Bullish Chart Patterns: A Complete Information (PDF Downloadable)

Bullish Chart Patterns: A Complete Information (PDF Downloadable)

Associated Articles: Bullish Chart Patterns: A Complete Information (PDF Downloadable)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Bullish Chart Patterns: A Complete Information (PDF Downloadable). Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Bullish Chart Patterns: A Complete Information (PDF Downloadable)

Introduction:

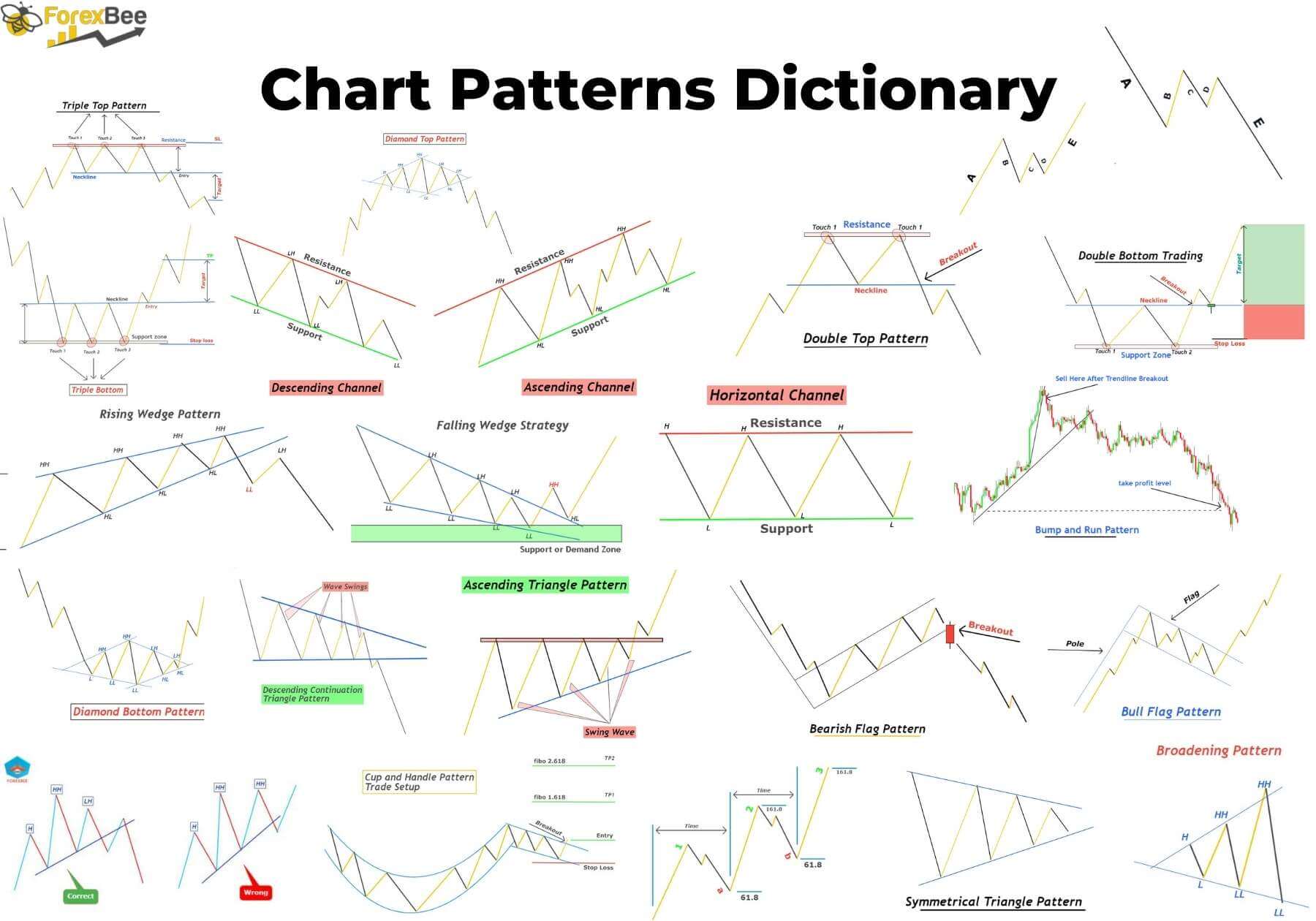

Technical evaluation is a cornerstone of profitable buying and selling. Whereas elementary evaluation focuses on an organization’s intrinsic worth, technical evaluation makes use of worth motion and quantity to foretell future worth actions. A key part of technical evaluation includes figuring out chart patterns – visually recognizable formations on worth charts that usually foreshadow particular worth actions. Bullish chart patterns, specifically, sign potential upward worth tendencies and provide merchants alternatives to enter lengthy positions. This complete information explores a number of frequent bullish chart patterns, their traits, and easy methods to establish them successfully. A downloadable PDF model of this information is on the market on the finish of the article.

Understanding Chart Patterns:

Chart patterns emerge from the interaction of provide and demand. When demand persistently outweighs provide, costs are likely to rise, forming bullish patterns. These patterns should not excellent predictors, however they supply priceless probabilistic insights into potential worth route. It is essential to do not forget that chart patterns ought to be used along side different technical indicators and elementary evaluation for a holistic buying and selling technique. Affirmation from different indicators strengthens the sign and reduces the danger of false breakouts.

Key Bullish Chart Patterns:

This part delves into a number of prevalent bullish chart patterns, outlining their traits and offering sensible examples.

