Chart Patterns: A Complete Information (Ebook PDF Exploration)

Chart Patterns: A Complete Information (Ebook PDF Exploration)

Associated Articles: Chart Patterns: A Complete Information (Ebook PDF Exploration)

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Chart Patterns: A Complete Information (Ebook PDF Exploration). Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Chart Patterns: A Complete Information (Ebook PDF Exploration)

The world of economic markets is a fancy ecosystem pushed by a confluence of things, from macroeconomic developments and geopolitical occasions to investor sentiment and firm efficiency. Whereas basic evaluation delves into the intrinsic worth of an asset, technical evaluation focuses on worth motion and quantity to establish potential buying and selling alternatives. A cornerstone of technical evaluation is the identification and interpretation of chart patterns. Quite a few books discover this matter, providing invaluable insights into recognizing, understanding, and taking advantage of these recurring formations. This text explores the important thing features coated in such "chart patterns ebook PDF" assets, inspecting their content material, advantages, and limitations.

What are Chart Patterns?

Chart patterns are recurring formations on worth charts that, primarily based on historic knowledge, recommend potential future worth actions. They signify the collective habits of market contributors, reflecting shifts in provide and demand. These patterns may be recognized throughout varied timeframes, from short-term intraday charts to long-term weekly or month-to-month charts. Understanding these patterns permits merchants to anticipate potential breakouts, reversals, or continuations of current developments.

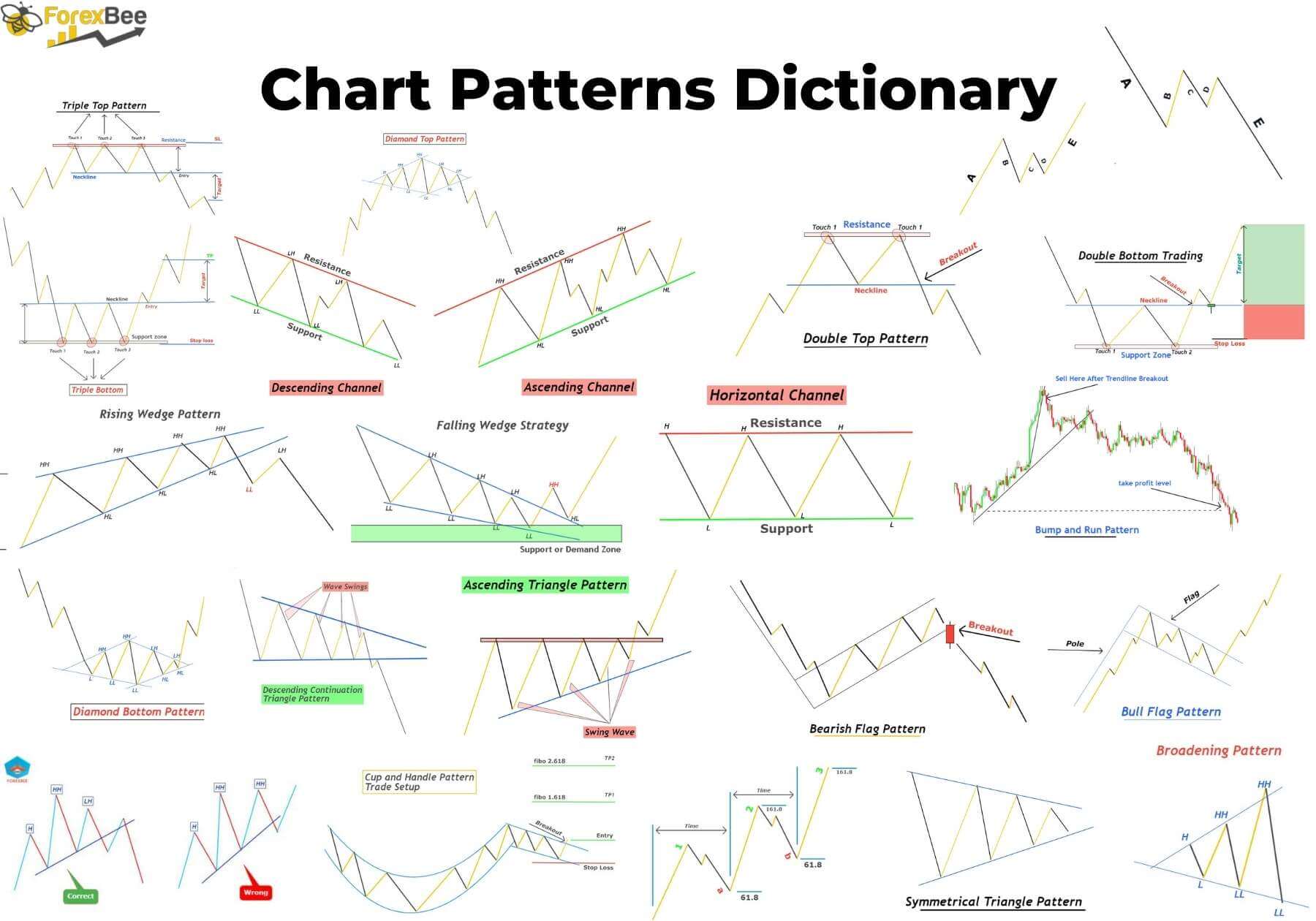

Key Chart Sample Classes Coated in "Chart Patterns Ebook PDF" Sources:

Most complete chart patterns books (out there as PDFs or bodily copies) sometimes cowl the next classes:

1. Continuation Patterns: These patterns recommend a brief pause in an current development earlier than its resumption. Widespread examples embrace:

- Triangles: Characterised by converging trendlines, triangles point out a interval of consolidation earlier than a breakout within the route of the previous development. Books usually differentiate between symmetrical, ascending, and descending triangles, explaining the nuances of every.

