Decoding The Charts: A Complete Information To Chart Studying For Choice Merchants

Decoding the Charts: A Complete Information to Chart Studying for Choice Merchants

Associated Articles: Decoding the Charts: A Complete Information to Chart Studying for Choice Merchants

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Charts: A Complete Information to Chart Studying for Choice Merchants. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Charts: A Complete Information to Chart Studying for Choice Merchants

Choice buying and selling, a robust but complicated technique, hinges on correct market prediction. Whereas elementary evaluation performs a task, technical evaluation, primarily counting on chart studying, gives invaluable insights into value actions and sentiment. Mastering chart studying is subsequently essential for profitable choice buying and selling. This text delves into varied chart sorts, indicators, and patterns, equipping you with the data to decipher market alerts and improve your buying and selling choices.

I. Understanding Chart Varieties:

Choice merchants primarily make the most of three most important chart sorts:

-

Line Charts: These are the best, displaying solely the closing value of an asset for every interval (e.g., day by day, weekly, month-to-month). They’re glorious for figuring out long-term traits however lack the element of different chart sorts. Line charts are helpful for shortly visualizing the general route of the worth over time.

-

Bar Charts: These supply extra info than line charts. Every bar represents a particular time interval (e.g., a day). The bar’s excessive, low, open, and shut costs are visually represented. The vertical size of the bar exhibits the worth vary for that interval, whereas the open and shut costs are indicated by the left and proper edges of the bar, respectively. Bar charts present a clearer image of value volatility and intraday actions.

-

Candlestick Charts: Thought-about probably the most informative, candlestick charts visually signify the open, excessive, low, and shut costs utilizing distinct shapes. A "physique" represents the distinction between the open and shut costs, whereas "wicks" (or shadows) lengthen from the physique to indicate the excessive and low costs. The colour of the physique usually signifies whether or not the worth closed greater (inexperienced or white, often) or decrease (crimson or black) than it opened. Candlestick charts are significantly helpful for figuring out candlestick patterns, that are recurring value formations that may sign potential value reversals or continuations.

II. Key Indicators for Choice Merchants:

Whereas charts alone present precious info, combining them with technical indicators amplifies their predictive energy. Listed here are some essential indicators:

-

Shifting Averages (MAs): These clean out value fluctuations, revealing underlying traits. Generally used MAs embody easy shifting averages (SMA), exponential shifting averages (EMA), and weighted shifting averages (WMA). Merchants usually use a number of MAs (e.g., 50-day SMA and 200-day SMA) to determine help and resistance ranges and ensure development route. Crossovers between MAs can sign purchase or promote alternatives.

-

Relative Power Index (RSI): This momentum indicator measures the magnitude of current value adjustments to judge overbought or oversold situations. RSI values above 70 typically counsel an overbought market (potential for value reversal), whereas values beneath 30 point out an oversold market (potential for value rebound). RSI divergences (value shifting in a single route whereas RSI strikes within the reverse) can even sign development adjustments.

-

Bollinger Bands: These encompass three traces: a easy shifting common (usually 20-period) and two commonplace deviation bands above and beneath the shifting common. Value actions exterior the bands usually point out volatility and potential reversals. The bands’ width additionally displays volatility; wider bands counsel greater volatility.

-

Quantity: Whereas not a direct value indicator, quantity confirms value motion. Excessive quantity throughout value will increase suggests sturdy shopping for strain, whereas excessive quantity throughout value decreases signifies sturdy promoting strain. Low quantity throughout important value actions raises suspicion of manipulation or weak development.

-

MACD (Shifting Common Convergence Divergence): This trend-following momentum indicator identifies adjustments within the energy, route, momentum, and length of a development. It consists of two shifting averages and a sign line. Crossovers between the MACD line and the sign line can sign purchase or promote alternatives.

