Decoding The Cocoa Bean’s Rollercoaster: A Historic Worth Chart Evaluation

Decoding the Cocoa Bean’s Rollercoaster: A Historic Worth Chart Evaluation

Associated Articles: Decoding the Cocoa Bean’s Rollercoaster: A Historic Worth Chart Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Cocoa Bean’s Rollercoaster: A Historic Worth Chart Evaluation. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Cocoa Bean’s Rollercoaster: A Historic Worth Chart Evaluation

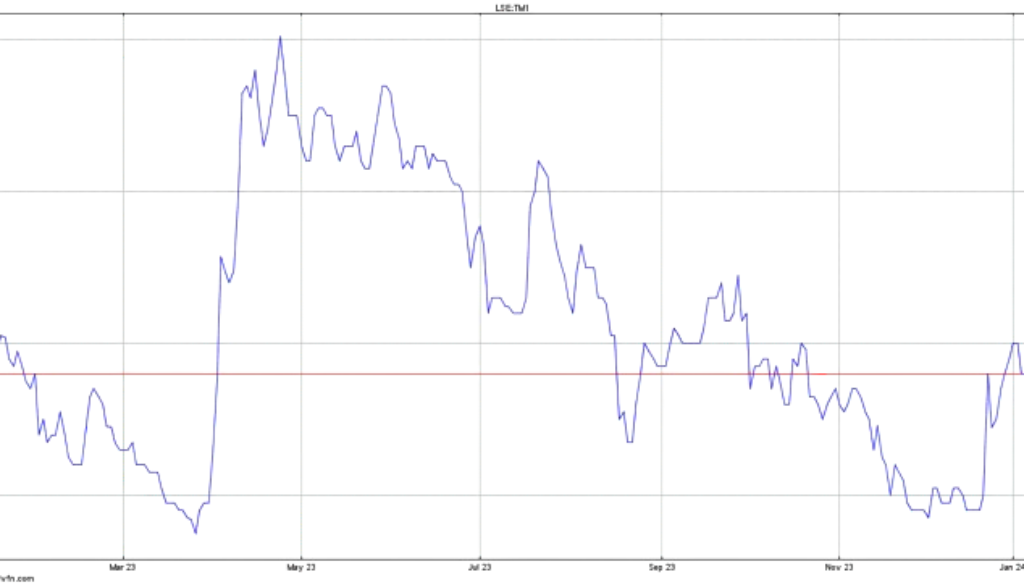

Cocoa, the first ingredient in chocolate, boasts a wealthy historical past intertwined with international economics, political instability, and the vagaries of nature. Understanding the historic value chart of cocoa is essential for anybody concerned within the chocolate trade, from farmers to customers, because it reveals patterns, influences, and potential future traits. This text delves deep into the historic value fluctuations of cocoa, analyzing key intervals, contributing elements, and providing insights into the complicated dynamics that form this important commodity market.

A Visible Journey By way of Time: Key Durations in Cocoa Worth Historical past

A complete evaluation necessitates inspecting the cocoa value chart throughout totally different timeframes. Whereas exact information for hundreds of years previous is scarce, available information from the late twentieth century onwards affords helpful insights. Let’s look at some key intervals:

-

The Nineteen Eighties and Nineties: A Interval of Relative Stability (with some exceptions): This period noticed a comparatively secure cocoa value, albeit with occasional spikes and dips pushed primarily by climate patterns affecting cocoa-producing areas. Elements equivalent to El Niño occasions, which brought on droughts and floods in West Africa, considerably impacted manufacturing and, consequently, costs. The Worldwide Cocoa Group (ICCO) performed a major position in trying to stabilize the market via worldwide agreements and buffer inventory administration. Nevertheless, these measures weren’t at all times efficient in mitigating value volatility.

-

The Early 2000s: The Rise of Hypothesis and Worth Volatility: The early 2000s witnessed a marked enhance in value volatility. A number of elements contributed to this: elevated hypothesis within the futures market, rising international demand for chocolate, and considerations in regards to the sustainability of cocoa manufacturing practices. The rising affect of economic buyers, in search of excessive returns, added to the market’s instability, resulting in intervals of sharp value will increase adopted by equally dramatic drops. This period highlighted the vulnerability of cocoa costs to exterior market forces past the management of cocoa farmers.

