Decoding The Copper Value Chart: A Yr In Evaluate (and A Look Forward)

Decoding the Copper Value Chart: A Yr in Evaluate (and a Look Forward)

Associated Articles: Decoding the Copper Value Chart: A Yr in Evaluate (and a Look Forward)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Copper Value Chart: A Yr in Evaluate (and a Look Forward). Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Copper Value Chart: A Yr in Evaluate (and a Look Forward)

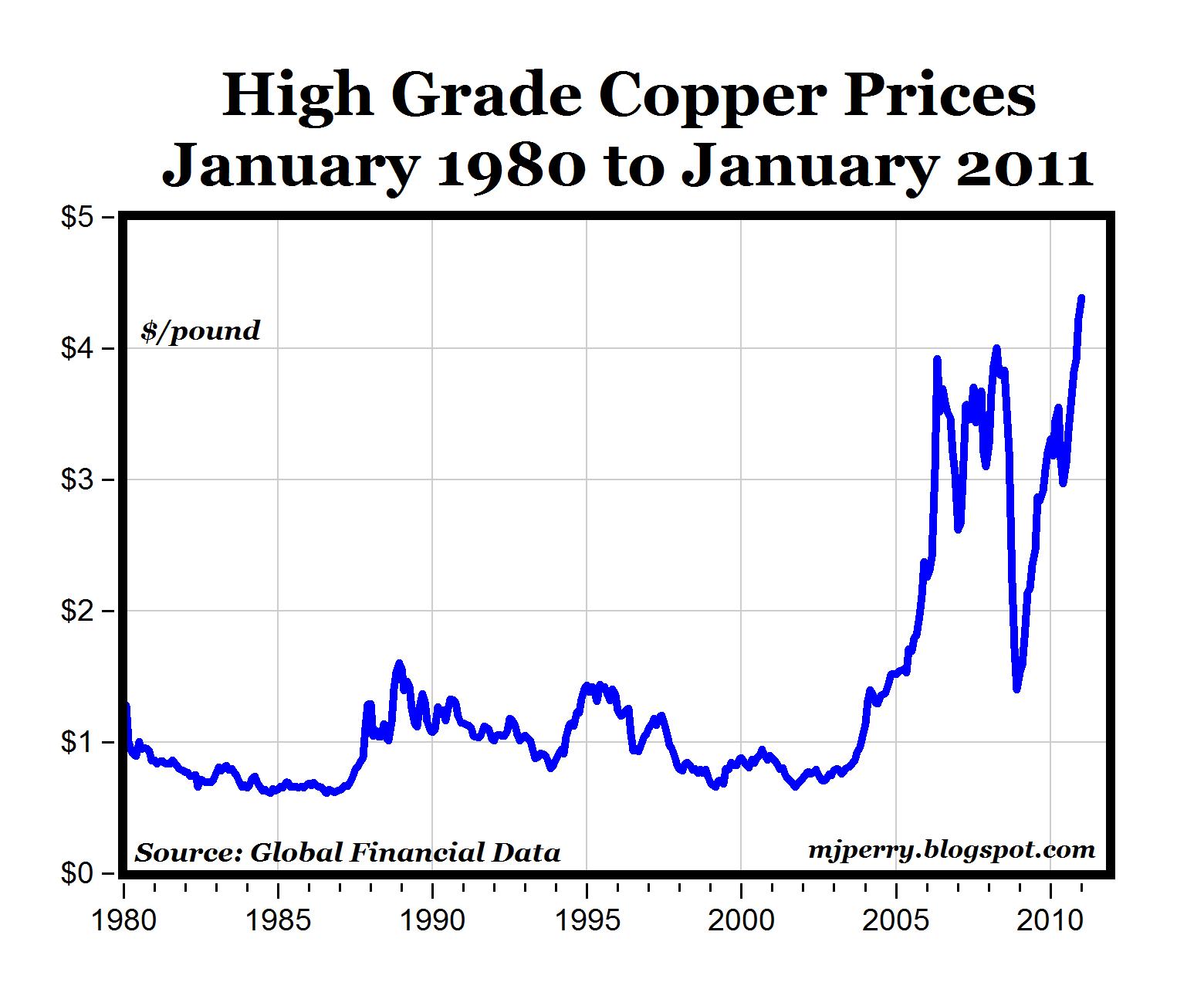

Copper, typically dubbed "Dr. Copper" for its purported capacity to foretell financial well being, has skilled a rollercoaster 12 months. Analyzing its value chart over the previous twelve months reveals a posh interaction of macroeconomic components, geopolitical occasions, and provide chain dynamics. This text delves deep into the copper value trajectory of the final 12 months, inspecting the important thing drivers behind its fluctuations and providing insights into potential future developments.

