Understanding The Chart Of Accounts: A Complete Information

Understanding the Chart of Accounts: A Complete Information

Associated Articles: Understanding the Chart of Accounts: A Complete Information

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Understanding the Chart of Accounts: A Complete Information. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Understanding the Chart of Accounts: A Complete Information

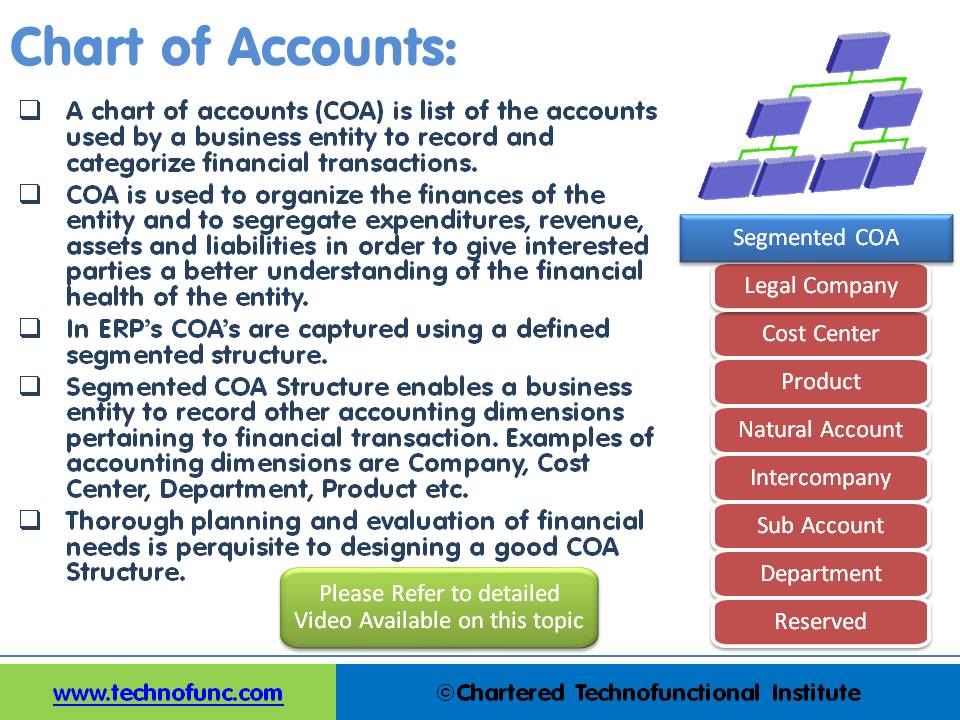

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured checklist of all of the accounts utilized by a enterprise to document its monetary transactions. Consider it as an in depth index categorizing each monetary exercise, from receiving funds to paying bills. A well-designed COA is essential for correct monetary reporting, environment friendly bookkeeping, and knowledgeable decision-making. This text supplies a complete overview of charts of accounts, together with their function, construction, widespread account sorts, examples, and greatest practices.

The Objective of a Chart of Accounts

The first function of a COA is to arrange and classify monetary transactions. And not using a structured system, monetary information could be chaotic and not possible to interpret meaningfully. A COA serves a number of key features:

-

Correct Monetary Reporting: By categorizing transactions, a COA ensures that monetary statements (revenue assertion, stability sheet, money move assertion) are correct and dependable. That is essential for inner administration, exterior stakeholders (buyers, lenders), and regulatory compliance.

-

Environment friendly Bookkeeping: A well-defined COA streamlines the bookkeeping course of. Transactions are simply categorized and posted to the right accounts, minimizing errors and saving time.

-

Improved Monetary Evaluation: A correctly designed COA facilitates monetary evaluation. By breaking down monetary information into significant classes, managers can determine traits, assess efficiency, and make knowledgeable selections.

-

Auditing and Compliance: A COA is important for auditing functions. Auditors use the COA to confirm the accuracy and completeness of monetary information, making certain compliance with accounting requirements and rules.

-

Budgeting and Forecasting: The COA supplies a framework for budgeting and forecasting. By monitoring bills and revenues in particular classes, companies can create extra correct budgets and monetary projections.

Construction of a Chart of Accounts:

A COA sometimes follows a hierarchical construction, typically utilizing a numbering system to categorize accounts. The particular construction varies relying on the scale and complexity of the enterprise, in addition to the accounting software program used. Nonetheless, most COAs comply with a common framework:

-

Main Account Classes: The best degree of the hierarchy sometimes consists of broad classes similar to Belongings, Liabilities, Fairness, Revenues, and Bills. This aligns with the elemental accounting equation: Belongings = Liabilities + Fairness.

-

Sub-accounts: Every main class is additional subdivided into extra particular accounts. For instance, the Asset class would possibly embrace sub-accounts like Money, Accounts Receivable, Stock, and Mounted Belongings. Equally, the Expense class might embrace sub-accounts like Lease Expense, Salaries Expense, and Utilities Expense.

-

Sub-sub-accounts (Element Accounts): For bigger organizations, additional subdivisions is perhaps needed to offer even better element. For instance, the Salaries Expense account may very well be damaged down into sub-accounts for various departments or worker sorts.

Frequent Account Varieties and Examples:

Let’s discover some widespread account sorts with illustrative examples:

1. Belongings: These characterize what an organization owns.

-

Present Belongings (liquidated inside one 12 months):

- Money: Cash within the financial institution, petty money.

- Accounts Receivable: Cash owed to the corporate by prospects. Instance: Bill #1234 for $500 from Buyer A.

