Chart Industries: Navigating The Cryogenic Panorama – A Deep Dive Into NYSE: GTLS

Chart Industries: Navigating the Cryogenic Panorama – A Deep Dive into NYSE: GTLS

Associated Articles: Chart Industries: Navigating the Cryogenic Panorama – A Deep Dive into NYSE: GTLS

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart Industries: Navigating the Cryogenic Panorama – A Deep Dive into NYSE: GTLS. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Chart Industries: Navigating the Cryogenic Panorama – A Deep Dive into NYSE: GTLS

Chart Industries (NYSE: GTLS) operates in a distinct segment however more and more very important sector: cryogenic know-how. The corporate designs, manufactures, and providers gear used to retailer, transport, and course of liquefied gases, primarily serving the vitality, industrial gasoline, and healthcare markets. Understanding Chart Industries’ inventory value requires a nuanced take a look at its enterprise mannequin, market dynamics, and future prospects, all throughout the broader context of the worldwide financial system and evolving vitality panorama.

The Cryogenic Market and Chart Industries’ Place:

Cryogenic know-how, involving extraordinarily low temperatures, is essential for numerous functions. Within the vitality sector, it is important for liquefied pure gasoline (LNG) transportation and storage, a key factor within the international vitality transition. Industrial gases like oxygen, nitrogen, and argon additionally rely closely on cryogenic processes for manufacturing and distribution. Moreover, the healthcare trade makes use of cryogenic know-how for medical functions, together with cryopreservation and medical imaging.

Chart Industries holds a major place on this market, providing a complete portfolio of services. This contains:

- LNG gear: From storage tanks and vaporizers to course of gear for LNG terminals and carriers, Chart Industries is a significant participant within the LNG worth chain. The rising demand for LNG globally, pushed by vitality safety issues and environmental laws, straight advantages the corporate.

- Industrial gasoline gear: The corporate offers gear for the manufacturing, storage, and transportation of business gases, catering to a variety of business functions.

- Healthcare options: Chart Industries provides cryogenic storage options for organic samples, prescribed drugs, and different healthcare supplies.

- Service and upkeep: Offering ongoing assist for its put in base of kit is a vital income stream, making certain long-term buyer relationships and recurring earnings.

Analyzing the NYSE: GTLS Inventory Value:

