Chart Sample Reversals: Figuring out Turning Factors In The Market

Chart Sample Reversals: Figuring out Turning Factors within the Market

Associated Articles: Chart Sample Reversals: Figuring out Turning Factors within the Market

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Chart Sample Reversals: Figuring out Turning Factors within the Market. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Chart Sample Reversals: Figuring out Turning Factors within the Market

Chart patterns are visible representations of worth motion on a chart, providing merchants beneficial insights into potential market traits and reversals. Whereas many patterns recommend continuation of the prevailing pattern, a big subset indicators potential shifts in momentum, indicating a attainable reversal. Understanding these reversal patterns is essential for navigating market volatility and capitalizing on vital worth swings. This text delves into the intricacies of chart sample reversals, exploring their traits, identification methods, and sensible software in buying and selling methods.

Understanding Reversal Patterns: A Shift in Momentum

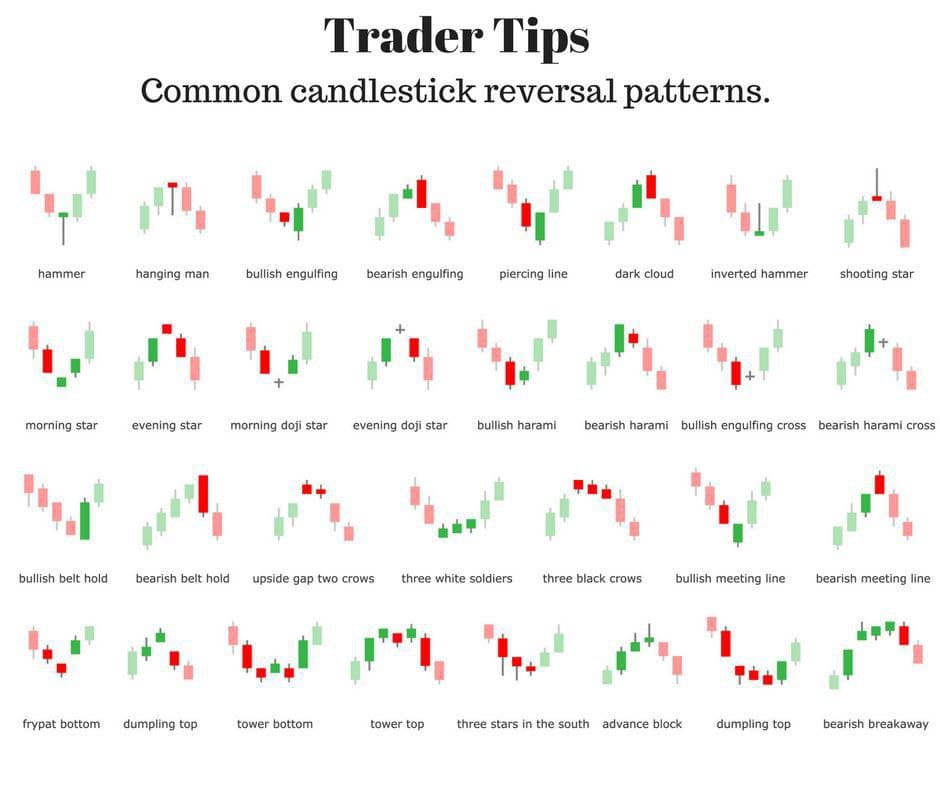

Reversal patterns sometimes emerge on the fruits of a pattern, signifying a possible exhaustion of shopping for or promoting stress. They’re characterised by a definite change in worth motion, usually accompanied by shifts in quantity and different technical indicators. These patterns will not be foolproof predictors; they merely spotlight areas of potential change, requiring affirmation from different analytical instruments earlier than coming into a commerce.

The formation of a reversal sample is a gradual course of. It begins with the weakening of the dominant pattern, manifested by smaller worth swings and lowered buying and selling quantity. This weakening part is adopted by a interval of consolidation or sideways motion, usually forming a definite sample on the chart. Lastly, a decisive breakout from the sample’s boundaries indicators the potential graduation of a brand new pattern in the other way.

