The Chart Of Accounts For A Merchandising Enterprise: A Complete Information

The Chart of Accounts for a Merchandising Enterprise: A Complete Information

Associated Articles: The Chart of Accounts for a Merchandising Enterprise: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to The Chart of Accounts for a Merchandising Enterprise: A Complete Information. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

The Chart of Accounts for a Merchandising Enterprise: A Complete Information

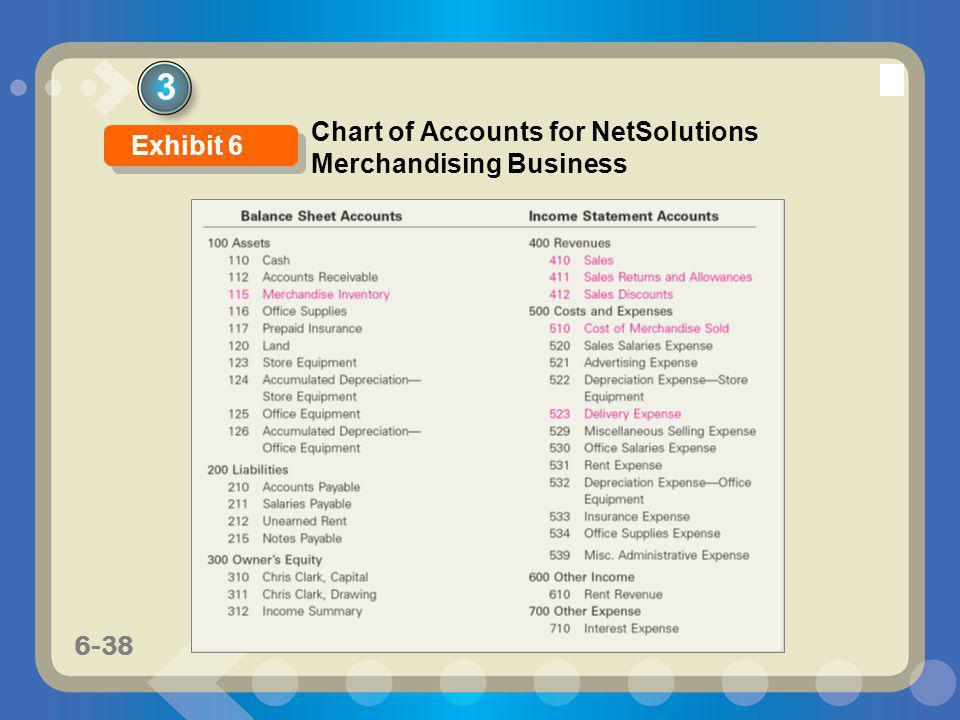

A well-structured chart of accounts is the spine of any profitable enterprise, and for merchandising companies, it is particularly essential. It supplies a scientific framework for recording and classifying all monetary transactions, enabling correct monetary reporting, environment friendly stock administration, and knowledgeable decision-making. This text delves into the intricacies of creating a strong chart of accounts particularly tailor-made for merchandising companies, protecting key account classes, finest practices, and issues for various enterprise sizes and complexities.

Understanding the Merchandising Enterprise Mannequin:

Earlier than diving into the specifics of the chart of accounts, it is important to know the distinctive monetary features of a merchandising enterprise. Not like service companies that primarily promote providers, merchandising companies purchase and promote items. This entails a number of key processes: buying stock, storing stock, promoting stock, and managing the related prices. The chart of accounts should precisely replicate these processes to offer a whole image of the enterprise’s monetary well being.

Key Account Classes in a Merchandising Chart of Accounts:

A typical chart of accounts for a merchandising enterprise contains the next main classes:

1. Belongings: These characterize what the enterprise owns.

-

Present Belongings: Belongings anticipated to be transformed into money inside one 12 months.

- Money: Contains money readily available, checking accounts, and financial savings accounts.

- Accounts Receivable: Cash owed to the enterprise by clients.

- Stock: The products held on the market. This can be a essential class for merchandising companies and sometimes requires sub-accounts for various product traces, places, or phases of manufacturing (e.g., uncooked supplies, work-in-progress, completed items).