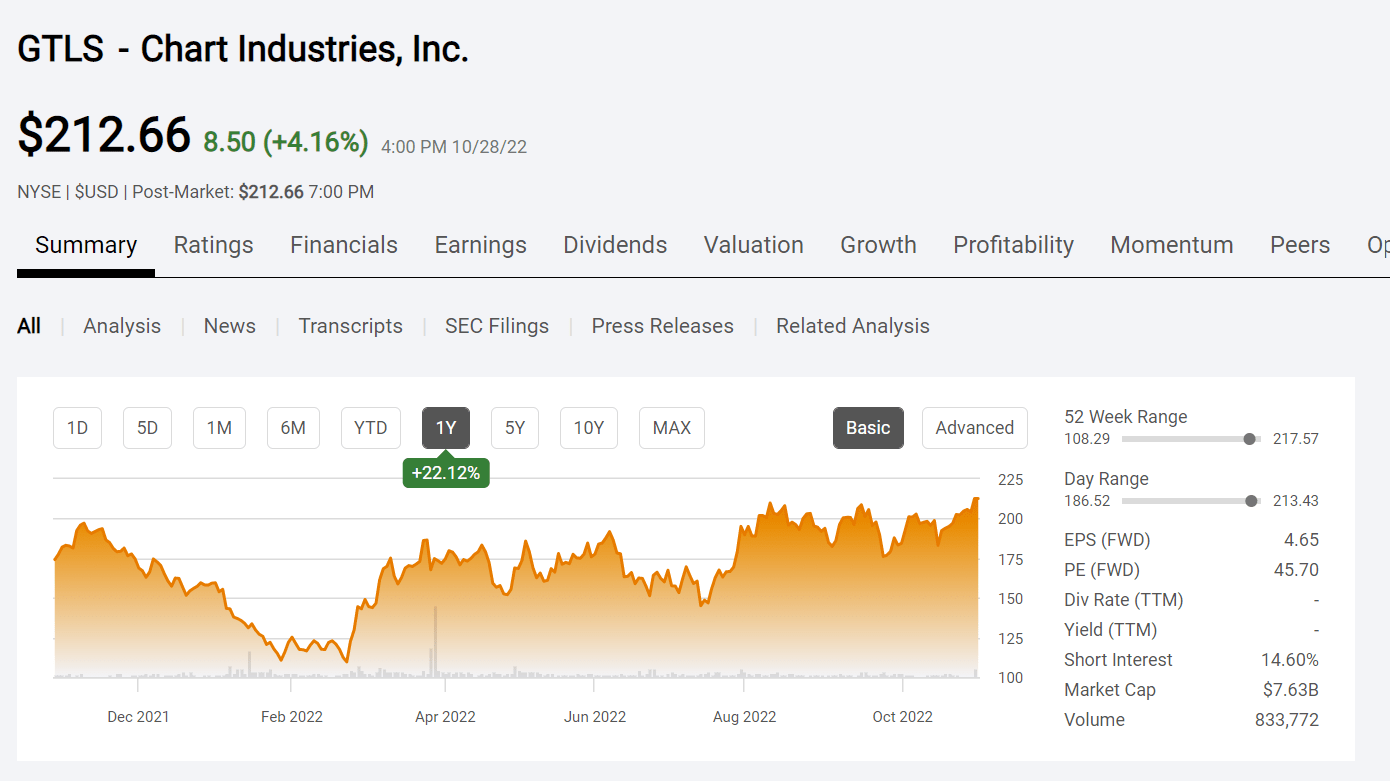

The GTLS inventory value displays a fancy interaction of things. A historic evaluation reveals durations of serious development interspersed with durations of consolidation or decline. A number of key drivers affect the inventory’s efficiency:

- LNG market dynamics: Fluctuations in LNG costs, demand, and international geopolitical occasions considerably affect Chart Industries’ efficiency. Intervals of excessive LNG demand and value will increase usually correlate with greater GTLS inventory costs, whereas downturns within the LNG market can negatively have an effect on the inventory.

- Industrial gasoline market development: The expansion of the economic gasoline sector, pushed by numerous industrial functions, contributes positively to GTLS’s efficiency. Elevated demand for industrial gases interprets into greater demand for Chart Industries’ gear and providers.

- Technological developments: Chart Industries’ means to innovate and develop superior cryogenic applied sciences is essential for sustaining its aggressive edge. New product launches and technological breakthroughs can positively affect investor sentiment and the inventory value.

- Macroeconomic elements: World financial circumstances, inflation charges, rates of interest, and provide chain disruptions all affect the corporate’s efficiency and consequently its inventory value. Intervals of financial uncertainty can result in decreased funding in capital-intensive tasks, impacting demand for Chart Industries’ merchandise.

- Competitors: Chart Industries operates in a aggressive market with a number of established gamers. The corporate’s means to distinguish itself by innovation, superior service, and cost-effectiveness is significant for sustaining market share and profitability.

- Monetary efficiency: The corporate’s monetary outcomes, together with income development, profitability, and money stream, straight affect investor confidence and the inventory value. Sturdy monetary efficiency usually results in greater inventory valuations, whereas poor efficiency may end up in decreased inventory costs.

Future Outlook and Funding Concerns:

The longer term outlook for Chart Industries is essentially tied to the expansion of the cryogenic market. A number of elements recommend a optimistic outlook:

- Rising LNG demand: The worldwide transition in the direction of cleaner vitality sources is driving elevated demand for LNG as a transitional gasoline. This pattern is anticipated to proceed for a number of years, benefiting Chart Industries’ LNG-related companies.

- Growth of business gasoline functions: The economic gasoline market continues to develop, pushed by numerous industrial functions, together with meals processing, electronics manufacturing, and healthcare.

- Technological innovation: Chart Industries’ continued funding in analysis and improvement shall be essential for sustaining its aggressive benefit and capturing market share in rising cryogenic functions.

- Strategic acquisitions: Buying smaller corporations with complementary applied sciences or market presence can speed up Chart Industries’ development and develop its market attain.

Nevertheless, traders also needs to think about potential dangers:

- Geopolitical instability: World political occasions and commerce disputes can disrupt provide chains and affect demand for cryogenic gear.

- Commodity value volatility: Fluctuations within the costs of uncooked supplies utilized in manufacturing can have an effect on Chart Industries’ profitability.

- Competitors: Intense competitors from established gamers and new entrants can put strain on margins and market share.

Conclusion:

Chart Industries’ inventory value is a mirrored image of the dynamic cryogenic market and its means to adapt to evolving trade tendencies. Whereas the long-term outlook for the cryogenic sector seems promising, pushed by the vitality transition and development in numerous industrial functions, traders ought to rigorously think about the dangers related to the corporate’s operations and the broader macroeconomic surroundings. Thorough due diligence, together with evaluation of economic statements, trade stories, and aggressive panorama, is essential earlier than making any funding choices concerning NYSE: GTLS. Monitoring key efficiency indicators, akin to income development, profitability, and order backlog, will present useful insights into the corporate’s efficiency and future prospects. Moreover, staying abreast of trade information and regulatory developments will assist traders make knowledgeable choices concerning their funding in Chart Industries. In the end, the success of an funding in GTLS is determined by the corporate’s means to execute its strategic plans, navigate market challenges, and capitalize on development alternatives throughout the evolving cryogenic panorama.

Closure

Thus, we hope this text has supplied useful insights into Chart Industries: Navigating the Cryogenic Panorama – A Deep Dive into NYSE: GTLS. We recognize your consideration to our article. See you in our subsequent article!