Decoding The Chart Of Accounts: The Spine Of Monetary Reporting

Decoding the Chart of Accounts: The Spine of Monetary Reporting

Associated Articles: Decoding the Chart of Accounts: The Spine of Monetary Reporting

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Chart of Accounts: The Spine of Monetary Reporting. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Chart of Accounts: The Spine of Monetary Reporting

/Financial%20Statements%20Decoding%20the%20Backbone%20of%20Business.webp)

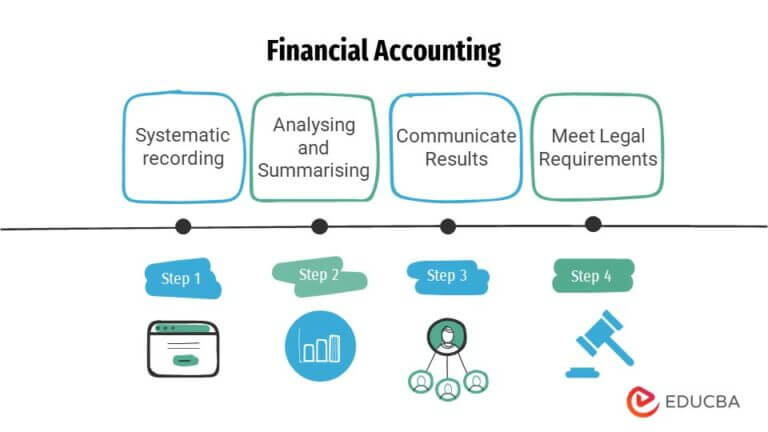

The chart of accounts (COA) is a foundational aspect of any group’s monetary administration system. It is greater than only a record of accounts; it is a structured, organized framework that categorizes all of the monetary transactions of a enterprise. Consider it as the corporate’s monetary blueprint, guiding the recording, classifying, and summarizing of monetary knowledge. With out a well-defined and maintained chart of accounts, correct monetary reporting turns into almost unattainable, resulting in flawed decision-making and potential regulatory points. This text delves into the intricacies of the chart of accounts, exploring its function, construction, frequent account sorts, finest practices for implementation and upkeep, and the implications of a poorly designed or managed COA.

The Objective of a Chart of Accounts:

The first function of a chart of accounts is to offer a constant and standardized methodology for recording and monitoring monetary transactions. This ensures that each one monetary knowledge is categorized logically and persistently, facilitating correct monetary reporting and evaluation. Particularly, a strong COA helps in:

- Correct Monetary Reporting: By systematically classifying transactions, the COA ensures that monetary statements (steadiness sheet, revenue assertion, money stream assertion) precisely replicate the monetary well being of the group.

- Improved Monetary Evaluation: A well-structured COA permits for detailed evaluation of monetary knowledge, figuring out developments, areas of energy and weak spot, and potential dangers. This allows knowledgeable decision-making relating to useful resource allocation, budgeting, and strategic planning.

- Enhanced Inner Controls: A transparent COA facilitates higher inner controls by offering a framework for segregation of duties and authorization processes. This reduces the chance of errors and fraud.

- Compliance with Rules: Many regulatory our bodies require companies to take care of a structured chart of accounts for compliance functions, notably for tax reporting and auditing.

- Streamlined Accounting Processes: A well-designed COA simplifies accounting processes, making knowledge entry, reconciliation, and reporting extra environment friendly.

Construction and Parts of a Chart of Accounts:

