Decoding The USD/CAD Trade Fee: A Complete Chart Evaluation

Decoding the USD/CAD Trade Fee: A Complete Chart Evaluation

Associated Articles: Decoding the USD/CAD Trade Fee: A Complete Chart Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the USD/CAD Trade Fee: A Complete Chart Evaluation. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the USD/CAD Trade Fee: A Complete Chart Evaluation

The USD/CAD change price, representing the worth of the US greenback towards the Canadian greenback, is a dynamic indicator reflecting the complicated interaction of financial forces impacting each North American economies. Understanding its fluctuations is essential for companies engaged in cross-border commerce, buyers contemplating investments in both nation, and anybody impacted by the fluctuating worth of their foreign money. This text delves into the historic traits, key influencing elements, and analytical methods used to interpret the USD/CAD change price chart, providing a complete overview for each novice and skilled market members.

Historic Perspective: A Look Again on the USD/CAD Chart

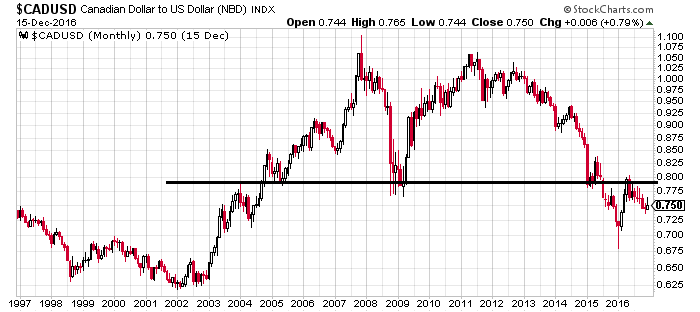

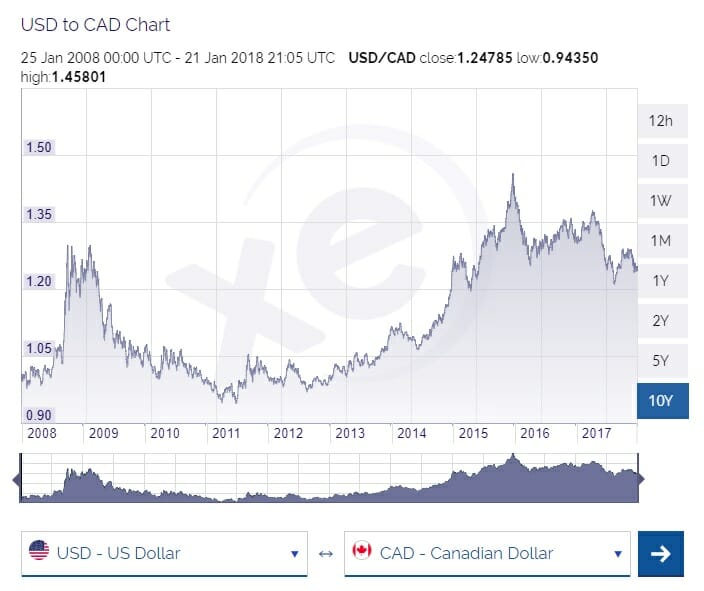

A look at a historic USD/CAD change price chart reveals an interesting narrative of financial shifts and geopolitical occasions. Over the previous 20 years, the pair has exhibited vital volatility, starting from lows beneath parity (USD 1 = CAD 1) to highs above 1.40. Analyzing totally different intervals reveals distinct traits:

-

Early 2000s: The early 2000s noticed a interval of relative stability, with the USD/CAD fluctuating inside a narrower vary. This era was marked by comparatively steady financial development in each nations and a usually sturdy US greenback.

-

Mid-2000s to Late 2000s: The mid-to-late 2000s witnessed a big appreciation of the Canadian greenback, pushed primarily by sturdy commodity costs, notably oil. Canada’s sturdy useful resource sector benefited from excessive world demand, resulting in a surge within the CAD’s worth towards the USD. The USD/CAD fell beneath parity for prolonged intervals throughout this time.

-

2008-2009 World Monetary Disaster: The worldwide monetary disaster triggered a pointy decline within the Canadian greenback, as danger aversion drove buyers in the direction of the perceived security of the US greenback. Commodity costs plummeted, additional weakening the CAD.

-

Publish-2009 Restoration: Following the disaster, the USD/CAD steadily recovered, influenced by elements akin to diverging financial insurance policies between the US and Canada, and fluctuating commodity costs.

