Decoding The Candlestick: A Complete Information To Chart Buying and selling

Decoding the Candlestick: A Complete Information to Chart Buying and selling

Associated Articles: Decoding the Candlestick: A Complete Information to Chart Buying and selling

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Candlestick: A Complete Information to Chart Buying and selling. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Candlestick: A Complete Information to Chart Buying and selling

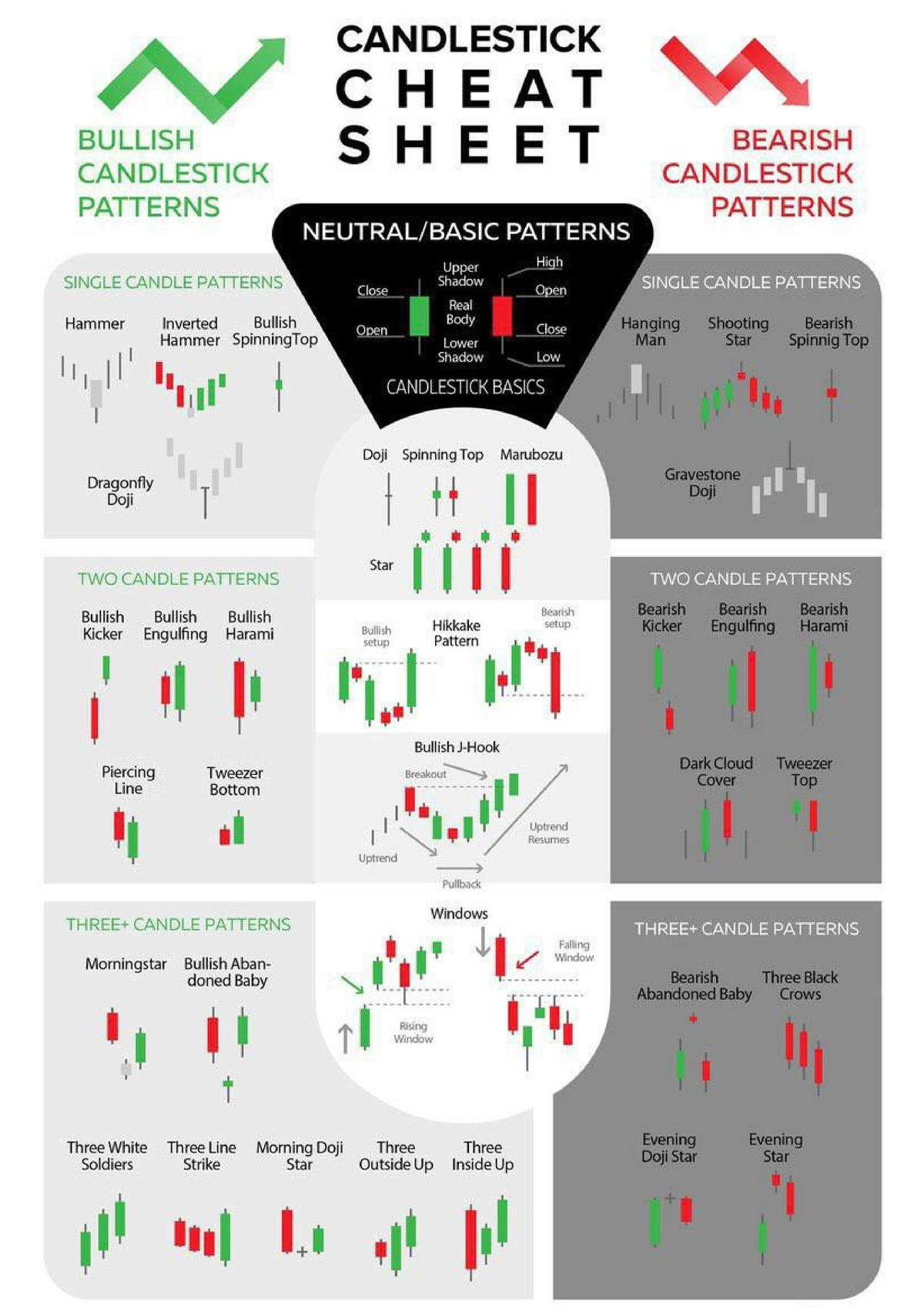

The candlestick chart, a staple of technical evaluation, affords a visually wealthy and informative technique to interpret worth actions in monetary markets. In contrast to bar charts which merely show the excessive, low, open, and shut costs, candlestick charts symbolize this knowledge in a visually compelling method, permitting merchants to rapidly establish developments, reversals, and potential buying and selling alternatives. This text gives a complete information to understanding and using candlestick charts in your buying and selling technique.

Understanding the Anatomy of a Candlestick

Every candlestick represents the worth motion over a selected time interval (e.g., 1 minute, 5 minutes, 1 hour, 1 day). The important thing parts are:

-

Physique: The oblong portion of the candlestick represents the worth vary between the open and shut. A bullish (inexperienced or white) candlestick signifies the closing worth was greater than the opening worth, exhibiting shopping for strain. A bearish (purple or black) candlestick signifies the closing worth was decrease than the opening worth, reflecting promoting strain. The size of the physique represents the magnitude of the worth distinction between the open and shut.

-

Wicks (Shadows or Tails): The traces extending above and under the physique are the wicks. The higher wick exhibits the very best worth reached throughout the interval, whereas the decrease wick exhibits the bottom worth. Lengthy wicks usually counsel robust worth rejection at these ranges.