Key Reversal Chart Patterns:

A number of well-established chart patterns reliably sign potential reversals. These embrace, however will not be restricted to:

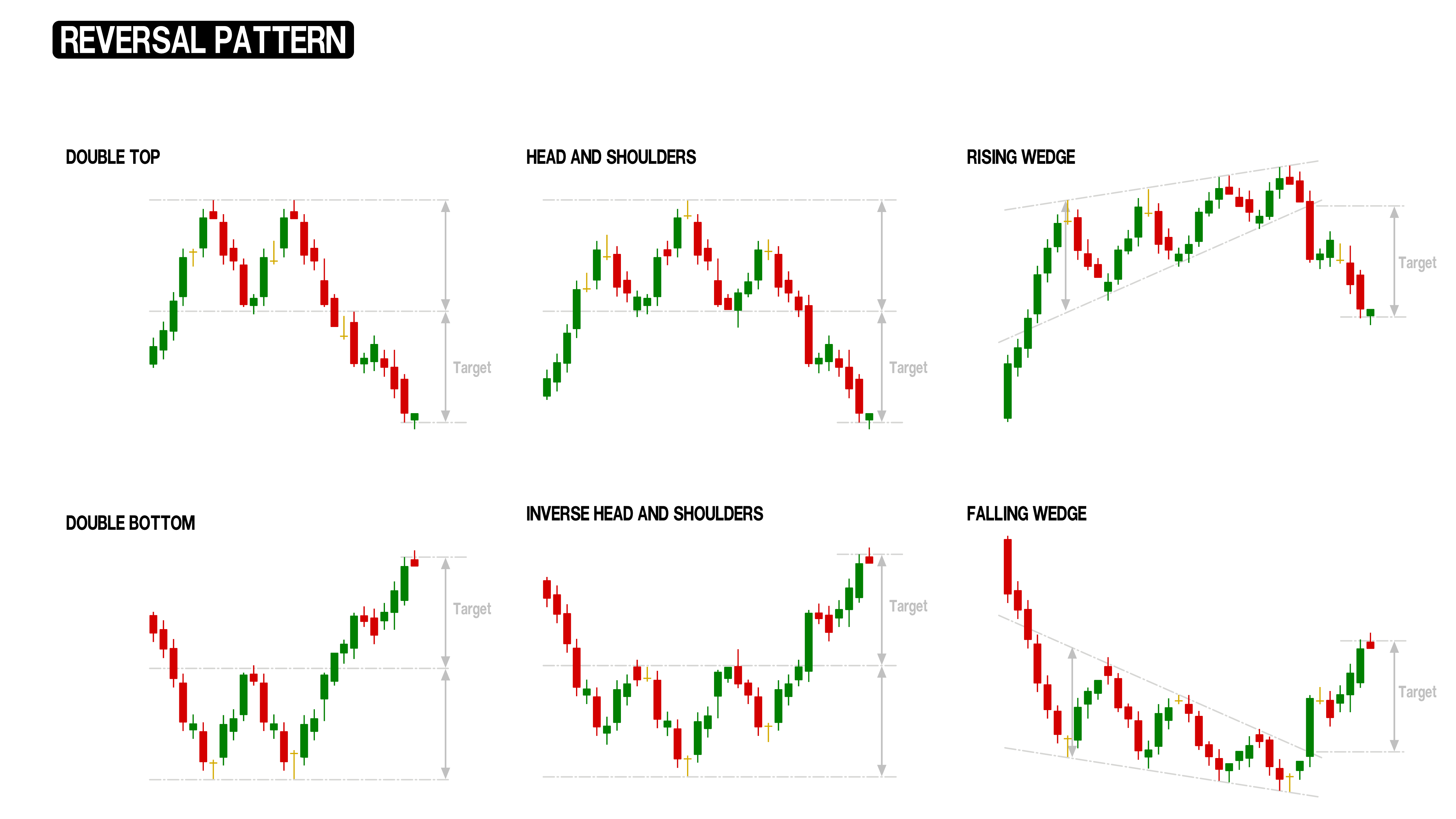

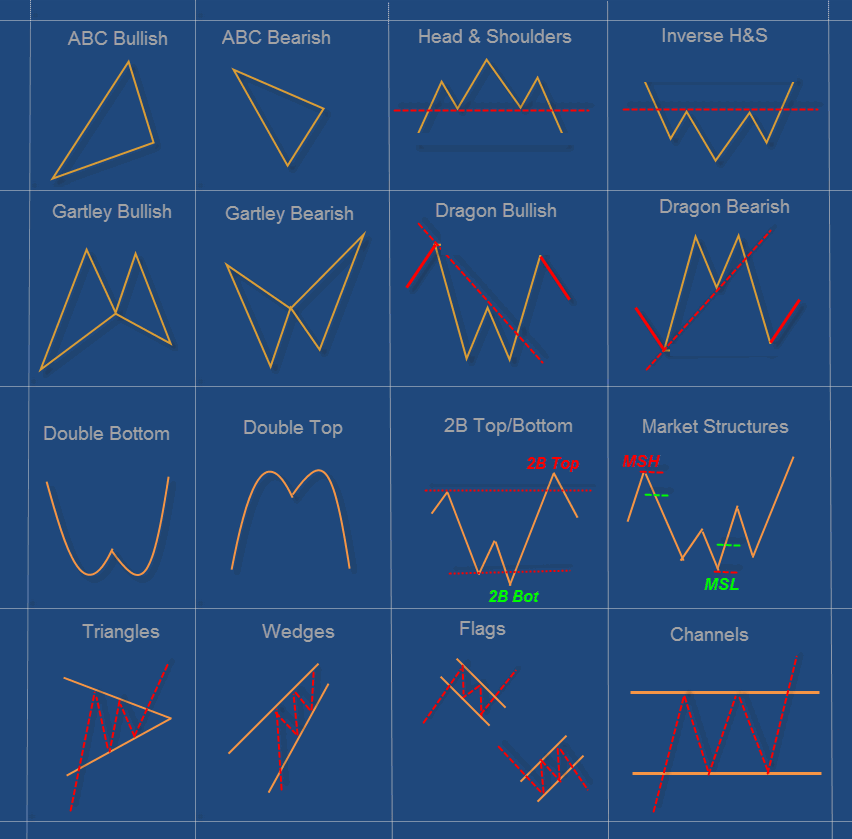

1. Head and Shoulders:

This basic reversal sample is arguably probably the most widely known. It consists of three peaks: a central peak (the "head") flanked by two smaller peaks (the "shoulders"). The neckline connects the troughs between the peaks. A decisive break under the neckline confirms the bearish reversal. The potential worth goal for the reversal is usually calculated by measuring the gap between the top and the neckline and projecting that distance downward from the neckline’s breakout level.

- Affirmation: Reducing quantity through the formation of the fitting shoulder and rising quantity upon the neckline breakout strongly reinforces the bearish sign. Destructive divergence between worth and an oscillator like RSI or MACD also can present affirmation.

2. Inverse Head and Shoulders:

That is the bullish counterpart of the Head and Shoulders sample. It types with three troughs, with the central trough being the bottom. The neckline connects the peaks between the troughs. A decisive break above the neckline indicators a possible bullish reversal. The worth goal is calculated by measuring the gap between the top (lowest trough) and the neckline and projecting that distance upward from the neckline’s breakout level.

- Affirmation: Growing quantity through the formation of the fitting shoulder (lowest trough) and rising quantity upon the neckline breakout strengthens the bullish sign. Optimistic divergence between worth and an oscillator also can present affirmation.