III. Figuring out Chart Patterns:

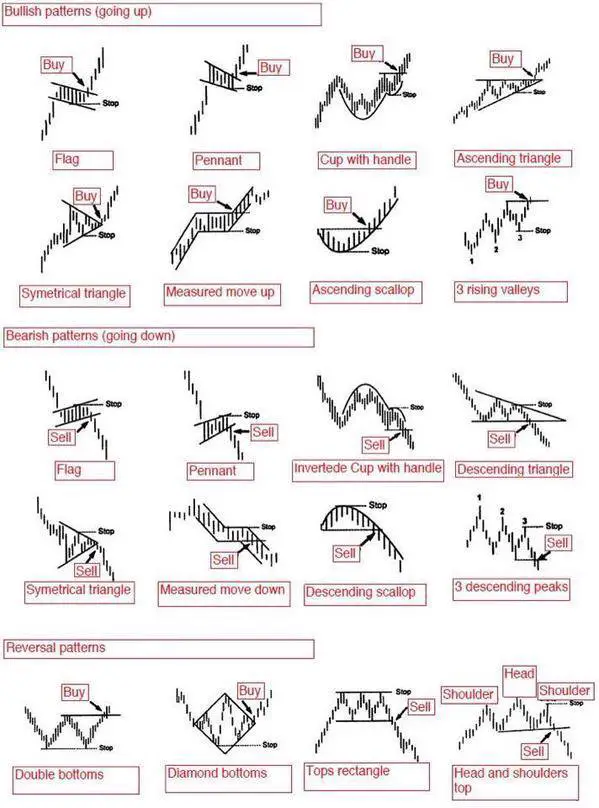

Recognizing chart patterns is essential for anticipating value actions. Listed here are some frequent patterns:

-

Head and Shoulders: This reversal sample consists of three peaks (left shoulder, head, proper shoulder), with decrease troughs between them. A neckline connects the troughs. A break beneath the neckline confirms a bearish reversal.

-

Inverse Head and Shoulders: That is the bullish counterpart of the top and shoulders sample. It alerts a possible value improve.

-

Double Tops/Bottoms: These patterns point out potential development reversals. A double prime consists of two comparable value peaks, whereas a double backside consists of two comparable value troughs. A break beneath the neckline (double prime) or above the help line (double backside) confirms the reversal.

-

Triangles: These patterns signify intervals of consolidation earlier than a big value transfer. Symmetrical triangles counsel continuation, whereas ascending triangles counsel bullish continuation and descending triangles counsel bearish continuation.

-

Flags and Pennants: These continuation patterns seem throughout sturdy traits. They’re characterised by a quick consolidation interval (the flag or pennant) earlier than the development resumes.

IV. Choice Methods and Chart Studying:

Understanding chart patterns and indicators is important for implementing varied choice methods successfully.

-

Shopping for Calls: Bullish merchants make the most of this technique when anticipating a value improve. Chart patterns like inverse head and shoulders or ascending triangles can sign favorable situations for getting calls. Sturdy momentum, indicated by RSI above 50 and upward-trending MACD, additional helps this choice.

-

Shopping for Places: Bearish merchants make use of this technique when anticipating a value decline. Patterns like head and shoulders or descending triangles, coupled with RSI beneath 50 and downward-trending MACD, may point out favorable situations for getting places.

-

Promoting Lined Calls: This technique is appropriate for these holding underlying property and keen to restrict upside potential in alternate for premium earnings. Excessive implied volatility and resistance ranges recognized on the chart can sign favorable situations for this technique.

-

Promoting Money-Secured Places: This technique is used to accumulate underlying property at a lower cost. Assist ranges recognized on the chart, alongside low implied volatility and a downward-trending MACD, can sign favorable situations for promoting cash-secured places.

V. Essential Issues:

-

Timeframe: The timeframe you select (day by day, weekly, month-to-month) impacts the interpretation of charts and indicators. Lengthy-term charts reveal main traits, whereas short-term charts spotlight intraday fluctuations.

-

Danger Administration: By no means threat greater than you’ll be able to afford to lose. Make the most of stop-loss orders to restrict potential losses.

-

Backtesting: Earlier than implementing any technique, backtest it utilizing historic knowledge to evaluate its effectiveness.

-

Affirmation: Depend on a number of indicators and patterns to verify buying and selling alerts. Keep away from making buying and selling choices based mostly on a single indicator.

-

Market Context: Think about broader market situations and information occasions that may affect value actions.

Conclusion:

Chart studying is a elementary talent for profitable choice buying and selling. By understanding totally different chart sorts, indicators, and patterns, and by combining technical evaluation with threat administration and market consciousness, choice merchants can considerably enhance their skill to determine worthwhile buying and selling alternatives. Do not forget that steady studying and observe are essential for mastering this talent and persistently making knowledgeable buying and selling choices. This text serves as a place to begin; additional analysis and expertise are important to changing into a proficient chart reader within the dynamic world of choice buying and selling. All the time seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered precious insights into Decoding the Charts: A Complete Information to Chart Studying for Choice Merchants. We admire your consideration to our article. See you in our subsequent article!