Navigating The World Markets: A Complete Information To Foreign exchange Time Zone Charts

Navigating the World Markets: A Complete Information to Foreign exchange Time Zone Charts

Associated Articles: Navigating the World Markets: A Complete Information to Foreign exchange Time Zone Charts

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Navigating the World Markets: A Complete Information to Foreign exchange Time Zone Charts. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Navigating the World Markets: A Complete Information to Foreign exchange Time Zone Charts

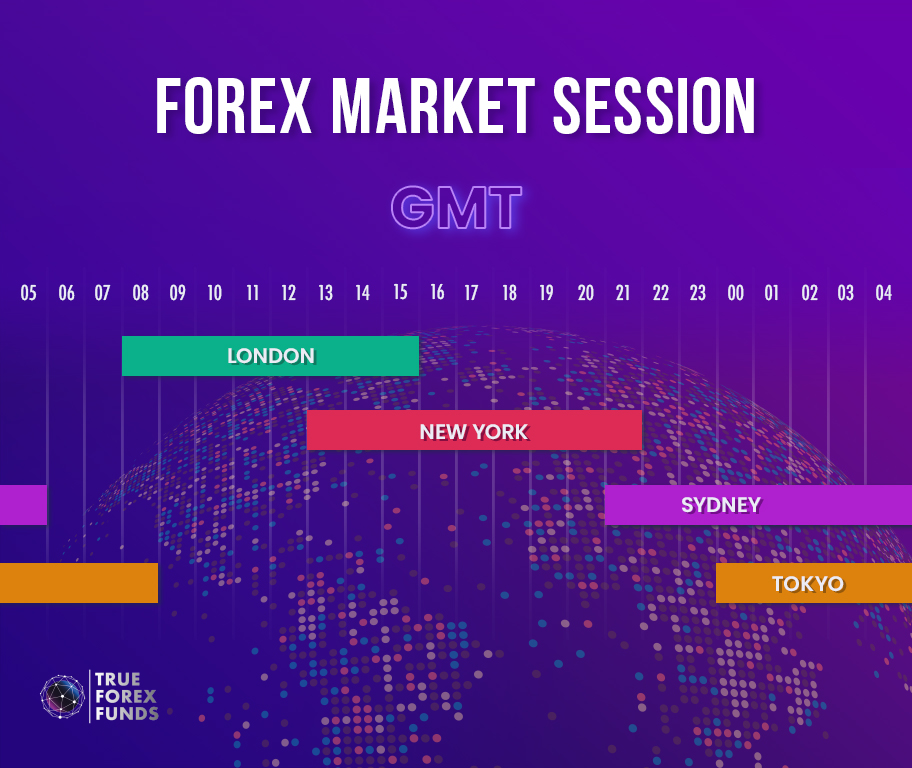

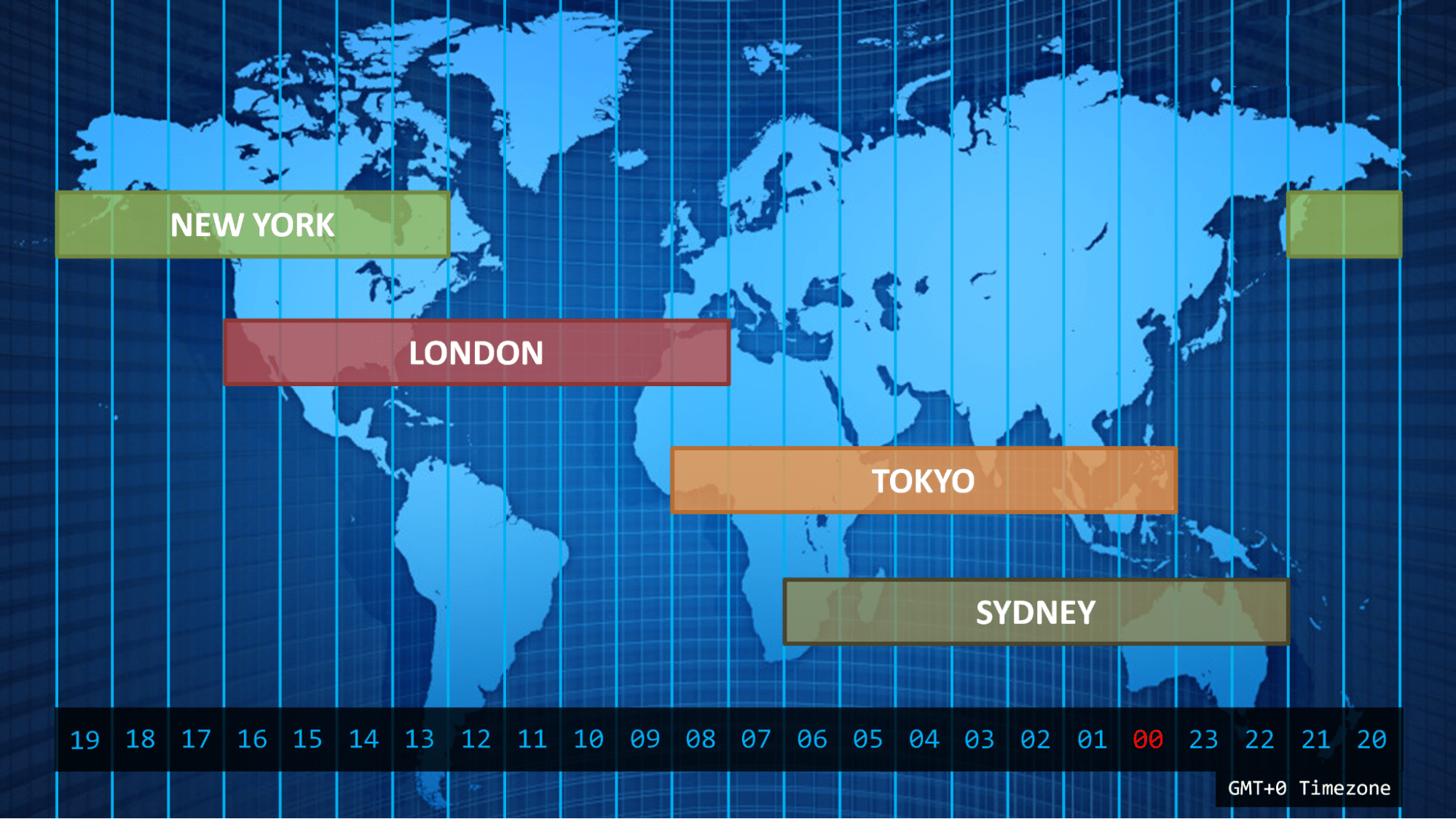

The international change (foreign exchange) market, also referred to as FX or foreign money market, is a decentralized, world market the place currencies are traded. In contrast to conventional inventory exchanges working inside particular time zones, the foreign exchange market operates 24 hours a day, 5 days every week, spanning throughout a number of time zones. Understanding these time zones is essential for foreign exchange merchants, because it dictates market liquidity, volatility, and buying and selling alternatives. This text offers a complete information to foreign exchange time zone charts and their implications for profitable buying and selling.

The World Nature of the Foreign exchange Market:

The foreign exchange market’s decentralized nature means there isn’t any single central location. As an alternative, buying and selling happens throughout a community of banks, monetary establishments, and particular person merchants related electronically. This world attain implies that as one market closes, one other opens, making a steady buying and selling cycle. The most important buying and selling facilities are London, New York, Tokyo, Sydney, and Zurich, every with its personal buying and selling hours and affect available on the market.