-

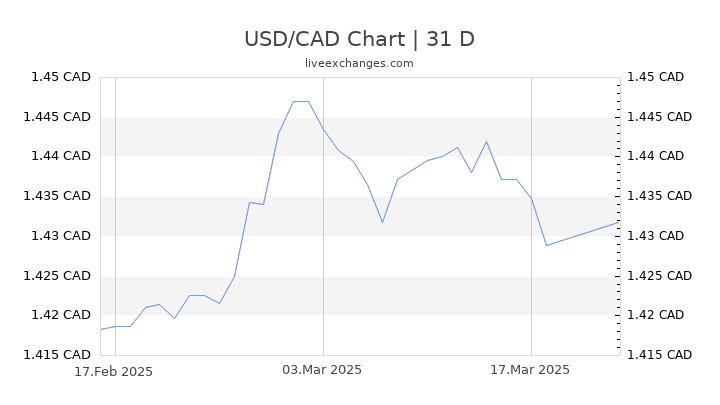

Current Years (2010-Current): The final decade has proven a extra complicated image, with the USD/CAD influenced by a large number of things, together with rate of interest differentials, financial development disparities, geopolitical occasions (e.g., the US-China commerce conflict), and the general world financial local weather. The COVID-19 pandemic additionally considerably impacted the change price, initially inflicting a pointy decline within the CAD earlier than a subsequent restoration.

Key Components Influencing the USD/CAD Trade Fee

The USD/CAD change price will not be pushed by a single issue however quite a posh interaction of varied financial and geopolitical forces. A number of the most important embody:

-

Curiosity Fee Differentials: The distinction in rates of interest between the US and Canada is a significant driver of the change price. Greater rates of interest in a single nation sometimes appeal to international funding, growing demand for its foreign money and strengthening its worth. The Federal Reserve’s (US) and the Financial institution of Canada’s financial coverage selections instantly influence this differential.

-

Commodity Costs: Canada is a significant exporter of commodities, notably oil. Fluctuations in world commodity costs, particularly crude oil, considerably influence the Canadian greenback. Greater oil costs usually increase the CAD, whereas decrease costs weaken it.

-

Financial Progress: Relative financial development charges within the US and Canada affect the change price. Stronger financial development in Canada tends to strengthen the CAD, whereas stronger US development can strengthen the USD. GDP development figures, employment information, and shopper confidence indices are key indicators to watch.

-

Geopolitical Occasions: World occasions, akin to commerce wars, political instability, or world crises, can considerably influence each currencies and subsequently the USD/CAD change price. Uncertainty typically drives buyers in the direction of the perceived security of the US greenback, weakening the CAD.

-

US Greenback Power/Weak point: The US greenback’s total energy or weak spot towards different main currencies additionally impacts the USD/CAD price. A powerful US greenback tends to place downward stress on the CAD.

-

Hypothesis and Market Sentiment: Market sentiment and hypothesis play a big position in short-term fluctuations. Giant institutional buyers and foreign money merchants can considerably affect the change price based mostly on their expectations and buying and selling methods.

Analyzing the USD/CAD Chart: Technical and Basic Approaches

Analyzing the USD/CAD change price chart includes a mixture of technical and basic evaluation:

Technical Evaluation: This method focuses on chart patterns, indicators, and historic value actions to foretell future value traits. Generally used technical indicators embody:

- Shifting Averages: These easy out value fluctuations and establish traits.

- Relative Power Index (RSI): This measures the magnitude of current value modifications to judge overbought or oversold circumstances.

- Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by way of, providing potential entry and exit factors for merchants.

- Chart Patterns: Figuring out patterns like head and shoulders, triangles, or double tops/bottoms can present insights into potential future value actions.

Basic Evaluation: This method focuses on underlying financial and geopolitical elements to evaluate the long-term worth of the currencies. Analysts contemplate macroeconomic information, together with:

- Rate of interest bulletins: Central financial institution selections on rates of interest considerably affect change charges.

- GDP development: Stronger financial development usually helps a stronger foreign money.

- Inflation information: Excessive inflation erodes buying energy and may weaken a foreign money.

- Employment figures: Sturdy employment information displays a wholesome financial system and may help a stronger foreign money.

- Commerce balances: A constructive commerce stability (exports exceeding imports) usually strengthens a foreign money.

Utilizing the USD/CAD Chart for Buying and selling and Funding Selections

The USD/CAD chart serves as a beneficial instrument for merchants and buyers making selections associated to foreign money change, worldwide investments, and hedging methods. Nevertheless, it is essential to do not forget that:

- No single indicator is ideal: Technical and basic evaluation must be utilized in conjunction, recognizing the constraints of every method.

- Threat administration is essential: Buying and selling currencies includes vital danger, and correct danger administration methods are important.

- Lengthy-term perspective is vital: Whereas short-term fluctuations will be worthwhile, a long-term perspective is commonly extra beneficial for funding selections.

- Diversification is vital: Do not put all of your eggs in a single basket. Diversifying investments throughout totally different asset lessons and currencies reduces total danger.

Conclusion:

The USD/CAD change price chart is a dynamic and sophisticated illustration of the financial and geopolitical relationship between the US and Canada. Understanding the historic traits, key influencing elements, and analytical methods used to interpret the chart is essential for making knowledgeable selections in varied contexts, from worldwide commerce to funding methods. By combining technical and basic evaluation, and using sound danger administration practices, people and companies can leverage the insights provided by the USD/CAD chart to navigate the ever-changing panorama of the international change market. Nevertheless, it is vital to do not forget that forecasting change charges with absolute certainty is unimaginable, and steady monitoring and adaptation are important for fulfillment.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the USD/CAD Trade Fee: A Complete Chart Evaluation. We recognize your consideration to our article. See you in our subsequent article!