3. Double Tops and Double Bottoms:

These patterns are less complicated than Head and Shoulders. A Double High types when the worth reaches an analogous excessive twice, adopted by a decline. A Double Backside is the inverse, with the worth reaching an analogous low twice, adopted by an increase. The neckline in these patterns is a horizontal line connecting the swing lows (Double High) or swing highs (Double Backside). A break under the neckline (Double High) or above the neckline (Double Backside) indicators a possible reversal.

- Affirmation: Quantity evaluation is essential right here. Reducing quantity through the second peak (Double High) and rising quantity upon the neckline breakout affirm the bearish sign. The other applies to Double Bottoms.

4. Triple Tops and Triple Bottoms:

Much like Double Tops and Bottoms, however with three cases of comparable highs or lows. These patterns are usually extra dependable as a result of they display stronger resistance or help ranges. The evaluation and affirmation strategies are just like Double Tops and Bottoms.

5. Wedge Patterns:

Wedge patterns are characterised by converging trendlines. Rising wedges are bearish reversal patterns, whereas falling wedges are bullish reversal patterns. A breakout under the decrease trendline of a rising wedge or above the higher trendline of a falling wedge confirms the reversal.

- Affirmation: Quantity evaluation is vital. Reducing quantity inside a rising wedge and rising quantity upon the breakout strengthens the bearish sign. The other holds true for falling wedges.

6. Broadening Formations:

Broadening formations are characterised by progressively wider worth swings. These patterns are much less widespread however can sign vital reversals. Broadening tops are bearish, whereas broadening bottoms are bullish. A break under the decrease trendline of a broadening high or above the higher trendline of a broadening backside indicators a possible reversal.

- Affirmation: Quantity evaluation is vital; vital quantity will increase throughout breakouts affirm the sign.

Figuring out and Confirming Reversal Alerts:

Figuring out reversal patterns requires cautious remark of worth motion and quantity. A number of components can improve the reliability of reversal indicators:

-

Quantity Evaluation: Reducing quantity through the formation of a bearish reversal sample and rising quantity through the breakout confirms the bearish sign. The other applies to bullish reversal patterns.

-

Technical Indicators: Utilizing indicators like RSI, MACD, and Stochastic Oscillator may also help affirm reversal indicators. Divergence between worth and these indicators (worth making greater highs whereas the indicator makes decrease highs, or vice versa) usually precedes a reversal.

-

Help and Resistance Ranges: Reversal patterns usually type at key help and resistance ranges, reinforcing their significance.

-

Trendline Evaluation: Figuring out trendlines that help or resist worth actions may also help outline the sample and make sure the breakout.

-

Fibonacci Retracements: Fibonacci retracement ranges can present potential worth targets for reversals.

Threat Administration and Buying and selling Methods:

Buying and selling reversal patterns entails inherent threat. It is essential to implement sturdy threat administration methods:

-

Cease-Loss Orders: Place stop-loss orders to restrict potential losses. These orders must be positioned under the neckline for bearish reversals and above the neckline for bullish reversals.

-

Place Sizing: By no means threat greater than a small proportion of your buying and selling capital on a single commerce.

-

Affirmation: All the time search affirmation from a number of indicators and evaluation methods earlier than coming into a commerce.

-

Endurance: Keep away from impulsive buying and selling. Look ahead to clear affirmation earlier than coming into a place.

Conclusion:

Chart sample reversals present beneficial insights into potential market turning factors. Nevertheless, they don’t seem to be infallible predictors. Profitable buying and selling utilizing reversal patterns requires a mix of technical evaluation, threat administration, and self-discipline. By fastidiously observing worth motion, quantity, and using supporting indicators, merchants can enhance their skill to establish high-probability reversal setups and capitalize on market shifts. Do not forget that steady studying and refinement of your buying and selling technique are important for long-term success within the dynamic world of economic markets. All the time conduct thorough analysis and think about consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered beneficial insights into Chart Sample Reversals: Figuring out Turning Factors within the Market. We respect your consideration to our article. See you in our subsequent article!