Chart Sample Full E book PDF: A Complete Information To Technical Evaluation

Chart Sample Full E book PDF: A Complete Information to Technical Evaluation

Associated Articles: Chart Sample Full E book PDF: A Complete Information to Technical Evaluation

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Chart Sample Full E book PDF: A Complete Information to Technical Evaluation. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Chart Sample Full E book PDF: A Complete Information to Technical Evaluation

The attract of predicting market actions is a strong power driving many into the world of finance. Technical evaluation, a technique of evaluating securities by analyzing statistics generated by market exercise, equivalent to previous costs and quantity, provides a framework for this prediction. A cornerstone of technical evaluation lies in recognizing and decoding chart patterns – recurring formations on value charts that recommend potential future value actions. Whereas quite a few books delve into this topic, the seek for a definitive "Chart Sample Full E book PDF" usually yields fragmented info. This text goals to synthesize the important thing ideas and patterns, successfully serving as a complete information to understanding and using chart patterns in your buying and selling technique.

What are Chart Patterns?

Chart patterns are visually identifiable formations on value charts, created by the interaction of provide and demand. They symbolize the collective habits of market individuals, reflecting their feelings, expectations, and buying and selling actions. Recognizing these patterns permits merchants to anticipate potential breakouts, reversals, or continuations of present traits. Crucially, these patterns are usually not standalone indicators; their effectiveness is amplified when mixed with different technical indicators and elementary evaluation.

Kinds of Chart Patterns:

Chart patterns are broadly categorized into two predominant teams: continuation and reversal patterns.

1. Continuation Patterns: These patterns recommend that the present development will probably proceed after a short lived pause or consolidation. Some outstanding examples embody:

-

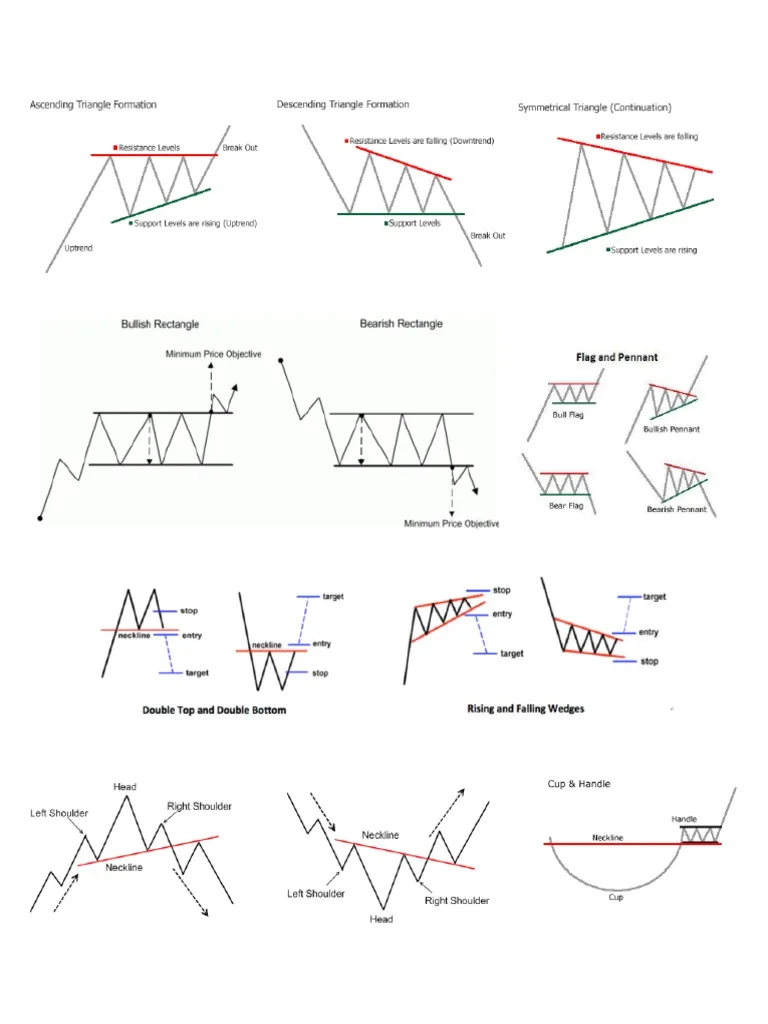

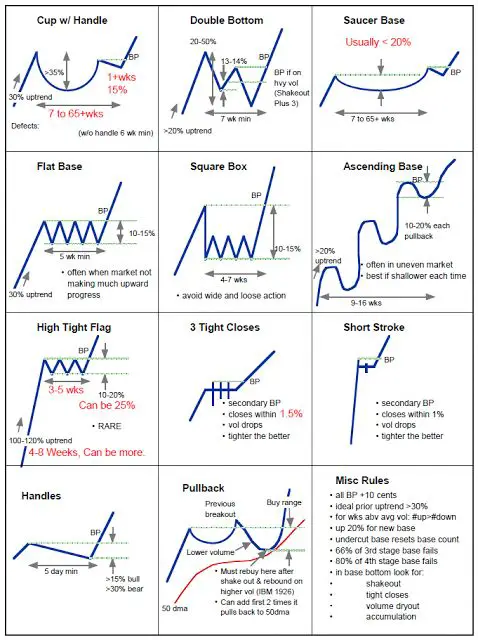

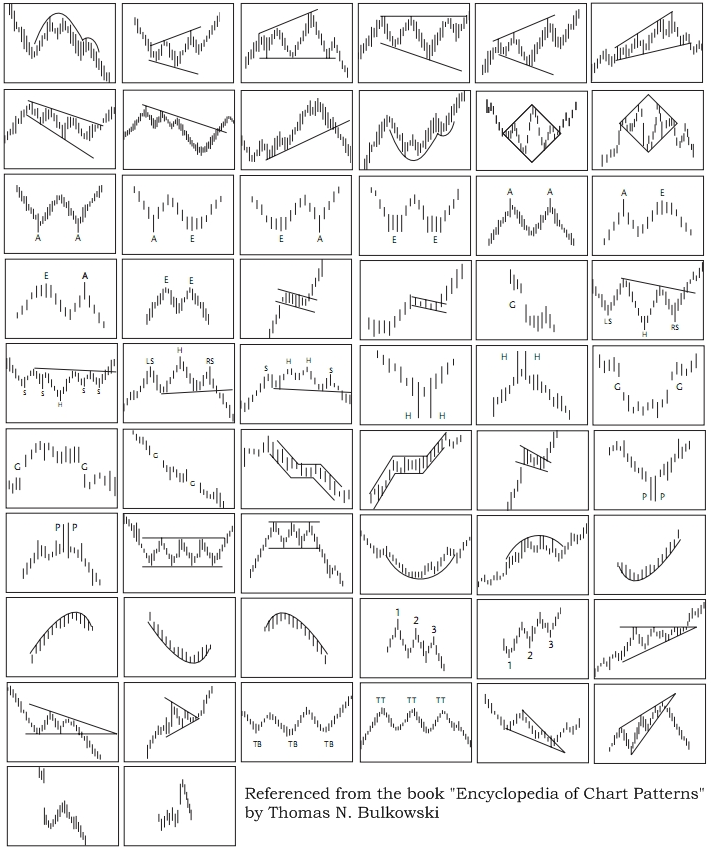

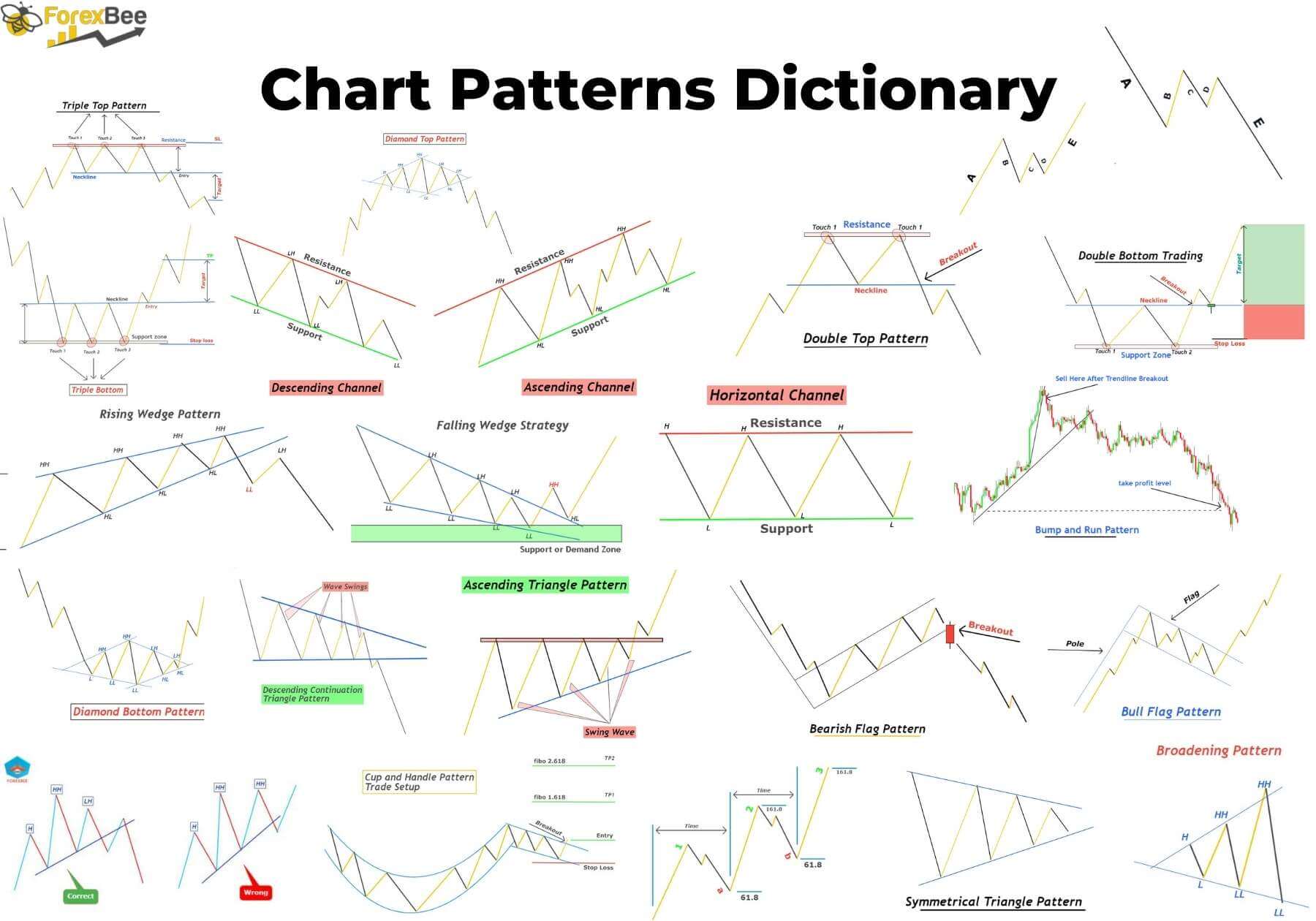

Triangles: These patterns are characterised by converging trendlines, forming a triangle form. There are three predominant varieties: symmetrical, ascending, and descending triangles. Symmetrical triangles recommend a continuation with a breakout in both path, whereas ascending triangles suggest an upward breakout and descending triangles a downward breakout. The breakout usually happens close to the apex of the triangle.

-

Flags and Pennants: These are short-term consolidation patterns characterised by a quick interval of sideways buying and selling inside a well-defined channel. Flags are characterised by parallel trendlines, whereas pennants are characterised by converging trendlines, just like triangles however on a smaller scale. Breakouts from these patterns usually sign a continuation of the previous development.