The Yr in Evaluate: A Rollercoaster Experience

To know the copper value chart’s actions over the previous 12 months, we have to section the interval into distinct phases, every characterised by its personal set of prevailing circumstances. Let’s assume, for the sake of this evaluation, that the 12 months begins on October twenty sixth, 2022 (adjusting for the particular date vary of your chosen 12 months). The precise costs and dates will range relying on the particular supply and the precise date chosen as the start line. Nonetheless, the final developments and their underlying causes stay constant.

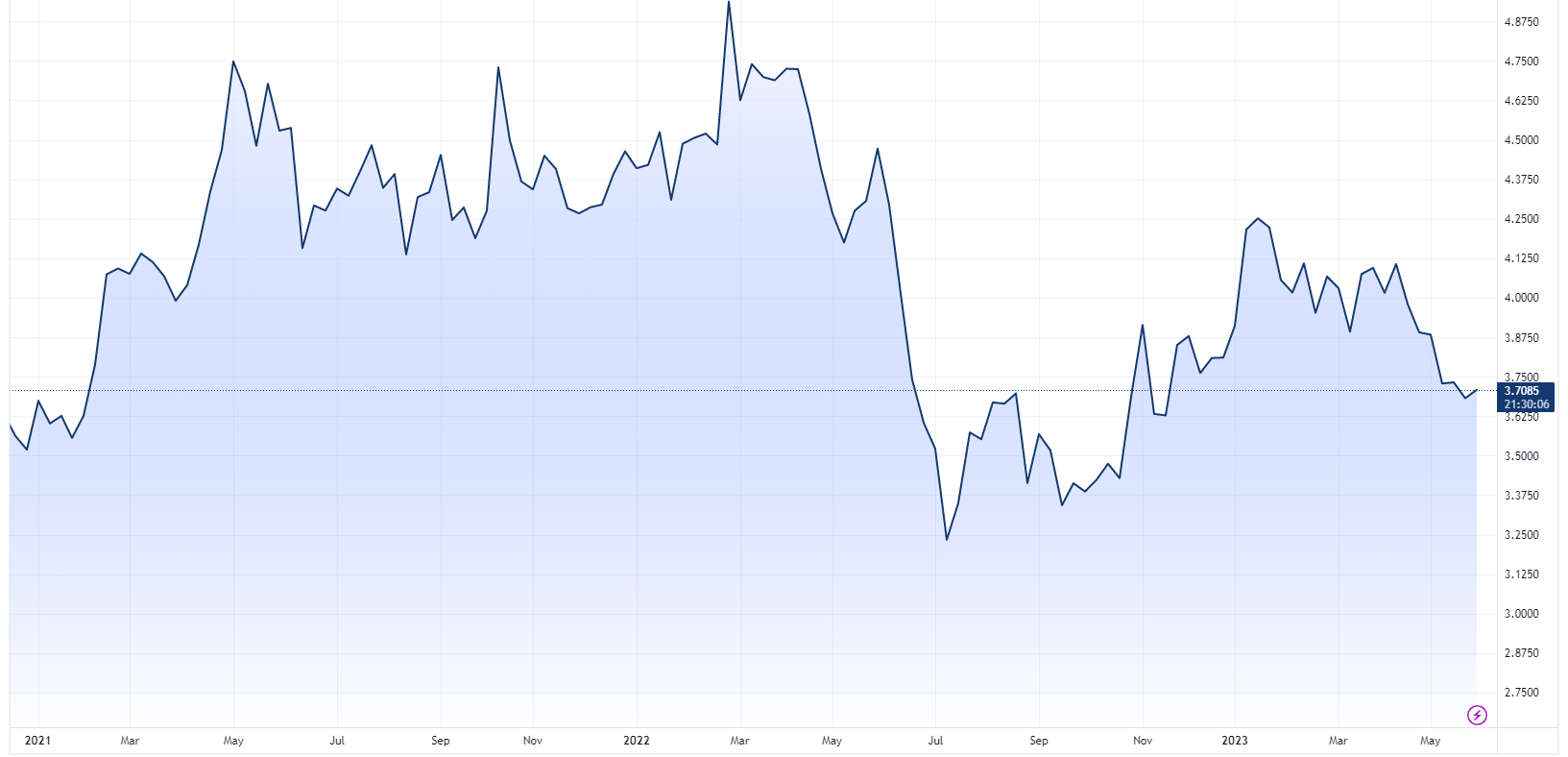

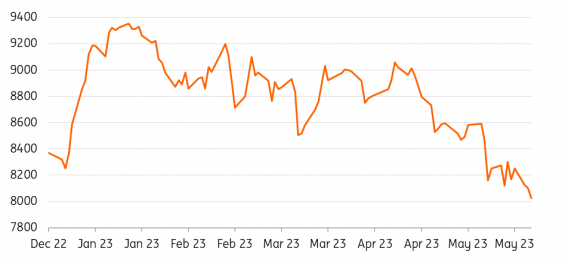

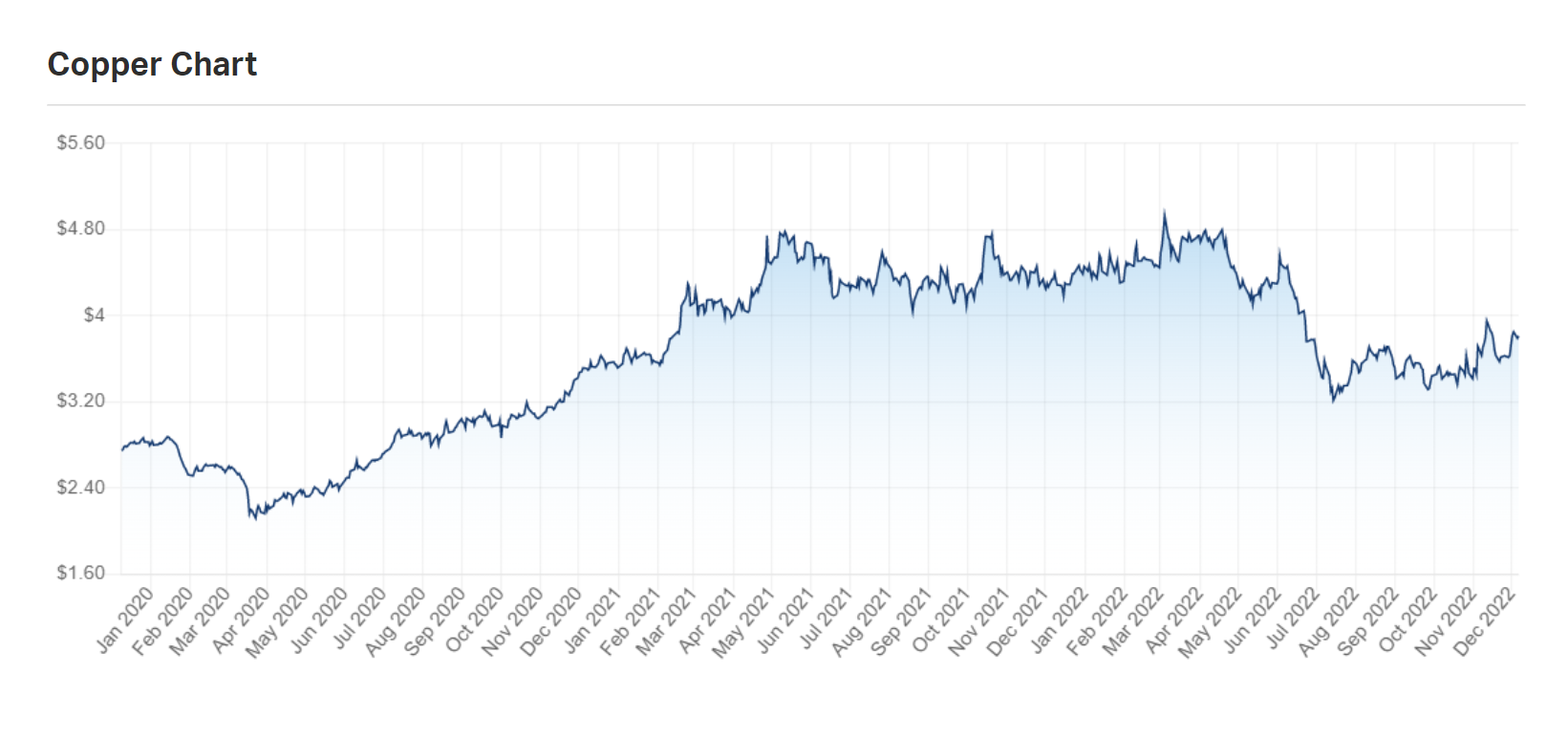

Section 1: The Descent (October 2022 – January 2023): This era noticed a basic downward pattern in copper costs. A number of components contributed to this decline:

- International Financial Slowdown: Fears of a world recession, fueled by persistent inflation and aggressive rate of interest hikes by central banks worldwide, dampened demand for copper. Manufacturing exercise, a key driver of copper consumption, weakened considerably in lots of nations.

- China’s Zero-COVID Coverage: China’s strict COVID-19 insurance policies severely impacted its financial system, resulting in decreased industrial manufacturing and a decline in copper demand from its building and manufacturing sectors. This was significantly impactful given China’s standing because the world’s largest copper shopper.

- Strengthening US Greenback: The strengthening US greenback made dollar-denominated commodities like copper dearer for patrons utilizing different currencies, additional suppressing demand.

