Decoding The Dow Jones Index Chart: A Deep Dive Into At the moment’s Market Actions

Decoding the Dow Jones Index Chart: A Deep Dive into At the moment’s Market Actions

Associated Articles: Decoding the Dow Jones Index Chart: A Deep Dive into At the moment’s Market Actions

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Dow Jones Index Chart: A Deep Dive into At the moment’s Market Actions. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Dow Jones Index Chart: A Deep Dive into At the moment’s Market Actions

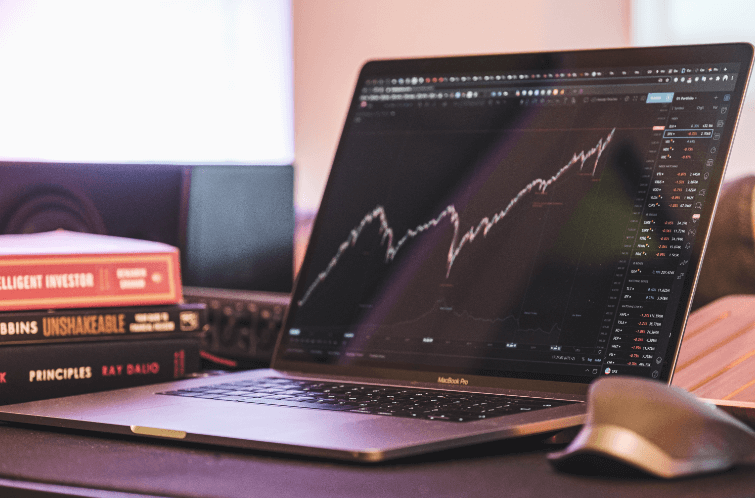

The Dow Jones Industrial Common (DJIA), a cornerstone of American monetary markets, continues to captivate buyers with its day by day fluctuations. Understanding at present’s Dow Jones index chart requires extra than simply glancing on the closing quantity; it necessitates a nuanced evaluation of assorted elements influencing its trajectory. This text delves into the intricacies of at present’s Dow chart, analyzing its actions within the context of broader financial indicators, geopolitical occasions, and sector-specific efficiency. Whereas we can not present particular real-time information (as market situations are always altering), we are going to discover the important thing parts that form the Dow’s day by day narrative and supply a framework for deciphering future charts.

Understanding the Chart’s Anatomy:

Earlier than analyzing at present’s particular actions, it is essential to grasp the elements of a typical Dow Jones index chart. An ordinary chart will show:

- Worth Axis (Y-axis): This reveals the worth of the Dow Jones Industrial Common at totally different time limits. The size is normally adjusted to replicate the present value vary.

- Time Axis (X-axis): This represents the time interval coated by the chart, usually starting from a couple of minutes to a number of years. Widespread timeframes embody intraday (minutes, hours), day by day, weekly, and month-to-month.

- Candlesticks or Line Graph: Many charts use candlestick patterns, the place every "candle" represents a selected time interval (e.g., a day). The physique of the candle reveals the worth vary between the opening and shutting costs, whereas the "wicks" (traces extending above and under the physique) characterize the excessive and low costs for that interval. Line graphs merely join the closing costs of every interval.

- Shifting Averages: These are traces that clean out value fluctuations, serving to to establish tendencies. Widespread transferring averages embody 50-day, 100-day, and 200-day averages.

- Quantity: This indicator reveals the variety of shares traded throughout every interval. Excessive quantity usually accompanies important value actions.

- Indicators: Technical analysts usually overlay varied indicators on the chart, corresponding to Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), and Bollinger Bands, to establish potential purchase or promote indicators.

Elements Influencing At the moment’s Dow Chart:

The Dow’s day by day efficiency is a posh interaction of quite a few elements, making it essential to contemplate a multifaceted method to evaluation:

1. Financial Knowledge Releases: The discharge of key financial indicators, such because the Gross Home Product (GDP) development fee, inflation figures (CPI and PPI), unemployment information, and client confidence indices, can considerably affect the Dow. Constructive financial information typically results in greater costs, whereas unfavourable information can set off sell-offs. At the moment’s chart might replicate the market’s response to a current financial report, both confirming or contradicting present market sentiment.