Deciphering Candlestick Patterns: Single Candlesticks

Whereas the facility of candlestick evaluation really shines when a number of candlesticks are mixed into patterns, understanding particular person candlestick formations gives a basis for extra superior evaluation.

-

Doji: A Doji options an open and shut worth which are nearly the identical, leading to a small or nonexistent physique. Dojis usually sign indecision out there and potential reversals. Various kinds of Dojis (e.g., long-legged Doji, dragonfly Doji, headstone Doji) provide nuanced interpretations.

-

Marubozu: This can be a candlestick with an extended physique and no higher or decrease wicks. A bullish Marubozu signifies robust shopping for strain, whereas a bearish Marubozu indicators robust promoting strain. They counsel a decisive transfer out there.

-

Spinning Prime: This candlestick has a small physique and lengthy higher and decrease wicks. It signifies indecision and a possible interval of consolidation or reversal.

-

Hammer and Hanging Man: These are comparable in look, each having a small physique with an extended decrease wick. The distinction lies of their context. A Hammer seems on the backside of a downtrend, suggesting a possible bullish reversal. A Hanging Man seems on the high of an uptrend, suggesting a possible bearish reversal. Affirmation from different indicators or patterns is essential.

-

Engulfing Sample: This two-candlestick sample includes a big candlestick engulfing the earlier one. A bullish engulfing sample happens when a big bullish candlestick utterly engulfs a previous bearish candlestick, suggesting a possible bullish reversal. Conversely, a bearish engulfing sample happens when a big bearish candlestick engulfs a previous bullish candlestick, signaling a possible bearish reversal.

Deciphering Candlestick Patterns: A number of Candlesticks

The true energy of candlestick evaluation emerges when analyzing a number of candlesticks together, forming distinct patterns that supply beneficial insights into market sentiment and potential worth actions.

-

Morning Star and Night Star: These three-candlestick patterns sign potential reversals. A Morning Star seems on the backside of a downtrend, that includes a bearish candlestick adopted by a small physique candlestick (usually a Doji), after which a bullish candlestick that gaps greater. An Night Star is the bearish counterpart, showing on the high of an uptrend.

-

Three White Troopers and Three Black Crows: These patterns include three consecutive bullish or bearish candlesticks, respectively, every with the next shut than the earlier one (Three White Troopers) or a decrease shut than the earlier one (Three Black Crows). They counsel a powerful pattern continuation.

-

Darkish Cloud Cowl and Piercing Line: These are two-candlestick reversal patterns. A Darkish Cloud Cowl is a bearish sample the place a big bullish candlestick is adopted by a bearish candlestick that opens above the earlier shut and closes considerably decrease. A Piercing Line is a bullish sample, the other of the Darkish Cloud Cowl, suggesting a possible bullish reversal after a downtrend.

-

Harami: This two-candlestick sample indicators indecision. A small physique candlestick is totally contained throughout the physique of the previous candlestick. A bullish Harami seems after a bearish candlestick, whereas a bearish Harami seems after a bullish candlestick.

Combining Candlestick Evaluation with Different Indicators

Whereas candlestick patterns present beneficial insights, combining them with different technical indicators enhances accuracy and reduces the danger of false indicators. Widespread indicators used along side candlestick evaluation embrace:

- Transferring Averages: Determine developments and potential help and resistance ranges.

- Relative Energy Index (RSI): Measures momentum and identifies overbought and oversold situations.

- MACD (Transferring Common Convergence Divergence): Identifies momentum modifications and potential pattern reversals.

- Quantity: Confirms worth actions and identifies durations of robust shopping for or promoting strain.

By evaluating candlestick patterns with these indicators, merchants can improve the arrogance of their buying and selling selections and filter out false indicators. For instance, a bullish engulfing sample confirmed by growing quantity and a bullish crossover of transferring averages considerably strengthens the bullish sign.

Limitations of Candlestick Evaluation

Whereas candlestick evaluation is a robust instrument, it is essential to acknowledge its limitations:

- Subjectivity: Interpretation of candlestick patterns might be subjective, resulting in differing opinions amongst merchants.

- Affirmation Bias: Merchants could give attention to patterns that verify their present biases, ignoring contradictory proof.

- False Indicators: Candlestick patterns can generate false indicators, resulting in incorrect buying and selling selections. Affirmation from different indicators and cautious threat administration are important.

- Context Issues: The importance of a candlestick sample relies upon closely on the broader market context and the particular asset being traded.

Conclusion:

Candlestick chart evaluation affords a wealthy and dynamic method to understanding worth motion in monetary markets. By mastering the artwork of decoding particular person candlesticks and recognizing widespread patterns, merchants can achieve beneficial insights into market sentiment and establish potential buying and selling alternatives. Nonetheless, it’s essential to do not forget that candlestick evaluation needs to be used along side different technical indicators and sound threat administration methods to maximise the probabilities of success. Constant studying, follow, and disciplined buying and selling are key to successfully using candlestick charts for worthwhile buying and selling. Bear in mind to backtest your methods and constantly refine your method based mostly in your buying and selling expertise and market situations. The candlestick chart is a robust instrument, however its effectiveness hinges on the dealer’s capacity to interpret its indicators precisely and make knowledgeable selections.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the Candlestick: A Complete Information to Chart Buying and selling. We hope you discover this text informative and helpful. See you in our subsequent article!