Section 2: The Restoration (February 2023 – Might 2023): The copper value chart began to point out indicators of restoration throughout this era. A number of components contributed to this upward pattern:

- Easing of COVID Restrictions in China: The easing of China’s zero-COVID coverage led to a big rebound in its financial system, boosting demand for copper. Development exercise picked up, and manufacturing output elevated, driving up copper consumption.

- Improved International Financial Outlook: Whereas recessionary fears remained, the worldwide financial outlook appeared much less bleak than beforehand anticipated. This improved sentiment helped to extend investor confidence in copper.

- Provide-Aspect Considerations: Considerations about potential provide disruptions, significantly in key producing nations like Chile and Peru, additionally performed a task in supporting copper costs. Strikes, political instability, and weather-related points contributed to those considerations.

Section 3: Consolidation and Volatility (June 2023 – September 2023): This section was characterised by value consolidation and elevated volatility. The market appeared to be grappling with conflicting alerts:

- Persistent Inflation and Curiosity Price Hikes: Whereas inflation confirmed indicators of cooling, it remained stubbornly excessive in lots of nations. Central banks continued to boost rates of interest, doubtlessly stifling financial development and impacting copper demand.

- Geopolitical Uncertainty: Geopolitical tensions, together with the continued battle in Ukraine and escalating US-China tensions, contributed to market uncertainty and value volatility.

- Stock Ranges: Modifications in copper stock ranges in key markets additionally influenced value fluctuations. Larger stock ranges may exert downward stress on costs, whereas decrease ranges may assist costs.

Section 4: The Current Pattern (October 2023 – Current): This era requires additional evaluation because it unfolds, however preliminary observations counsel continued volatility. Components to look at embrace:

- International Financial Development: The energy of worldwide financial restoration can be a vital determinant of copper demand. A sturdy restoration would seemingly assist increased copper costs, whereas a slowdown may result in additional value declines.

- China’s Financial Efficiency: China’s financial efficiency stays a key driver of copper demand. Any important slowdown in China’s financial system may negatively affect copper costs.

- Provide Chain Dynamics: Disruptions to copper provide, whether or not on account of geopolitical occasions, weather-related points, or labor disputes, may proceed to assist costs.

- Inexperienced Power Transition: The growing demand for copper within the renewable power sector, significantly in electrical autos and photo voltaic panels, may present a long-term assist for copper costs. It is a essential issue to contemplate for the long-term outlook.

Technical Evaluation of the Copper Value Chart:

An in depth technical evaluation of the copper value chart over the previous 12 months would contain inspecting varied indicators resembling:

- Shifting Averages: Analyzing shifting averages (e.g., 50-day, 100-day, 200-day) can assist determine developments and potential assist and resistance ranges.

- Relative Energy Index (RSI): The RSI can point out whether or not the copper value is overbought or oversold, offering insights into potential value reversals.

- MACD (Shifting Common Convergence Divergence): The MACD can assist determine momentum modifications and potential purchase or promote alerts.

- Assist and Resistance Ranges: Figuring out key assist and resistance ranges on the chart can assist predict potential value actions.

This technical evaluation, mixed with basic evaluation (mentioned above), gives a extra complete understanding of the copper value chart’s actions. Nonetheless, it is essential to keep in mind that technical evaluation will not be foolproof and ought to be used together with basic evaluation.

Components to Watch within the Coming Yr:

Trying forward, a number of components will seemingly form the copper value chart within the coming 12 months:

- Inflation and Curiosity Charges: The trajectory of inflation and rates of interest will considerably affect world financial development and demand for copper.

- China’s Financial Development: China’s financial efficiency will proceed to be a significant driver of copper demand.

- Geopolitical Dangers: Geopolitical instability and potential provide disruptions stay important dangers.

- Inexperienced Power Transition: The expansion of the inexperienced power sector will more and more drive copper demand.

- Technological Developments: Technological developments in copper manufacturing and recycling may affect provide dynamics.

Conclusion:

The copper value chart over the previous 12 months has been a mirrored image of the advanced and dynamic world financial panorama. Understanding the interaction of macroeconomic components, geopolitical occasions, and provide chain dynamics is essential for decoding its actions. Whereas predicting future costs with certainty is unattainable, analyzing historic developments, conducting thorough basic and technical evaluation, and thoroughly monitoring key financial and geopolitical indicators can present beneficial insights into potential future value actions. The long-term outlook for copper stays constructive, pushed by the growing demand from the inexperienced power transition, however short-term volatility is more likely to persist. Subsequently, steady monitoring and adaptation are important for buyers and companies concerned within the copper market.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Copper Value Chart: A Yr in Evaluate (and a Look Forward). We admire your consideration to our article. See you in our subsequent article!