The Chart Of Accounts: The Spine Of Monetary Reporting And Enterprise Administration

The Chart of Accounts: The Spine of Monetary Reporting and Enterprise Administration

Associated Articles: The Chart of Accounts: The Spine of Monetary Reporting and Enterprise Administration

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to The Chart of Accounts: The Spine of Monetary Reporting and Enterprise Administration. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

The Chart of Accounts: The Spine of Monetary Reporting and Enterprise Administration

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

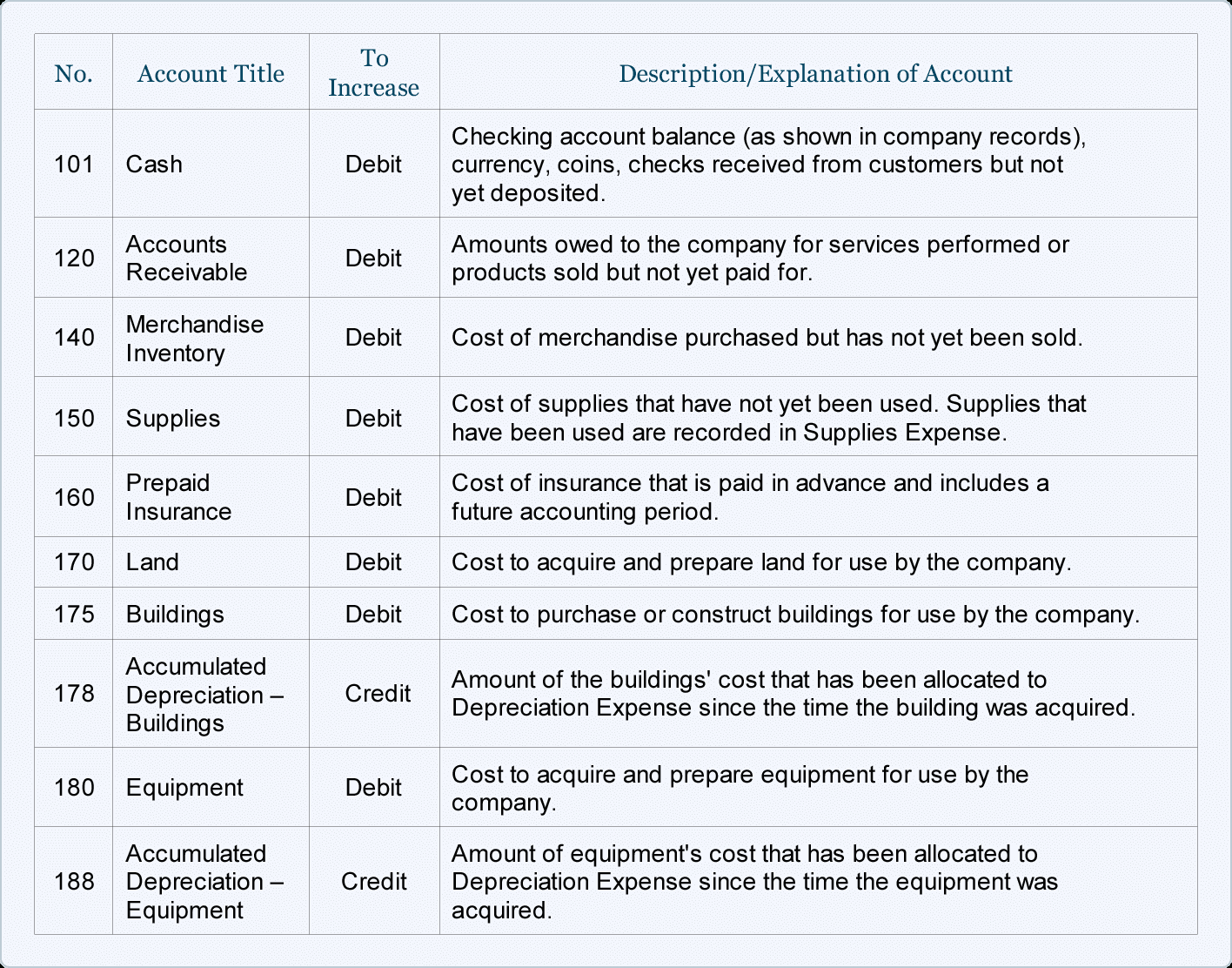

The chart of accounts (COA) is a basic part of any group’s monetary system. Greater than only a record of accounts, it serves as a structured framework for recording, classifying, summarizing, and reporting monetary transactions. Its objective extends far past easy bookkeeping; it is a important software for administration decision-making, regulatory compliance, and the general well being of a enterprise. This text delves into the aim of the chart of accounts, exploring its numerous capabilities and the implications of a well-designed versus a poorly designed system.

