Charting The Course: A Historical past Of Value Charts In Finance

Charting the Course: A Historical past of Value Charts in Finance

Associated Articles: Charting the Course: A Historical past of Value Charts in Finance

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Charting the Course: A Historical past of Value Charts in Finance. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Charting the Course: A Historical past of Value Charts in Finance

Value charts, seemingly easy graphical representations of asset costs over time, are elementary instruments on the planet of finance. Their historical past is interwoven with the event of markets themselves, reflecting evolving technological capabilities and the ever-increasing sophistication of market evaluation. From rudimentary hand-drawn plots to the advanced interactive charts we see immediately, their evolution mirrors the journey of economic markets from localized buying and selling to the globally interconnected system we all know.

Early Days: Hand-Drawn Charts and the Beginning of Technical Evaluation

Lengthy earlier than computer systems and complicated software program, worth charts had been painstakingly created by hand. Early merchants and buyers relied on easy line charts, meticulously plotting each day, weekly, or month-to-month closing costs on graph paper. These rudimentary charts offered a visible illustration of worth actions, permitting merchants to determine developments and patterns. The dearth of available knowledge restricted the scope of those analyses, usually specializing in a slim vary of belongings and comparatively brief timeframes.

The seeds of technical evaluation, the methodology of utilizing worth charts to foretell future worth actions, had been sown throughout this period. Whereas exact attribution is tough, early pioneers like Charles Dow, whose theories shaped the muse of Dow Concept, laid the groundwork for decoding chart patterns. Dow’s observations of market developments, assist and resistance ranges, and the significance of quantity, although missing the delicate instruments of recent evaluation, had been essential in establishing the conceptual foundation of chart interpretation. His work, together with the contributions of different early market observers, step by step popularized using worth charts as a invaluable analytical software.

The Rise of Mechanization: Calculating Machines and the Enlargement of Information

The early twentieth century noticed the introduction of calculating machines, considerably decreasing the effort and time required to compile and plot worth knowledge. This technological development allowed for the creation of extra detailed charts, encompassing bigger datasets and longer time durations. The elevated accessibility of knowledge fueled the expansion of technical evaluation, resulting in the event of extra advanced chart patterns and indicators.

The emergence of specialised monetary publications additional propelled using worth charts. These publications, usually that includes hand-drawn or mechanically produced charts, offered buyers with readily accessible visible representations of market exercise. This facilitated the dissemination of technical evaluation strategies and contributed to its rising acceptance inside the funding neighborhood.

The Pc Revolution: Interactive Charts and Algorithmic Buying and selling

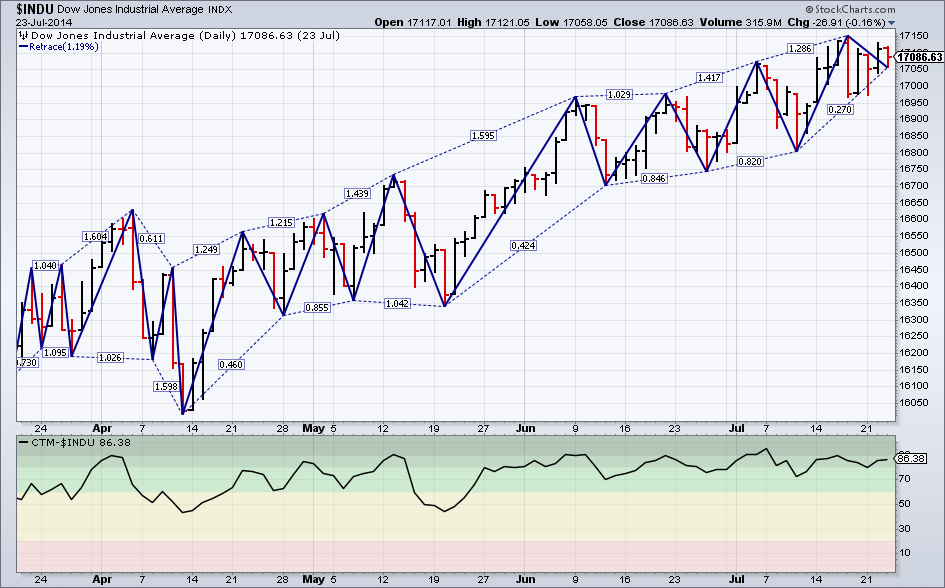

The appearance of computer systems within the latter half of the twentieth century revolutionized the world of worth charting. The flexibility to course of and show huge quantities of knowledge quickly remodeled the best way buyers analyzed markets. Software program packages emerged that would routinely generate varied chart varieties, together with candlestick charts, bar charts, and point-and-figure charts, every providing distinctive views on worth actions. The event of subtle charting software program additionally allowed for the incorporation of varied technical indicators, overlays, and drawing instruments, enhancing the analytical capabilities of worth charts.