1. Head and Shoulders Backside:

This sample resembles an inverted head and shoulders sample. It is a highly effective reversal sample signaling a possible shift from a downtrend to an uptrend.

-

Traits:

- A "head" – a decrease low.

- Two "shoulders" – decrease lows on both aspect of the pinnacle, roughly equal in depth.

- A "neckline" – a horizontal line connecting the troughs of the 2 shoulders.

- A breakout above the neckline confirms the sample.

-

Affirmation: Elevated quantity throughout the breakout above the neckline strengthens the bullish sign. Search for constructive divergence in an oscillator just like the Relative Energy Index (RSI) throughout the formation of the sample.

-

Goal Worth: The goal worth is usually calculated by measuring the gap between the pinnacle and the neckline and including it to the breakout worth.

2. Double Backside:

A double backside sample suggests a possible reversal from a downtrend.

-

Traits:

- Two consecutive lows at roughly the identical worth stage.

- A "V-shaped" restoration between the 2 lows.

- A breakout above the neckline (the best level connecting the 2 lows).

-

Affirmation: Elevated quantity on the breakout is a constructive signal. Observe the RSI or MACD for affirmation of a bullish reversal.

-

Goal Worth: The goal worth is calculated by including the gap between the neckline and the low level of the double backside to the breakout worth.

3. Triple Backside:

Much like a double backside, however with three lows at roughly the identical worth stage. The added affirmation from the third low will increase the sample’s reliability.

-

Traits:

- Three consecutive lows at roughly the identical worth stage.

- Breakouts above the neckline (the best level connecting the three lows).

-

Affirmation: Elevated quantity throughout the breakout, constructive divergence in oscillators.

-

Goal Worth: Calculated equally to the double backside – including the gap between the neckline and the low level to the breakout worth.

4. Inverse Head and Shoulders:

It is a highly effective bullish reversal sample.

-

Traits:

- A "head" – the next excessive.

- Two "shoulders" – greater highs on both aspect of the pinnacle, roughly equal in peak.

- A "neckline" – a horizontal line connecting the troughs between the pinnacle and shoulders.

- A breakout above the neckline confirms the sample.

-

Affirmation: Elevated quantity throughout the breakout, constructive divergence in oscillators.

-

Goal Worth: The goal worth is calculated by measuring the gap between the pinnacle and the neckline and including it to the breakout worth.

5. Cup and Deal with:

This sample is characterised by a U-shaped "cup" adopted by a brief, downward "deal with."

-

Traits:

- A U-shaped worth motion forming the cup.

- A slight downward correction forming the deal with.

- A breakout above the resistance line of the deal with confirms the sample.

-

Affirmation: Elevated quantity throughout the breakout, constructive RSI divergence throughout the deal with formation.

-

Goal Worth: The goal worth is often calculated by measuring the depth of the cup and including it to the breakout worth.

6. Ascending Triangle:

This sample signifies a continuation of an uptrend.

-

Traits:

- An upward-sloping trendline connecting greater lows.

- A horizontal resistance line.

- A breakout above the resistance line confirms the sample.

-

Affirmation: Rising quantity as the value approaches the resistance line.

-

Goal Worth: The goal worth is usually projected by measuring the peak of the triangle and including it to the breakout worth.

7. Bull Flag:

A bull flag is a continuation sample indicating a brief pause in an uptrend.

-

Traits:

- A powerful upward pattern previous the flag.

- A consolidation interval forming the flag (often a pennant or rectangle).

- A breakout above the flag’s resistance line.

-

Affirmation: Elevated quantity throughout the breakout.

-

Goal Worth: The goal worth might be projected by measuring the pole (the preliminary robust uptrend) and including that distance to the breakout worth.

8. Bull Pennant:

A kind of bull flag the place the consolidation interval varieties a symmetrical triangle. This sample is characterised by converging trendlines.

Figuring out and Buying and selling Bullish Chart Patterns:

Efficient use of bullish chart patterns requires apply and expertise. Listed here are some key concerns:

-

Timeframes: Chart patterns can seem throughout varied timeframes (each day, weekly, month-to-month). The timeframe chosen influences the buying and selling technique.

-

Quantity: Adjustments in quantity typically affirm sample breakouts. Elevated quantity throughout a breakout strengthens the bullish sign.

-

Different Indicators: Combining chart patterns with different technical indicators (RSI, MACD, shifting averages) enhances accuracy and reduces danger.

-

Danger Administration: All the time use stop-loss orders to restrict potential losses. Place sizing is essential for efficient danger administration.

-

Affirmation: Do not solely depend on chart patterns. Search for affirmation from different technical indicators and elementary evaluation.

Conclusion:

Bullish chart patterns are priceless instruments for technical merchants. By understanding their traits and making use of them strategically, merchants can establish potential shopping for alternatives and improve their buying and selling success. Nevertheless, it is essential to do not forget that no sample ensures earnings. Thorough evaluation, danger administration, and diversification are very important for profitable buying and selling.

(Downloadable PDF Hyperlink: [Insert Link Here – This would be a link to a PDF version of this article. You would need to create the PDF separately using a word processor or PDF creation tool])

Disclaimer: This text is for academic functions solely and doesn’t represent monetary recommendation. Buying and selling includes important danger, and you can lose cash. All the time conduct thorough analysis and seek the advice of with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered priceless insights into Bullish Chart Patterns: A Complete Information (PDF Downloadable). We thanks for taking the time to learn this text. See you in our subsequent article!