- Pay as you go Bills: Bills paid upfront, corresponding to insurance coverage or hire.

- Provides: Small gadgets used within the enterprise’s operations.

-

Non-Present Belongings: Belongings not anticipated to be transformed into money inside one 12 months.

- Property, Plant, and Tools (PP&E): Land, buildings, equipment, and tools used within the enterprise. These are often depreciated over their helpful life.

- Intangible Belongings: Non-physical property like patents, emblems, and goodwill.

- Lengthy-term Investments: Investments not anticipated to be liquidated inside one 12 months.

2. Liabilities: These characterize what the enterprise owes to others.

-

Present Liabilities: Liabilities due inside one 12 months.

- Accounts Payable: Cash owed to suppliers for bought stock or different items and providers.

- Salaries Payable: Wages owed to workers.

- Utilities Payable: Excellent funds for utilities.

- Quick-term Loans Payable: Loans due inside one 12 months.

-

Non-Present Liabilities: Liabilities due after one 12 months.

- Lengthy-term Loans Payable: Loans due after one 12 months.

- Mortgage Payable: Mortgage secured by actual property.

- Bonds Payable: Debt securities issued by the enterprise.

3. Fairness: This represents the homeowners’ stake within the enterprise.

- Proprietor’s Fairness (Sole Proprietorship): The proprietor’s capital account.

- Retained Earnings (Company): Accrued earnings that haven’t been distributed as dividends.

- Widespread Inventory (Company): Shares of possession issued to buyers.

4. Income: This represents the revenue generated from the enterprise’s operations.

- Gross sales Income: Revenue from the sale of products. This usually requires sub-accounts to trace gross sales by product, buyer, or gross sales channel.

- Different Income: Revenue from sources aside from the sale of products, corresponding to rental revenue or curiosity revenue.

5. Bills: These characterize the prices incurred in operating the enterprise.

- Price of Items Bought (COGS): The direct prices related to producing or buying the products offered. This can be a essential expense class for merchandising companies and contains the price of stock offered through the interval. It is calculated utilizing strategies like FIFO (First-In, First-Out), LIFO (Final-In, First-Out), or weighted-average value.

- Promoting Bills: Prices associated to advertising and marketing and promoting the products, corresponding to promoting, gross sales salaries, and commissions.

- Basic and Administrative Bills: Prices associated to the general administration of the enterprise, corresponding to hire, utilities, salaries of administrative employees, and workplace provides.

- Curiosity Expense: Price of borrowing cash.

- Depreciation Expense: The allocation of the price of PP&E over its helpful life.

Finest Practices for Creating a Chart of Accounts:

- Consistency: Keep constant account names and numbering all through the chart of accounts.

- Specificity: Use particular and descriptive account names to keep away from ambiguity.

- Flexibility: Design the chart of accounts to accommodate future progress and modifications within the enterprise.

- Business Requirements: Contemplate trade finest practices and customary account classifications.

- Common Evaluate: Periodically overview and replace the chart of accounts to make sure it stays related and correct.

- Chart of Accounts Software program: Make the most of accounting software program to handle the chart of accounts successfully. Many accounting packages supply pre-built chart of accounts templates that may be custom-made to suit particular enterprise wants.

Concerns for Totally different Enterprise Sizes and Complexities:

- Small Companies: Might use a less complicated chart of accounts with fewer accounts and sub-accounts.

- Giant Companies: Would require a extra advanced chart of accounts with quite a few accounts and sub-accounts to trace detailed details about varied product traces, departments, and places.

- Multi-location Companies: Want to trace stock and gross sales individually for every location.

- E-commerce Companies: Require accounts to trace on-line gross sales, transport prices, and on-line advertising and marketing bills.