Understanding Foreign exchange Time Zone Charts:

A foreign exchange time zone chart visually represents the buying and selling hours of main monetary facilities all over the world. These charts sometimes show the opening and shutting occasions of every market, usually utilizing a 24-hour clock. They’re invaluable instruments for:

-

Figuring out overlapping buying and selling classes: Understanding when a number of markets are open concurrently helps merchants perceive intervals of upper liquidity and doubtlessly decrease spreads (the distinction between the bid and ask worth). These overlapping classes are sometimes characterised by elevated volatility and buying and selling alternatives.

-

Planning buying and selling methods: Merchants can use time zone charts to plan their buying and selling actions based mostly on market circumstances. For instance, a dealer may select to give attention to the London and New York overlap for elevated liquidity or the quieter Asian session for scalping alternatives.

-

Managing danger: Understanding when particular markets are open and closed permits merchants to handle their danger extra successfully. For instance, a dealer may select to keep away from buying and selling in periods of low liquidity when worth actions might be unpredictable and spreads wider.

-

Analyzing market sentiment: Observing the development of worth motion throughout completely different time zones can present insights into general market sentiment. For instance, a damaging development beginning within the Asian session may proceed into the European and US classes.

A Typical Foreign exchange Time Zone Chart Format:

A typical foreign exchange time zone chart will embody:

-

Metropolis/Area: Clearly identifies the main buying and selling facilities (London, New York, Tokyo, Sydney, and so forth.).