2. Curiosity Price Selections: Selections made by central banks, such because the Federal Reserve (Fed) within the US, concerning rates of interest have a profound impact on the inventory market. Rate of interest hikes have a tendency to extend borrowing prices for companies, probably slowing financial development and impacting company income, resulting in a downward stress on the Dow. Conversely, rate of interest cuts can stimulate financial exercise and increase inventory costs. Any anticipation or announcement associated to rate of interest modifications can be clearly mirrored in at present’s chart.

3. Geopolitical Occasions: International occasions, corresponding to worldwide conflicts, political instability, and commerce disputes, can considerably affect investor sentiment and market volatility. Uncertainty surrounding geopolitical dangers usually results in danger aversion, inflicting buyers to promote shares and pushing the Dow downwards. At the moment’s chart may reveal the market’s response to a current geopolitical growth, both constructive or unfavourable.

4. Company Earnings Reviews: The discharge of quarterly earnings stories from main corporations listed within the Dow can have a considerable affect on their particular person inventory costs and, consequently, the general index. Stronger-than-expected earnings usually result in value will increase, whereas disappointing outcomes can set off sell-offs. At the moment’s chart may present the impact of a selected firm’s earnings announcement on the general index.

5. Sector-Particular Efficiency: The Dow is comprised of 30 large-cap corporations representing varied sectors of the financial system. The efficiency of particular sectors (e.g., expertise, power, healthcare) can affect the general index’s motion. If a dominant sector experiences important good points or losses, it is more likely to be mirrored within the Dow’s trajectory. At the moment’s chart may spotlight the outperformance or underperformance of a selected sector, driving the general index’s route.

6. Investor Sentiment and Market Psychology: Investor sentiment, usually pushed by information headlines, social media tendencies, and skilled opinions, performs an important position in shaping market actions. Durations of optimism are likely to push costs greater, whereas worry and uncertainty can result in sell-offs. At the moment’s chart might replicate a shift in investor sentiment, indicating a change in market psychology.

7. Algorithmic Buying and selling and Excessive-Frequency Buying and selling: The growing prevalence of algorithmic and high-frequency buying and selling can contribute to short-term volatility and fast value swings within the Dow. These automated buying and selling techniques can react to market modifications a lot quicker than human merchants, probably amplifying value actions. This affect may be significantly seen in intraday charts.

Deciphering At the moment’s Dow Chart: A Case Examine Method

As an example learn how to interpret at present’s Dow chart, let’s contemplate a hypothetical state of affairs. Suppose at present’s chart reveals a major downward motion, accompanied by excessive buying and selling quantity. Additional investigation may reveal that this decline is primarily pushed by:

- Unfavorable financial information: A weaker-than-expected GDP report launched earlier within the day fueled considerations about financial slowdown.

- Elevated rates of interest: The Fed introduced a larger-than-anticipated rate of interest hike, growing borrowing prices for companies.

- Geopolitical tensions: Escalating tensions in a key area raised considerations about potential disruptions to international provide chains.

On this state of affairs, the downward development within the Dow just isn’t merely a random fluctuation however a response to a confluence of unfavourable elements. Analyzing these elements offers a extra complete understanding of the market’s conduct than merely observing the worth motion alone.

Conclusion:

Analyzing the Dow Jones index chart requires a holistic method, contemplating a variety of financial, geopolitical, and company elements. Whereas at present’s particular chart actions are dynamic and require real-time information for correct interpretation, the framework offered right here offers a sturdy methodology for understanding the forces shaping the Dow’s day by day efficiency. By contemplating these elements and using technical evaluation instruments, buyers can achieve a deeper perception into the market and make extra knowledgeable funding choices. Keep in mind, previous efficiency just isn’t indicative of future outcomes, and market evaluation entails inherent dangers. All the time conduct thorough analysis and contemplate consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Dow Jones Index Chart: A Deep Dive into At the moment’s Market Actions. We thanks for taking the time to learn this text. See you in our subsequent article!