Chart Sample Screeners: Your Free Information To Recognizing Worthwhile Alternatives

Chart Sample Screeners: Your Free Information to Recognizing Worthwhile Alternatives

Associated Articles: Chart Sample Screeners: Your Free Information to Recognizing Worthwhile Alternatives

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Chart Sample Screeners: Your Free Information to Recognizing Worthwhile Alternatives. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Chart Sample Screeners: Your Free Information to Recognizing Worthwhile Alternatives

The inventory market can really feel like an unlimited, unpredictable ocean. Navigating its currents and tides requires ability, information, and, importantly, the best instruments. One highly effective software usually missed by novice and even seasoned merchants is the chart sample screener. These instruments can considerably improve your buying and selling technique by robotically figuring out potential buying and selling alternatives primarily based on pre-defined chart patterns. Whereas many premium providers provide refined screeners, a number of wonderful free choices exist, permitting you to leverage this highly effective approach with out breaking the financial institution. This text will discover the world of free chart sample screeners, outlining their advantages, limitations, and methods to successfully make the most of them in your buying and selling technique.

Understanding Chart Patterns:

Earlier than diving into the specifics of screeners, it is essential to grasp the underlying idea: chart patterns. These are recurring formations on value charts that, primarily based on historic information, usually predict future value actions. Figuring out these patterns manually might be time-consuming and vulnerable to subjective interpretation. That is the place chart sample screeners are available. They automate the method, scanning huge quantities of knowledge to pinpoint potential patterns throughout quite a few shares or different belongings.