- Stock: Items held on the market. Instance: 100 models of Product X at $10 every.

- Pay as you go Bills: Bills paid prematurely, like insurance coverage or hire. Instance: $1200 pay as you go hire for the following 6 months.

-

Non-Present Belongings (long-term property):

- Property, Plant, and Gear (PP&E): Land, buildings, equipment, gear. Instance: Workplace constructing valued at $1,000,000.

- Intangible Belongings: Patents, copyrights, logos. Instance: Patent for a brand new know-how valued at $50,000.

2. Liabilities: These characterize what an organization owes to others.

-

Present Liabilities (due inside one 12 months):

- Accounts Payable: Cash owed to suppliers. Instance: $2000 owed to Provider B for uncooked supplies.

- Salaries Payable: Unpaid salaries to staff. Instance: $5000 owed in worker salaries.

- Brief-term Loans: Loans due inside one 12 months. Instance: $10,000 mortgage from a financial institution due in 6 months.

-

Non-Present Liabilities (due in multiple 12 months):

- Lengthy-term Loans: Loans due in multiple 12 months. Instance: $100,000 mortgage on the workplace constructing.

- Bonds Payable: Cash raised by issuing bonds.

3. Fairness: This represents the house owners’ stake within the firm.

- Frequent Inventory: Shares issued to buyers.

- Retained Earnings: Gathered income that haven’t been distributed as dividends.

4. Revenues: These characterize revenue generated from the corporate’s operations.

- Gross sales Income: Revenue from promoting items or providers. Instance: $10,000 in gross sales of Product X.

- Service Income: Revenue from offering providers. Instance: $5000 in consulting charges.

- Curiosity Income: Revenue from curiosity earned on investments.

5. Bills: These characterize prices incurred in producing income.

- Value of Items Bought (COGS): Direct prices related to producing items offered. Instance: $3000 in uncooked supplies used to supply Product X.

- Promoting, Basic, and Administrative Bills (SG&A): Bills associated to promoting, advertising, and administration.

- Salaries Expense: Wages paid to staff.

- Lease Expense: Value of renting workplace house.

- Utilities Expense: Value of electrical energy, water, and gasoline.

- Advertising and marketing Expense: Value of promoting and advertising campaigns.

- Curiosity Expense: Value of borrowing cash.

- Depreciation Expense: Allocation of the price of long-term property over their helpful life.

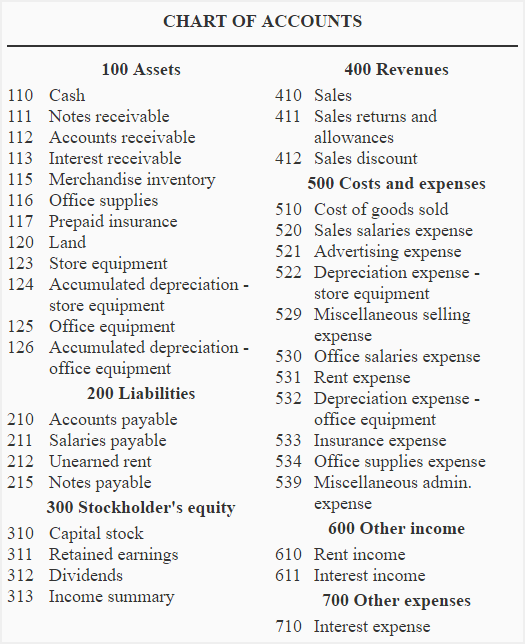

Chart of Accounts Instance:

This is a simplified instance of a chart of accounts:

| Account Quantity | Account Title | Account Sort |

|---|---|---|

| 101 | Money | Asset |

| 102 | Accounts Receivable | Asset |

| 103 | Stock | Asset |

| 104 | Pay as you go Bills | Asset |

| 201 | Accounts Payable | Legal responsibility |

| 202 | Salaries Payable | Legal responsibility |

| 301 | Frequent Inventory | Fairness |

| 302 | Retained Earnings | Fairness |

| 401 | Gross sales Income | Income |

| 501 | Value of Items Bought | Expense |

| 502 | Salaries Expense | Expense |

| 503 | Lease Expense | Expense |

| 504 | Utilities Expense | Expense |

| 505 | Advertising and marketing Expense | Expense |

Finest Practices for Designing a Chart of Accounts:

-

Maintain it Easy: Keep away from extreme element, particularly for smaller companies. A less complicated COA is simpler to handle and keep.

-

Use a Constant Numbering System: A constant numbering system ensures that accounts are simply identifiable and arranged.

-

Think about Future Progress: Design the COA to accommodate future development and modifications within the enterprise.

-

Recurrently Assessment and Replace: Periodically overview and replace the COA to make sure it stays related and correct.

-

Use Standardized Account Names: Utilizing standardized account names improves consistency and facilitates monetary reporting.

-

Seek the advice of with an Accountant: Search skilled recommendation from a professional accountant to make sure the COA is acceptable on your particular enterprise wants.

Conclusion:

The chart of accounts is a elementary element of any profitable enterprise. A well-designed COA supplies a structured framework for organizing monetary information, enabling correct monetary reporting, environment friendly bookkeeping, and knowledgeable decision-making. By understanding the aim, construction, and customary account sorts, companies can create a COA that helps their monetary administration wants and contributes to their total success. Keep in mind that a well-structured COA isn’t a static doc; it must be usually reviewed and up to date to replicate the evolving wants of the enterprise.

Closure

Thus, we hope this text has supplied precious insights into Understanding the Chart of Accounts: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!