index, like several market, entails threat. Implementing efficient threat administration methods is essential:

-

Place Sizing: By no means threat extra capital than you may afford to lose on a single commerce. Decide an acceptable place dimension primarily based in your threat tolerance and account stability.

-

Cease-Loss Orders: These orders robotically promote your place when the worth reaches a predetermined stage, limiting potential losses. Inserting stop-loss orders is a basic facet of threat administration.

-

Take-Revenue Orders: These orders robotically promote your place when the worth reaches a predetermined revenue goal, securing earnings and stopping potential losses from revenue erosion.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your investments throughout completely different asset lessons to scale back total portfolio threat.

-

Backtesting: Earlier than implementing any buying and selling technique, backtest it on historic information to evaluate its efficiency and establish potential weaknesses. TradingView’s backtesting instruments could be invaluable on this course of.

V. Superior Strategies and Options on TradingView:

TradingView gives a number of superior options that may improve your Dow Jones index chart evaluation:

-

Pine Script: This programming language permits you to create customized indicators and methods tailor-made to your particular buying and selling type.

-

Alerts: Arrange alerts to inform you of great worth actions, indicator crossovers, or different occasions related to your buying and selling technique.

-

Screeners: Use TradingView’s screeners to establish shares and indices assembly particular standards, serving to you discover potential buying and selling alternatives.

-

Group Evaluation: Have interaction with the TradingView group to achieve insights from different merchants and be taught from their experiences.

VI. Conclusion:

The Dow Jones index chart on TradingView gives a strong software for analyzing market actions and making knowledgeable buying and selling choices. By combining technical evaluation, basic evaluation, and efficient threat administration methods, merchants can improve their probabilities of success. Nonetheless, keep in mind that no buying and selling technique ensures earnings, and losses are an inherent a part of buying and selling. Steady studying, adaptation, and self-discipline are key to long-term success available in the market. Mastering TradingView’s options and leveraging its sources will considerably contribute to your understanding of the Dow Jones and enhance your buying and selling efficiency. At all times bear in mind to conduct thorough analysis and contemplate consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Dow Jones Index Chart on TradingView: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!