-

The Mid-2000s to the Current: A Complicated Tapestry of Influences: This era showcases a extra complicated image. Whereas international demand continued to rise, pushed by rising consumption in rising markets like China and India, different elements got here into play. Issues about local weather change and its affect on cocoa manufacturing grew to become more and more distinguished. Droughts, illnesses, and pests additional threatened cocoa yields, contributing to cost spikes. Concurrently, efforts to advertise sustainable cocoa farming and honest commerce practices gained momentum, influencing market dynamics and shopper preferences. This era additionally noticed vital fluctuations on account of geopolitical occasions, foreign money fluctuations, and shifts in international financial situations.

Key Elements Influencing Cocoa Costs:

Analyzing the historic value chart requires understanding the multifaceted elements driving value fluctuations. These could be broadly categorized as:

-

Provide and Demand: The elemental driver of any commodity value, the steadiness between international cocoa provide and demand considerably impacts costs. Elements influencing provide embrace climate patterns (droughts, floods, illnesses), pest infestations, farming practices, and political instability in producing international locations. Demand is pushed by international chocolate consumption, influenced by financial progress, shopper preferences, and advertising efforts.

-

Hypothesis and Futures Markets: The cocoa futures market performs a vital position in value willpower. Speculators, buying and selling contracts for future supply, can considerably affect costs, usually exacerbating volatility. Their actions are pushed by varied elements, together with anticipated provide shortages, financial forecasts, and foreign money fluctuations.

-

Political and Financial Elements: Political instability in cocoa-producing international locations can disrupt manufacturing and exports, main to cost will increase. Equally, international financial situations, foreign money change charges, and commerce insurance policies can affect cocoa costs. As an illustration, a weakening of the US greenback, the foreign money through which cocoa is commonly traded, can result in increased costs for patrons utilizing different currencies.

-

Sustainability and Moral Issues: Rising shopper consciousness of moral and environmental considerations surrounding cocoa manufacturing is more and more influencing costs. Demand for sustainably sourced cocoa, licensed via initiatives like Fairtrade and Rainforest Alliance, is rising, probably pushing costs upwards for licensed beans.

-

Technological Developments: Technological developments in cocoa farming, processing, and chocolate manufacturing can even affect costs. Improved farming strategies can enhance yields, probably decreasing costs, whereas developments in processing can improve product high quality and enhance demand.

Decoding the Chart: Figuring out Traits and Patterns:

A cautious examination of the historic cocoa value chart reveals a number of traits and patterns:

-

Cyclical Worth Fluctuations: Cocoa costs are likely to exhibit cyclical patterns, with intervals of excessive costs adopted by intervals of decrease costs. These cycles are sometimes influenced by climate patterns and manufacturing cycles.

-

Impression of El Niño: El Niño occasions, characterised by uncommon warming of the Pacific Ocean, steadily correlate with decrease cocoa yields and better costs on account of antagonistic climate situations in key cocoa-producing areas.

-

Correlation with International Financial Development: Cocoa costs usually present a constructive correlation with international financial progress. Stronger financial progress sometimes results in elevated demand for chocolate and, consequently, increased cocoa costs.

-

Affect of Foreign money Fluctuations: Modifications in foreign money change charges can considerably affect cocoa costs, significantly for patrons and sellers utilizing totally different currencies.

The Way forward for Cocoa Costs: Challenges and Alternatives

Predicting future cocoa costs is inherently difficult because of the complicated interaction of things mentioned above. Nevertheless, some key traits and challenges are price contemplating:

-

Local weather Change: Local weather change poses a major menace to cocoa manufacturing, with rising temperatures and altering rainfall patterns probably decreasing yields and rising value volatility.

-

Rising Demand: International demand for chocolate is predicted to proceed rising, significantly in rising markets. It will possible put upward strain on cocoa costs.

-

Sustainability Initiatives: The rising emphasis on sustainable cocoa farming practices will possible form the market within the coming years. Elevated demand for licensed cocoa may result in increased costs for sustainably produced beans.

-

Technological Improvements: Technological developments in cocoa farming and processing may mitigate a number of the challenges posed by local weather change and enhance effectivity, probably influencing future value traits.

Conclusion:

The historic cocoa value chart affords an enchanting glimpse into the complicated interaction of things shaping this important commodity market. Understanding these historic patterns, together with the present challenges and alternatives, is crucial for navigating the way forward for the cocoa trade. From farmers striving for honest costs to chocolate producers managing their prices, and customers making knowledgeable decisions, a grasp of the cocoa value dynamics is vital to making sure the sustainability and way forward for this beloved ingredient. Ongoing monitoring of the chart, coupled with a deep understanding of the underlying financial, environmental, and social elements, stays essential for all stakeholders within the international cocoa ecosystem.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Cocoa Bean’s Rollercoaster: A Historic Worth Chart Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!