This era additionally witnessed the rise of interactive charts, permitting customers to zoom out and in, modify timeframes, and overlay completely different indicators dynamically. This interactive nature considerably improved the person expertise and made technical evaluation extra accessible to a wider viewers. Moreover, the mixing of real-time knowledge feeds enabled buyers to trace market actions in real-time, offering quick suggestions and facilitating faster decision-making.

The pc revolution additionally paved the best way for algorithmic buying and selling, the place pc packages execute trades based mostly on pre-programmed algorithms that always incorporate chart patterns and technical indicators. This automated buying and selling method leverages the pace and effectivity of computer systems to investigate charts and execute trades at optimum occasions, additional highlighting the significance of worth charts in trendy finance.

Trendy Period: Large Information, AI, and the Way forward for Value Charts

In the present day, worth charting has turn into an integral a part of the monetary panorama. The provision of large datasets, encompassing a variety of belongings and timeframes, has enabled the creation of more and more subtle charts and analytical instruments. Large knowledge analytics and machine studying algorithms at the moment are used to determine advanced patterns and relationships inside worth knowledge, providing insights that will be inconceivable to discern by way of guide evaluation.

The combination of synthetic intelligence (AI) is reworking the best way worth charts are used. AI-powered platforms can routinely determine chart patterns, predict future worth actions, and optimize buying and selling methods based mostly on historic knowledge and real-time market circumstances. This elevated automation is driving the evolution of algorithmic buying and selling, resulting in extra subtle and environment friendly buying and selling methods.

Nevertheless, the reliance on know-how additionally presents challenges. The potential for knowledge manipulation, algorithmic biases, and the overfitting of fashions to historic knowledge necessitates a vital method to the interpretation of worth charts and the applying of AI-driven insights. The significance of elementary evaluation and threat administration stays paramount, even within the age of superior charting instruments and AI.

Completely different Varieties of Value Charts and Their Functions:

A number of kinds of worth charts cater to completely different analytical wants:

- Line Charts: The only type, plotting solely the closing worth of every interval. Helpful for figuring out long-term developments.

- Bar Charts: Show the open, excessive, low, and shutting costs for every interval, offering a extra complete image of worth actions.

- Candlestick Charts: Just like bar charts however with a visible illustration of the open, excessive, low, and shutting costs utilizing distinct "candles," making it simpler to determine patterns like bullish and bearish engulfing patterns.

- Level-and-Determine Charts: Focuses on important worth modifications, ignoring minor fluctuations, offering a filtered view of developments and potential reversals.

- Renko Charts: Just like Level-and-Determine charts, however makes use of fixed-size bricks to signify worth actions, emphasizing important worth modifications.

- Kagi Charts: Makes use of strains of various thickness to signify worth developments, filtering out noise and highlighting important worth reversals.

Every chart kind has its strengths and weaknesses, and the selection is determined by the particular analytical objectives and the traits of the asset being analyzed.

Conclusion:

The historical past of worth charts is a testomony to the continued evolution of economic markets and the fixed quest for higher methods to know and predict worth actions. From humble beginnings as hand-drawn plots to the delicate interactive charts powered by AI, worth charts have turn into indispensable instruments for buyers and merchants. Nevertheless, it is essential to do not forget that worth charts are only one piece of the puzzle. Efficient funding selections require a holistic method that integrates technical evaluation with elementary evaluation, threat administration, and an intensive understanding of market dynamics. The way forward for worth charting will undoubtedly contain additional integration of AI, huge knowledge, and progressive visualization strategies, promising much more highly effective instruments for navigating the complexities of economic markets. However the elementary ideas of figuring out developments, assist and resistance, and decoding patterns will stay central to profitable chart evaluation.

Closure

Thus, we hope this text has offered invaluable insights into Charting the Course: A Historical past of Value Charts in Finance. We admire your consideration to our article. See you in our subsequent article!