Decoding The USD/IDR Chart: A Deep Dive Into The Indonesian Rupiah’s Fluctuations

Decoding the USD/IDR Chart: A Deep Dive into the Indonesian Rupiah’s Fluctuations

Associated Articles: Decoding the USD/IDR Chart: A Deep Dive into the Indonesian Rupiah’s Fluctuations

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the USD/IDR Chart: A Deep Dive into the Indonesian Rupiah’s Fluctuations. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the USD/IDR Chart: A Deep Dive into the Indonesian Rupiah’s Fluctuations

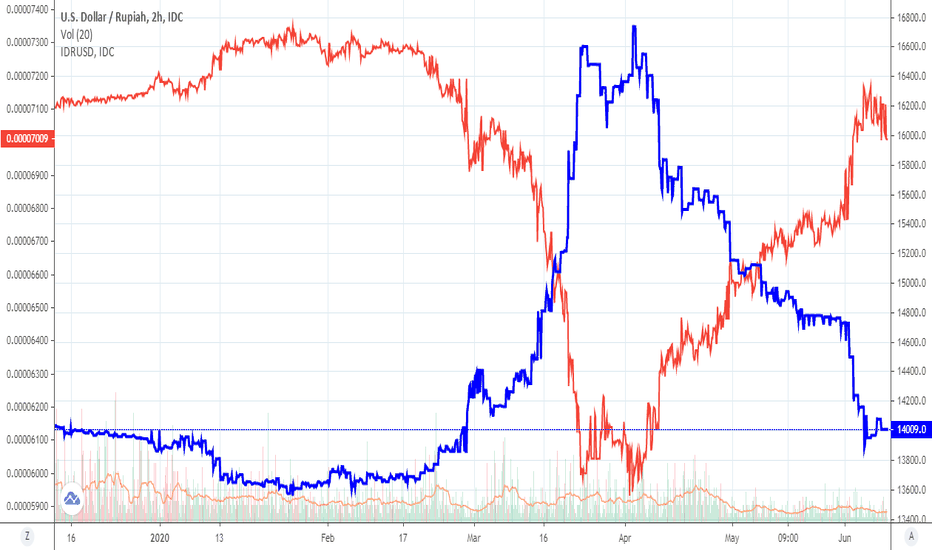

The Indonesian Rupiah (IDR) in opposition to the USA Greenback (USD) is a dynamic change charge, reflecting the complicated interaction of world and home financial components. Understanding the USD/IDR chart requires analyzing these influences and recognizing the patterns that emerge over time. This text offers a complete overview of the USD/IDR change charge, exploring its historic tendencies, key drivers, and potential future actions.

Historic Context: A Rollercoaster Journey

The USD/IDR change charge has skilled important volatility all through its historical past. Previous to the 1997-98 Asian Monetary Disaster, the Rupiah maintained a comparatively secure, although managed, change charge in opposition to the greenback. Nonetheless, the disaster uncovered the fragility of the Indonesian financial system, resulting in a dramatic devaluation of the Rupiah. The IDR plummeted in opposition to the USD, reaching ranges unseen earlier than, highlighting the vulnerability of rising markets to international monetary shocks.

The post-crisis interval noticed a gradual restoration, with the Indonesian authorities implementing numerous reforms geared toward stabilizing the financial system and strengthening the Rupiah. Nonetheless, the change charge remained vulnerable to exterior components, together with international commodity costs (Indonesia is a major commodity exporter), international rate of interest modifications, and shifts in investor sentiment in direction of rising markets.

The 2008 international monetary disaster as soon as once more put strain on the Rupiah, although the influence was much less extreme than in 1997-98, reflecting the improved resilience of the Indonesian financial system. Newer years have witnessed durations of each appreciation and depreciation of the Rupiah in opposition to the greenback, reflecting the continuing challenges and alternatives going through the Indonesian financial system.

Key Drivers of USD/IDR Fluctuations:

A number of key components affect the USD/IDR change charge. These could be broadly categorized as:

-

International Financial Circumstances: International financial development, rate of interest modifications by main central banks (significantly the Federal Reserve), and threat urge for food in worldwide markets considerably influence the USD/IDR change charge. A robust US greenback, usually pushed by larger US rates of interest, usually places downward strain on the Rupiah, as buyers search larger returns in US dollar-denominated belongings. Conversely, international risk-off sentiment usually results in capital flight from rising markets like Indonesia, weakening the Rupiah.

-

Commodity Costs: Indonesia is a significant exporter of commodities similar to palm oil, coal, and nickel. Fluctuations in international commodity costs instantly influence Indonesia’s export earnings and present account steadiness. Greater commodity costs usually assist the Rupiah, whereas decrease costs exert downward strain. This relationship isn’t at all times simple, nevertheless, as different components can override the influence of commodity worth modifications.

-

Home Financial Elements: Indonesia’s home financial efficiency performs a vital function in figuring out the Rupiah’s worth. Elements similar to inflation, rates of interest set by Financial institution Indonesia (the central financial institution), authorities debt ranges, and financial development prospects all affect investor confidence and, consequently, the change charge. Sturdy financial development and low inflation are inclined to strengthen the Rupiah, whereas excessive inflation and weak development put downward strain.

-

Political Stability and Coverage Uncertainty: Political stability and clear, constant authorities insurance policies are important for attracting overseas funding and sustaining investor confidence. Political uncertainty or coverage modifications can set off capital flight and weaken the Rupiah. Transparency and predictability in authorities actions are essential for a secure change charge.

-

Hypothesis and Market Sentiment: Hypothesis and market sentiment can considerably affect short-term fluctuations within the USD/IDR change charge. Information occasions, each home and worldwide, can set off speedy modifications in investor sentiment, resulting in short-term volatility. This makes it difficult to foretell short-term actions within the change charge with full accuracy.