-

Rectangles: These patterns contain value consolidation inside a horizontal channel, bounded by parallel help and resistance ranges. Breakouts above the resistance degree recommend a continuation of an uptrend, whereas breakouts under the help degree recommend a continuation of a downtrend.

-

Wedges: Wedges are characterised by converging trendlines, just like triangles, however the general slope of the wedge signifies the path of the anticipated breakout. Ascending wedges (upward sloping) recommend a bearish continuation, whereas descending wedges (downward sloping) recommend a bullish continuation.

2. Reversal Patterns: These patterns recommend a possible change within the path of the prevailing development. Key examples embody:

-

Head and Shoulders: This can be a traditional reversal sample consisting of three peaks, with the center peak (the "head") being considerably greater than the opposite two ("shoulders"). A neckline connects the lows of the 2 shoulders. A break under the neckline confirms the bearish reversal.

-

Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, indicating a bullish reversal. A break above the neckline confirms the upward development reversal.

-

Double Tops and Double Bottoms: These patterns include two comparable peaks (double high) or troughs (double backside) at roughly the identical value degree. A break under the neckline of a double high or above the neckline of a double backside alerts a reversal.

-

Triple Tops and Triple Bottoms: Just like double tops and bottoms, however with three peaks or troughs. These patterns usually present stronger affirmation of a reversal.

Past the Fundamentals: Analyzing Chart Patterns Successfully

Whereas recognizing the visible formations is essential, profitable chart sample buying and selling requires a extra nuanced method:

-

Quantity Affirmation: Modifications in buying and selling quantity usually accompany vital value actions. Elevated quantity throughout a breakout from a chart sample confirms the validity of the sample and will increase the chance of a profitable commerce. Conversely, low quantity breakouts could also be false alerts.

-

Help and Resistance Ranges: Chart patterns usually work together with present help and resistance ranges. Breakouts above resistance or under help ranges strengthen the sign.

-

Development Context: Chart patterns must be analyzed inside the context of the broader market development. A bullish sample in a bearish market may be unreliable.

-

Danger Administration: As with all buying and selling technique, danger administration is paramount. Cease-loss orders must be positioned to restrict potential losses. Revenue targets must be outlined based mostly on the sample’s potential value motion.

-

Combining with Different Indicators: Integrating chart sample evaluation with different technical indicators, equivalent to transferring averages, RSI, MACD, and Bollinger Bands, can improve accuracy and filter out false alerts.

-

Observe and Endurance: Mastering chart sample recognition requires vital follow and endurance. Start by analyzing historic charts and backtesting your buying and selling methods. Keep away from emotional buying and selling selections and keep on with your pre-defined danger administration plan.

The Limitations of Chart Patterns:

It is essential to acknowledge the restrictions of relying solely on chart patterns:

-

Subjectivity: Figuring out chart patterns might be subjective, with totally different merchants doubtlessly decoding the identical formation otherwise.

-

False Alerts: Not all chart patterns result in profitable trades. Many patterns might fail to materialize, leading to false alerts.

-

Market Manipulation: Refined market gamers can manipulate value actions to create false patterns, trapping inexperienced merchants.

-

Lack of Basic Evaluation: Relying solely on chart patterns with out contemplating elementary evaluation can result in inaccurate predictions.

Conclusion:

A "Chart Sample Full E book PDF" would ideally embody all of the nuances mentioned above, offering a complete information to recognizing, decoding, and using varied chart patterns. Whereas a single PDF may not seize everything of this advanced topic, this text goals to supply a strong basis. By understanding the various kinds of chart patterns, their strengths and limitations, and integrating them with different technical and elementary evaluation instruments, merchants can considerably enhance their buying and selling methods and enhance their probabilities of success. Do not forget that constant studying, follow, and disciplined danger administration are important for long-term success within the dynamic world of monetary markets. Steady studying by books, programs, and sensible expertise will refine your means to interpret chart patterns and make knowledgeable buying and selling selections.

Closure

Thus, we hope this text has supplied worthwhile insights into Chart Sample Full E book PDF: A Complete Information to Technical Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!