-

Time Zone: Specifies the native time zone for every middle (GMT, EST, JST, AEST, and so forth.).

-

Buying and selling Hours: Signifies the everyday buying and selling hours for every middle, often in 24-hour format. Word that these hours can range barely relying on the particular market and dealer.

-

Overlap Intervals: Highlights the intervals when a number of markets are open concurrently. These are sometimes probably the most energetic buying and selling intervals.

-

Market Open/Shut Indicators: Visible cues, equivalent to arrows or color-coding, point out the opening and shutting occasions of every market.

-

Daylight Saving Time (DST) Changes: Necessary issues, as DST modifications can shift buying and selling hours. Respected charts will replicate these changes.

Main Foreign exchange Market Facilities and Their Time Zones:

Let’s study the important thing foreign currency trading facilities and their typical buying and selling hours:

-

Sydney (AEST/AEDT): The Sydney market is the primary main market to open, sometimes round 5:00 PM GMT on Sunday (or 1:00 AM EST on Monday). It closes round 2:00 AM GMT. Buying and selling quantity is usually decrease than different main facilities.

-

Tokyo (JST): The Tokyo market opens round 12:00 AM GMT and closes round 11:00 AM GMT. It is a important market, notably for Yen pairs, and its exercise usually influences the London session.

-

London (GMT): The London market is taken into account probably the most influential market by way of buying and selling quantity and liquidity. It opens round 8:00 AM GMT and closes round 5:00 PM GMT. Overlaps with the Tokyo and New York classes are essential.

-

New York (EST/EDT): The New York market opens round 1:00 PM GMT and closes round 10:00 PM GMT. It is the second largest market and closely influences the value motion of main foreign money pairs, particularly the US Greenback.

Deciphering Overlapping Classes and Their Significance:

The overlapping classes are probably the most essential points of a foreign exchange time zone chart. Understanding these overlaps helps merchants capitalize on elevated liquidity and volatility.

-

Sydney/Tokyo Overlap: This overlap is comparatively quick and fewer important in comparison with others. It offers a preview of the day’s buying and selling, notably for Yen pairs.

-

Tokyo/London Overlap: This overlap is reasonably energetic. The London session’s elevated quantity usually influences worth actions initiated within the Tokyo session.

-

London/New York Overlap: That is probably the most liquid and risky interval of the day. The mixed quantity from these two main facilities creates important worth actions and buying and selling alternatives. Many merchants focus their actions throughout this overlap.

Strategic Issues Based mostly on Time Zones:

-

Scalping: Scalping methods usually profit from the excessive liquidity of the London/New York overlap, permitting for fast entries and exits.

-

Swing Buying and selling: Swing merchants may choose to give attention to the much less risky Asian classes or capitalize on breakouts through the London/New York overlap.

-

Information Buying and selling: Important financial information releases from varied international locations affect the markets in a different way relying on the time zone. Merchants want to pay attention to these releases and their potential affect.

-

Day Buying and selling: Day merchants can make the most of your complete 24-hour cycle, specializing in completely different market classes based mostly on their methods and danger tolerance.

Limitations of Foreign exchange Time Zone Charts:

Whereas foreign exchange time zone charts are invaluable instruments, they’ve limitations:

-

Generalizations: They supply basic buying and selling hours; precise exercise can range barely relying on market circumstances and particular brokers.

-

Liquidity Fluctuations: Liquidity inside a session can fluctuate all through the day, even throughout peak hours.

-

Particular person Dealer Variations: Dealer platforms may need barely completely different interpretations of buying and selling hours.

-

Ignoring Non-Main Markets: The charts primarily give attention to main facilities, overlooking smaller however nonetheless important markets.

Conclusion:

A foreign exchange time zone chart is a vital software for any foreign exchange dealer. Understanding the worldwide nature of the market and the implications of various time zones is essential for creating profitable buying and selling methods, managing danger, and in the end, reaching profitability. By rigorously analyzing the overlapping classes and planning buying and selling actions accordingly, merchants can maximize their alternatives and navigate the complexities of the 24-hour foreign exchange market successfully. Keep in mind to at all times keep up to date on market circumstances, use a dependable time zone chart, and regulate your technique based mostly on real-time market dynamics. The foreign exchange market is dynamic and requires steady studying and adaptation.

Closure

Thus, we hope this text has offered worthwhile insights into Navigating the World Markets: A Complete Information to Foreign exchange Time Zone Charts. We thanks for taking the time to learn this text. See you in our subsequent article!