- Flags and Pennants: These patterns resemble small, short-term consolidations inside a bigger development, usually showing as mini-triangles or rectangles. They sign a brief pause earlier than a continuation of the development.

- Rectangles: Horizontal consolidations between two parallel trendlines recommend a interval of indecision earlier than a breakout, sometimes within the route of the previous development.

2. Reversal Patterns: These patterns recommend a possible change within the route of the prevailing development. Examples embrace:

- Head and Shoulders: A traditional reversal sample characterised by three peaks, with the center peak (the "head") being considerably larger than the outer two ("shoulders"). Books element the way to establish neckline assist/resistance and challenge potential worth targets.

- Inverse Head and Shoulders: The mirror picture of the top and shoulders sample, indicating a possible bullish reversal in a downtrend.

- Double Tops and Bottoms: These patterns encompass two related peaks (tops) or troughs (bottoms), suggesting a possible reversal after the second peak/backside is shaped.

- Triple Tops and Bottoms: Just like double tops/bottoms however with three peaks/troughs, usually indicating stronger reversal indicators.

3. Different Notable Patterns:

- Wedges: These patterns encompass converging trendlines, however in contrast to triangles, they slope within the route of the development, suggesting a continuation relatively than a reversal.

- Gaps: Vital worth jumps with none buying and selling exercise, usually signaling necessary market occasions or shifts in sentiment. Books clarify varied forms of gaps and their implications.

- Rounding Tops and Bottoms: These patterns signify gradual reversals, characterised by a clean curve relatively than sharp peaks or troughs.

Past Sample Identification: Content material of a Typical "Chart Patterns Ebook PDF"

A complete chart sample ebook PDF would not simply record patterns; it delves into essential supplementary data:

- Technical Indicators: Many books combine technical indicators (e.g., RSI, MACD, Bollinger Bands) to verify or refute indicators generated by chart patterns. They clarify how these indicators can improve buying and selling selections primarily based on sample identification.

- Quantity Evaluation: Quantity is an important element of technical evaluation. Books emphasize the significance of analyzing quantity alongside worth motion to verify the validity of chart patterns. Excessive quantity throughout breakouts usually strengthens the sign.

- Threat Administration: Efficient buying and selling includes managing threat. Good chart sample books emphasize the significance of stop-loss orders, place sizing, and cash administration methods.

- Buying and selling Methods: Many books define particular buying and selling methods primarily based on chart patterns, offering step-by-step steering on entry and exit factors, goal ranges, and threat administration protocols.

- Backtesting: The effectiveness of chart patterns may be validated by means of backtesting. Some books clarify the way to backtest methods primarily based on chart patterns utilizing historic knowledge.

- Market Context: Whereas chart patterns present helpful insights, it is essential to contemplate the broader market context. Profitable merchants combine chart sample evaluation with basic evaluation and an understanding of macroeconomic components.

Advantages of Utilizing a "Chart Patterns Ebook PDF" Useful resource:

- Structured Studying: Books supply a structured strategy to studying about chart patterns, offering a scientific understanding of varied formations and their implications.

- Complete Protection: They sometimes cowl a variety of patterns, making certain a complete understanding of technical evaluation instruments.

- Detailed Explanations: Books present detailed explanations of every sample, together with their traits, formation, and interpretation.

- Visible Aids: They usually incorporate quite a few charts and illustrations to boost understanding and facilitate sample recognition.

- Accessibility and Portability: PDF variations supply easy accessibility and portability, permitting merchants to check with the fabric anytime, wherever.

Limitations of Relying Solely on Chart Patterns:

- Subjectivity: Figuring out chart patterns may be subjective, and completely different merchants might interpret the identical sample in another way.

- False Indicators: Chart patterns are usually not foolproof, they usually can generate false indicators, resulting in losses if not used cautiously.

- Affirmation Bias: Merchants could also be liable to affirmation bias, searching for patterns that verify their current beliefs, relatively than objectively assessing the market.

- Lack of Context: Chart patterns shouldn’t be utilized in isolation. They need to be mixed with different types of evaluation, together with basic evaluation and an understanding of market context.

- Overfitting: Over-reliance on previous patterns can result in overfitting, the place a technique performs effectively on historic knowledge however poorly in stay buying and selling.

Conclusion:

Chart patterns are a helpful software for technical analysts, offering insights into potential market actions. "Chart patterns ebook PDF" assets supply a structured and complete option to study these formations, bettering buying and selling expertise and decision-making. Nonetheless, it is essential to do not forget that chart patterns are usually not a assured path to income. They need to be used at the side of different analytical instruments, threat administration methods, and a deep understanding of market dynamics. Profitable buying and selling requires a holistic strategy, integrating varied analytical strategies and sustaining a disciplined strategy to threat administration. A well-structured chart patterns ebook PDF may be a useful asset on this journey, however it must be seen as one software amongst many in a dealer’s arsenal. Steady studying, follow, and adaptation are key to mastering the artwork of technical evaluation and reaching constant success within the monetary markets.

![]()

![[PDF] Encyclopedia of Chart Patterns: 225 (Wiley Trading) - Free PDF Books](http://www.freepdfbook.com/wp-content/uploads/2021/05/Encyclopedia-of-Chart-Patterns-Free-Download-1.jpg)

Closure

Thus, we hope this text has supplied helpful insights into Chart Patterns: A Complete Information (Ebook PDF Exploration). We hope you discover this text informative and useful. See you in our subsequent article!