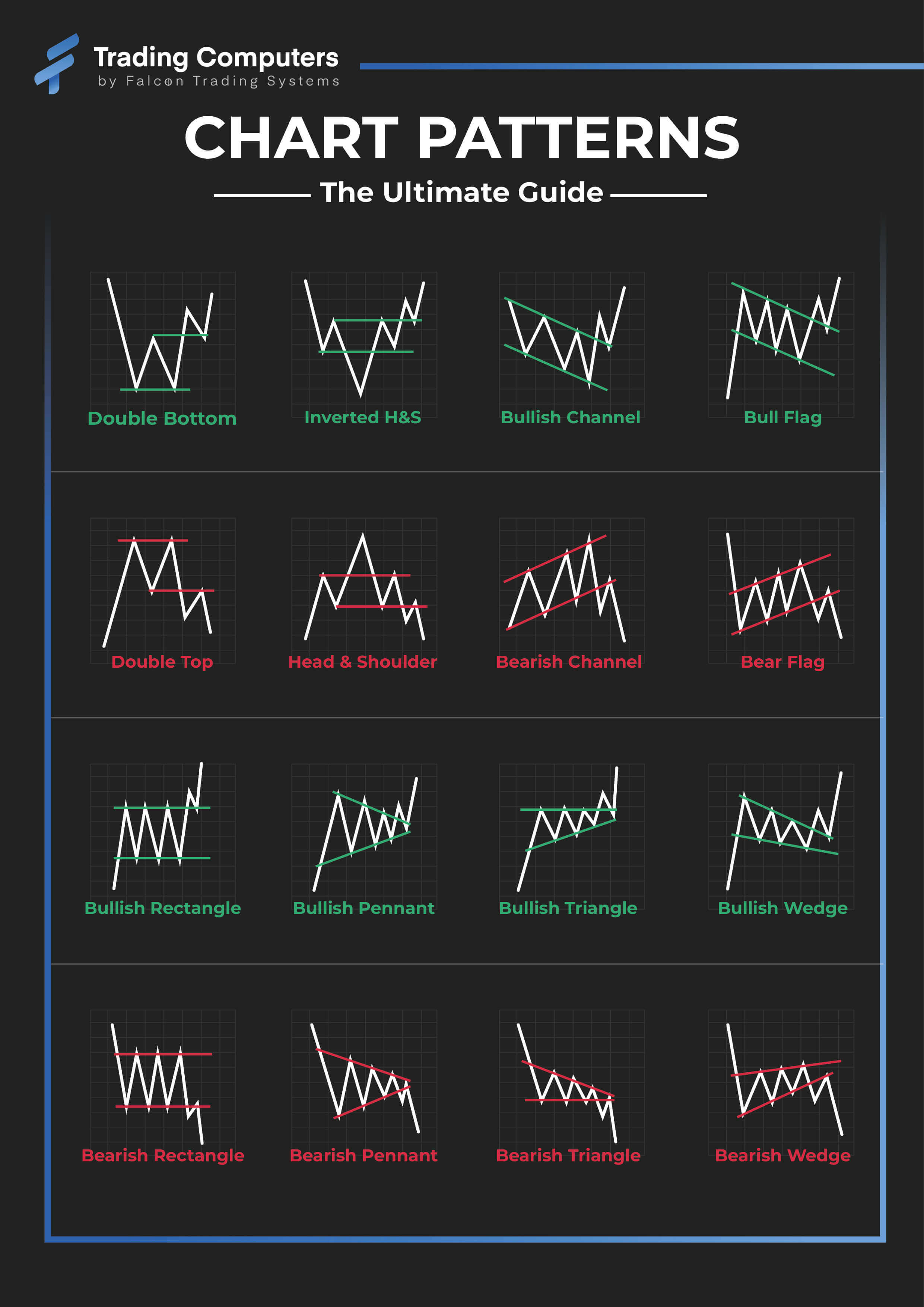

Frequent chart patterns embrace:

- Head and Shoulders: A reversal sample suggesting a possible value drop.

- Inverse Head and Shoulders: A bullish reversal sample indicating a possible value improve.

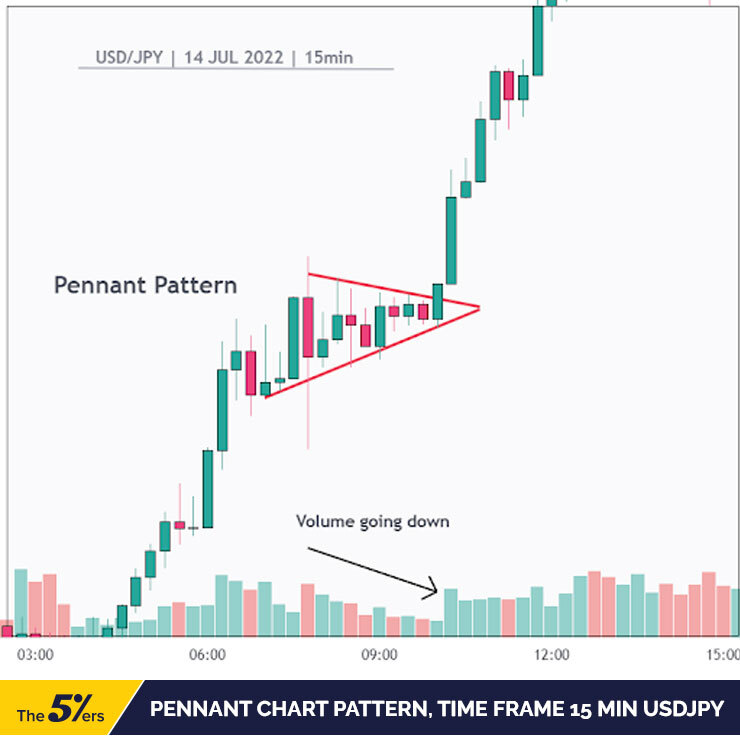

- Triangles (Ascending, Descending, Symmetrical): Consolidation patterns that may predict breakouts in both route.

- Flags and Pennants: Continuation patterns suggesting a continuation of the present pattern.

- Double Tops and Double Bottoms: Reversal patterns just like Head and Shoulders however less complicated in construction.

- Cup and Deal with: A bullish continuation sample.

Every sample has particular traits, entry and exit methods, and ranging levels of reliability. Understanding these nuances is essential for profitable buying and selling utilizing chart patterns.