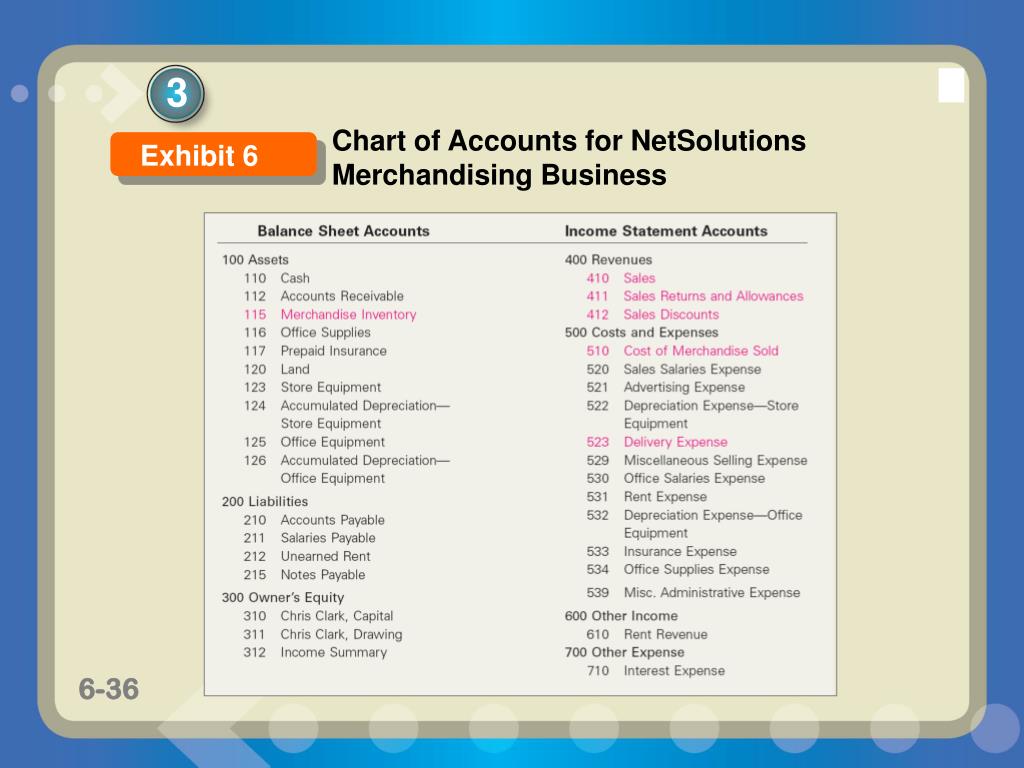

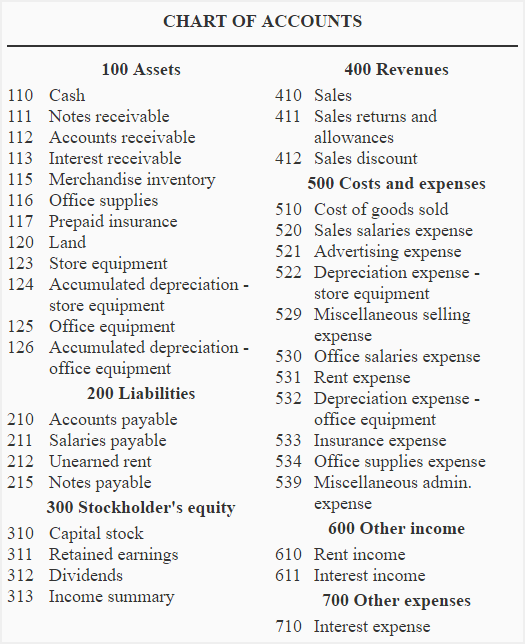

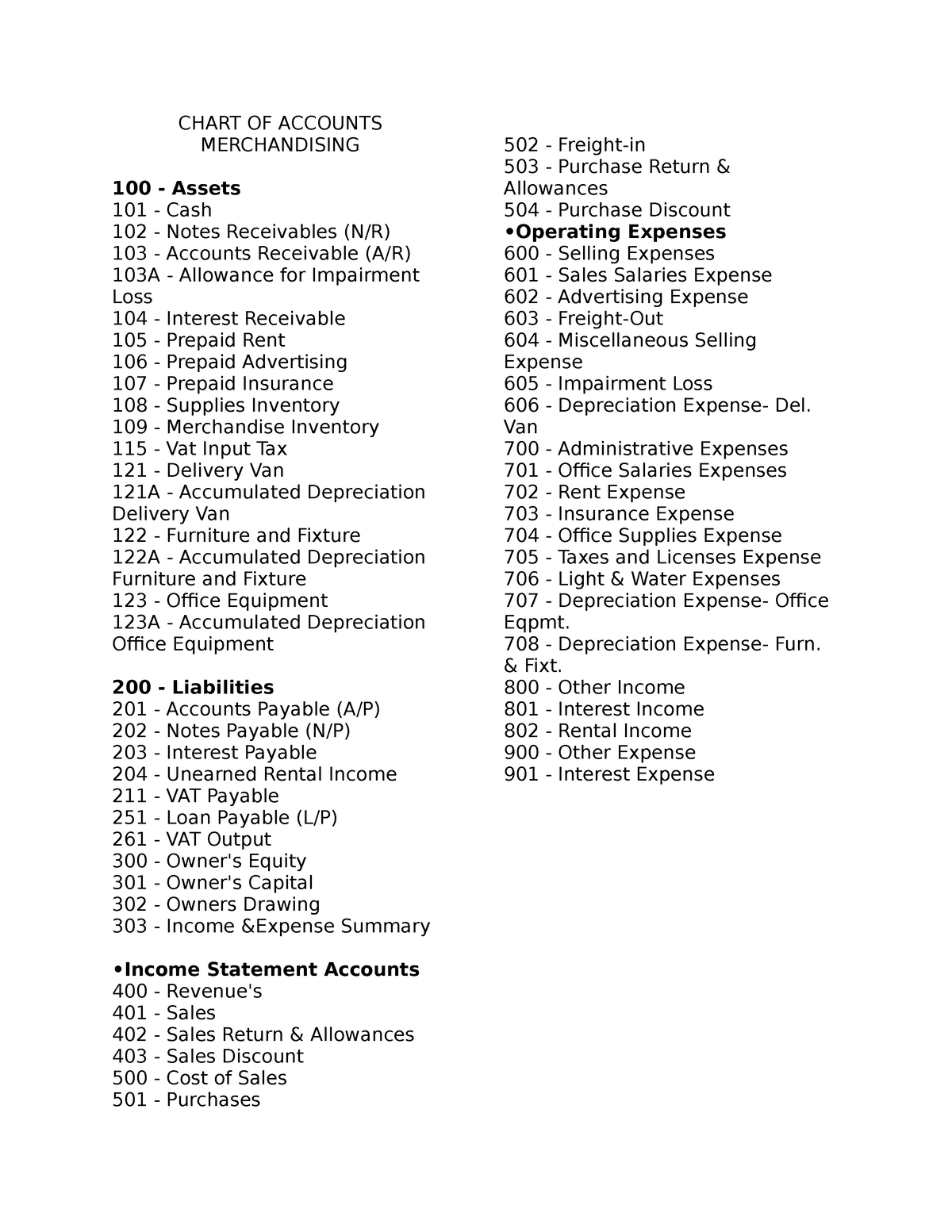

Instance of a Simplified Chart of Accounts:

This instance illustrates a simplified chart of accounts for a small merchandising enterprise. An actual-world chart could be considerably extra detailed.

| Account Quantity | Account Identify | Account Kind |

|---|---|---|

| 101 | Money | Asset |

| 102 | Accounts Receivable | Asset |

| 103 | Stock | Asset |

| 201 | Accounts Payable | Legal responsibility |

| 301 | Proprietor’s Fairness | Fairness |

| 401 | Gross sales Income | Income |

| 501 | Price of Items Bought | Expense |

| 502 | Lease Expense | Expense |

| 503 | Salaries Expense | Expense |

| 504 | Utilities Expense | Expense |

Conclusion:

A well-designed chart of accounts is significant for the monetary success of any merchandising enterprise. It supplies a structured framework for recording and analyzing monetary transactions, enabling correct monetary reporting, environment friendly stock administration, and knowledgeable decision-making. By following finest practices and contemplating the precise wants of the enterprise, firms can develop a chart of accounts that helps their progress and profitability. Bear in mind to repeatedly overview and replace the chart of accounts to make sure it stays related and correct because the enterprise evolves. Investing effort and time in creating a strong chart of accounts is an funding within the long-term monetary well being of the enterprise.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has offered beneficial insights into The Chart of Accounts for a Merchandising Enterprise: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!