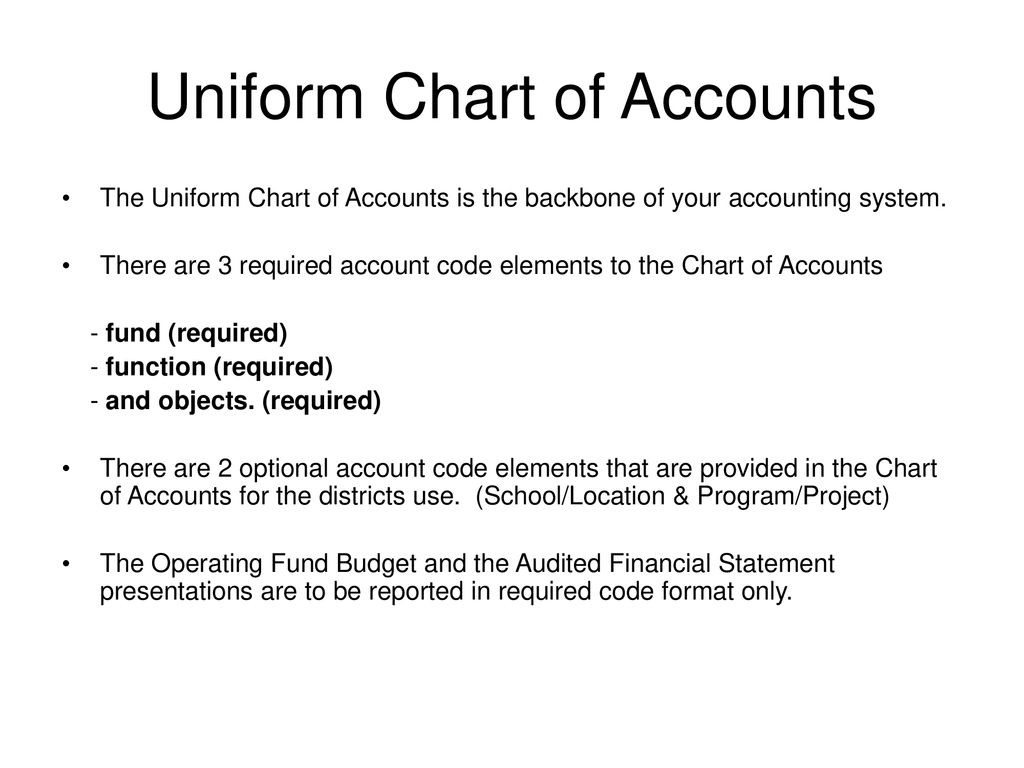

A chart of accounts usually follows a hierarchical construction, usually utilizing a numbering system to categorize accounts. This technique permits for detailed classification and facilitates looking out and reporting. The construction generally contains:

-

Main Account Classes: These are the highest-level classifications, usually representing the primary monetary assertion parts. Frequent classes embody:

- Property: Assets owned by the enterprise (e.g., money, accounts receivable, stock, property, plant, and gear).

- Liabilities: Obligations owed by the enterprise (e.g., accounts payable, loans payable, salaries payable).

- Fairness: The homeowners’ stake within the enterprise (e.g., frequent inventory, retained earnings).

- Income: Earnings generated from the enterprise’s operations (e.g., gross sales income, service income).

- Bills: Prices incurred in producing income (e.g., price of products bought, salaries expense, hire expense).

-

Sub-accounts: Every main account class is additional damaged down into sub-accounts, offering extra granular element. For instance, "Property" may be subdivided into "Present Property" and "Non-Present Property," with additional subdivisions underneath every. "Present Property" may embody "Money," "Accounts Receivable," and "Stock," every with its personal sub-accounts for particular forms of money, receivables, or stock.

-

Account Numbers: A numerical coding system is used to determine every account uniquely. This technique usually displays the hierarchical construction, with the primary digits representing the foremost class, adopted by digits representing sub-accounts. For instance, 1000 may characterize "Present Property," 1100 "Money," and 1110 "Checking Account."

Frequent Account Sorts:

The particular accounts inside a chart of accounts will fluctuate relying on the character and measurement of the enterprise. Nonetheless, some frequent account sorts embody:

- Money Accounts: These accounts observe varied types of money, together with checking accounts, financial savings accounts, and petty money.

- Accounts Receivable: These accounts observe cash owed to the enterprise by clients.

- Stock: This account tracks the worth of products held on the market.

- Mounted Property: These accounts observe the worth of long-term belongings similar to property, plant, and gear.

- Accounts Payable: These accounts observe cash owed by the enterprise to suppliers.

- Loans Payable: These accounts observe cash owed by the enterprise to lenders.

- Gross sales Income: This account tracks revenue generated from gross sales.

- Price of Items Offered: This account tracks the direct prices related to producing items bought.

- Salaries Expense: This account tracks salaries paid to workers.

- Lease Expense: This account tracks hire funds.

Finest Practices for Implementing and Sustaining a Chart of Accounts:

- Planning and Design: Cautious planning is essential. Take into account the enterprise’s particular wants, business requirements, and regulatory necessities. Contain key stakeholders within the design course of.

- Consistency: Keep consistency in account naming, numbering, and classification. This ensures correct knowledge aggregation and reporting.

- Common Assessment and Updates: The chart of accounts ought to be reviewed and up to date periodically to replicate modifications within the enterprise’s operations and monetary construction. This contains including new accounts as wanted and eradicating out of date ones.

- Documentation: Keep complete documentation of the chart of accounts, together with account descriptions, definitions, and any related insurance policies.

- Coaching: Present sufficient coaching to all personnel concerned in utilizing the chart of accounts.

- Software program Integration: Combine the chart of accounts with the accounting software program utilized by the enterprise. This ensures seamless knowledge entry and reporting.

Implications of a Poorly Designed or Managed COA:

A poorly designed or managed chart of accounts can have critical penalties, together with:

- Inaccurate Monetary Statements: This will result in flawed decision-making and misrepresentation of the corporate’s monetary well being.

- Inefficient Accounting Processes: This will improve the time and sources required for monetary reporting and evaluation.

- Elevated Threat of Errors and Fraud: A poorly structured COA could make it simpler for errors and fraud to go undetected.

- Non-Compliance with Rules: This can lead to penalties and authorized points.

- Problem in Monetary Evaluation: This will hinder the power to determine developments, alternatives, and dangers.

Conclusion:

The chart of accounts is a crucial part of any profitable enterprise. A well-designed and meticulously maintained COA is important for correct monetary reporting, environment friendly accounting processes, knowledgeable decision-making, and compliance with laws. By investing time and sources in creating and sustaining a strong COA, companies can lay a stable basis for his or her monetary administration and long-term success. Ignoring this basic facet of monetary administration can result in important challenges and probably jeopardize the well being and way forward for the group. Due to this fact, understanding and correctly implementing a chart of accounts will not be merely a technical requirement, however a strategic crucial for any enterprise, no matter its measurement or complexity.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Chart of Accounts: The Spine of Monetary Reporting. We thanks for taking the time to learn this text. See you in our subsequent article!