The Benefits of Utilizing Free Chart Sample Screeners:

The first benefit of utilizing a free chart sample screener is, in fact, the price. Premium providers might be costly, making them inaccessible to many merchants, notably these beginning out. Free screeners eradicate this barrier to entry, permitting everybody to discover the facility of technical evaluation.

Past price, free screeners provide a number of different benefits:

- Accessibility: Many are available on-line, usually built-in into brokerage platforms or standalone web sites.

- Studying Device: They supply a beneficial studying alternative for rookies to familiarize themselves with varied chart patterns and their traits.

- Time Financial savings: Automating the sample identification course of frees up beneficial time for merchants to concentrate on different facets of their technique, corresponding to danger administration and order execution.

- Broad Market Protection: Whereas the depth of study may be much less complete than paid alternate options, free screeners usually cowl a variety of shares or belongings.

Limitations of Free Chart Sample Screeners:

Whereas free chart sample screeners provide important advantages, it is important to acknowledge their limitations:

- Restricted Options: Free variations usually provide fewer customizable choices in comparison with paid providers. This may limit the power to filter outcomes primarily based on particular standards, corresponding to quantity, volatility, or market capitalization.

- Accuracy: The accuracy of sample identification can range, and false positives are doable. It is essential to manually confirm any potential patterns recognized by the screener earlier than making any buying and selling selections.

- Knowledge Lag: Some free screeners could expertise information delays, doubtlessly impacting the timeliness of buying and selling indicators.

- Lack of Assist: Free providers usually present restricted or no buyer help, leaving customers to troubleshoot points independently.

- Promoting: Many free screeners are supported by promoting, which might be intrusive.

Discovering and Utilizing Free Chart Sample Screeners:

A number of avenues exist for accessing free chart sample screeners:

- Brokerage Platforms: Many on-line brokerage platforms provide built-in charting instruments with fundamental sample recognition capabilities as a part of their free providers. Verify the options provided by your dealer.

- TradingView: Whereas TradingView affords premium options, its free plan supplies entry to fundamental charting instruments and a few sample identification capabilities.

- Standalone Web sites: A number of web sites provide free chart sample screening instruments, though the options and accuracy could range considerably. Thorough analysis is important earlier than counting on any particular platform.

Efficient Utilization of Free Chart Sample Screeners:

To maximise the effectiveness of free chart sample screeners, contemplate the next:

- Mix with different indicators: Do not rely solely on chart patterns. Combine the screener’s outcomes with different technical indicators (e.g., transferring averages, RSI, MACD) and elementary evaluation to verify buying and selling indicators.

- Backtesting: If doable, backtest your methods utilizing historic information to evaluate their potential profitability and danger.

- Threat Administration: At all times implement a sturdy danger administration plan, together with stop-loss orders, to guard your capital.

- Guide Verification: By no means blindly comply with indicators generated by the screener. At all times manually confirm the recognized patterns on the chart to make sure their validity and accuracy.

- Deal with high-probability patterns: Prioritize patterns with the next historic success charge, corresponding to head and shoulders or triangles.

- Regulate your parameters: Experiment with completely different screening parameters to optimize your outcomes. This may contain adjusting the sensitivity of the sample recognition algorithm or filtering outcomes primarily based on particular standards.

Conclusion:

Free chart sample screeners provide a beneficial software for merchants of all ranges. Whereas they’ve limitations, their accessibility and skill to avoid wasting time make them a worthwhile addition to any buying and selling arsenal. By understanding their strengths and weaknesses and utilizing them judiciously along with different analytical instruments and danger administration methods, merchants can considerably enhance their probabilities of success within the dynamic world of economic markets. Keep in mind, nevertheless, that no software ensures earnings, and thorough analysis and disciplined buying and selling are important for long-term success. At all times strategy buying and selling with warning and handle your danger successfully.

Closure

Thus, we hope this text has supplied beneficial insights into Chart Sample Screeners: Your Free Information to Recognizing Worthwhile Alternatives. We thanks for taking the time to learn this text. See you in our subsequent article!