Analyzing the USD/IDR Chart:

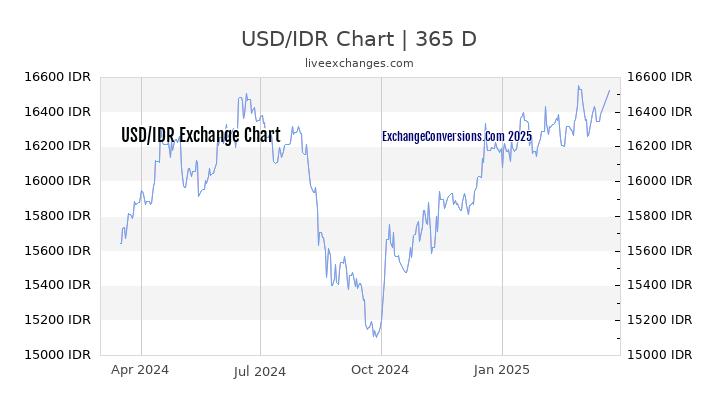

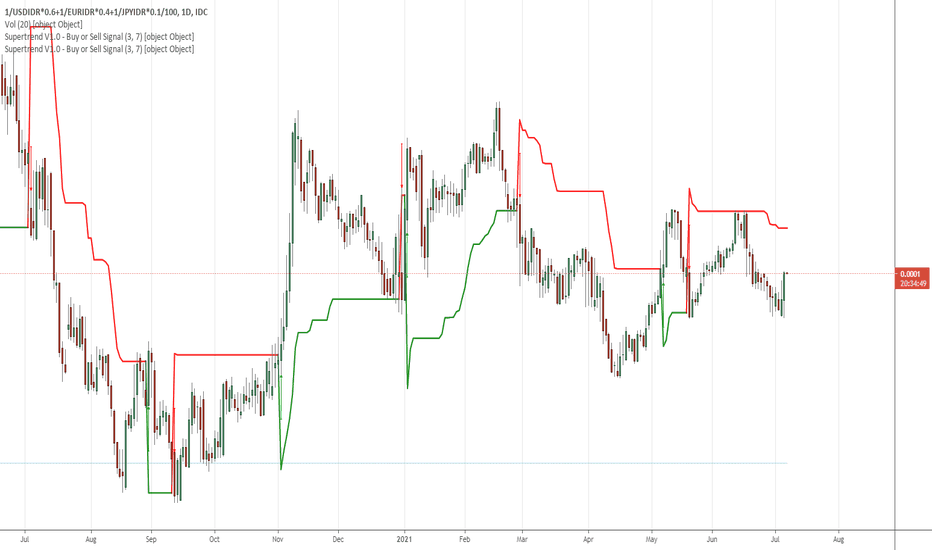

Analyzing the USD/IDR chart requires contemplating each short-term and long-term tendencies. Technical evaluation, utilizing indicators similar to shifting averages, assist and resistance ranges, and oscillators, may also help establish potential short-term buying and selling alternatives. Nonetheless, it is essential to keep in mind that technical evaluation alone is inadequate for predicting long-term actions.

Elementary evaluation, specializing in the financial components talked about above, is crucial for understanding the underlying drivers of the change charge and predicting its long-term trajectory. By combining technical and basic evaluation, merchants and buyers can develop a extra complete understanding of the USD/IDR chart and make knowledgeable selections.

Deciphering Chart Patterns:

Totally different chart patterns can point out potential future actions. For instance:

-

Uptrends: A sustained uptrend suggests a strengthening Rupiah in opposition to the greenback, probably pushed by constructive financial information, larger commodity costs, or elevated investor confidence.

-

Downtrends: A sustained downtrend signifies a weakening Rupiah, presumably as a consequence of destructive financial knowledge, falling commodity costs, or international risk-off sentiment.

-

Consolidation Patterns: Intervals of sideways motion (consolidation) usually precede important worth breaks, both upwards or downwards. These durations can present alternatives to establish potential breakout factors.

-

Assist and Resistance Ranges: These are worth ranges the place the change charge has traditionally struggled to interrupt by way of. Assist ranges characterize potential shopping for alternatives, whereas resistance ranges point out potential promoting alternatives.

Future Outlook and Issues:

Predicting the longer term motion of the USD/IDR change charge is inherently difficult. Nonetheless, by fastidiously contemplating the components mentioned above and monitoring developments in each the Indonesian and international economies, it is potential to type knowledgeable expectations.

The long-term outlook for the Indonesian Rupiah will rely upon the success of Indonesia’s financial reforms, its capability to handle inflation and preserve macroeconomic stability, and the efficiency of the worldwide financial system. Continued financial development, structural reforms, and prudent financial coverage are essential for strengthening the Rupiah in the long term.

Conclusion:

The USD/IDR chart is a fancy and dynamic illustration of the interplay between international and home financial forces. Understanding the historic tendencies, key drivers, and potential future actions requires a complete evaluation of each technical and basic components. Whereas predicting short-term fluctuations with precision is troublesome, a radical understanding of those components permits for a extra knowledgeable evaluation of the long-term outlook for the Indonesian Rupiah in opposition to the US greenback. Staying abreast of world and home financial information, monitoring key financial indicators, and using each technical and basic evaluation are important for navigating the complexities of the USD/IDR change charge. Finally, profitable buying and selling and funding selections require a balanced strategy, combining cautious evaluation with threat administration methods.

Closure

Thus, we hope this text has offered useful insights into Decoding the USD/IDR Chart: A Deep Dive into the Indonesian Rupiah’s Fluctuations. We hope you discover this text informative and useful. See you in our subsequent article!