The Core Operate: Organizing Monetary Knowledge

At its most elementary stage, the chart of accounts organizes all monetary transactions into particular classes. Think about attempting to handle a enterprise’s funds and not using a systematic option to categorize bills like lease, salaries, utilities, and advertising and marketing. The ensuing chaos would make correct monetary reporting not possible. The COA offers this important construction, guaranteeing that each transaction is assigned to a selected account, permitting for correct monitoring and evaluation. This group is essential for:

-

Correct Bookkeeping: The COA ensures that every one transactions are correctly recorded, lowering the chance of errors and omissions. This accuracy is significant for producing dependable monetary statements.

-

Environment friendly Reporting: By grouping related transactions into particular accounts, the COA simplifies the method of producing monetary studies. As a substitute of sifting by way of hundreds of particular person transactions, accountants can shortly entry summarized data on income, bills, belongings, liabilities, and fairness.

-

Simplified Monetary Evaluation: The organized knowledge offered by the COA facilitates monetary evaluation. Managers can simply establish developments, examine efficiency throughout completely different intervals, and assess the monetary well being of the enterprise.

Past Fundamental Bookkeeping: The Broader Functions

The aim of the chart of accounts extends far past the essential capabilities of bookkeeping and reporting. A well-designed COA performs a significant function in:

-

Inside Management: A correctly structured COA contributes considerably to an organization’s inside management system. By establishing clear account classifications and authorization procedures, it helps stop fraud and errors. Segregation of duties, for instance, will be enforced by way of the COA construction, guaranteeing that no single particular person has full management over the recording and authorization of transactions.

-

Administration Determination-Making: The info organized by the COA is invaluable for administration decision-making. Managers can use this data to evaluate the profitability of various services or products, establish areas for price discount, and make knowledgeable selections about investments and useful resource allocation. Detailed breakdowns of bills, for instance, can reveal inefficiencies or areas the place prices will be optimized.

-

Regulatory Compliance: The COA is crucial for complying with numerous regulatory necessities. Tax authorities and different regulatory our bodies usually require particular account classifications and reporting codecs. A well-designed COA ensures that the group can simply generate the mandatory studies and adjust to all relevant rules. This contains adherence to Typically Accepted Accounting Rules (GAAP) or Worldwide Monetary Reporting Requirements (IFRS), relying on the jurisdiction.

-

Auditing: Exterior auditors rely closely on the chart of accounts to conduct their audits. A well-organized COA simplifies the audit course of, making it simpler for auditors to confirm the accuracy of monetary statements and assess the effectiveness of the group’s inside controls. A transparent and constant COA minimizes the effort and time required for auditing, resulting in price financial savings.

-

Benchmarking and Comparative Evaluation: The COA allows companies to benchmark their efficiency towards trade friends or opponents. Through the use of standardized account classifications, corporations can examine key monetary metrics and establish areas the place they will enhance their effectivity and profitability. This requires a constant and comparable COA construction throughout completely different entities.

Designing an Efficient Chart of Accounts:

The effectiveness of a chart of accounts relies upon closely on its design. A poorly designed COA can result in inaccurate monetary reporting, inefficient operations, and difficulties in complying with regulatory necessities. Key issues for designing an efficient COA embrace:

-

Business Finest Practices: The COA ought to align with trade greatest practices and related accounting requirements. This ensures consistency and comparability with different organizations in the identical trade.

-

Scalability: The COA ought to be designed to accommodate the group’s future development and enlargement. It ought to be versatile sufficient to deal with new merchandise, providers, and enterprise segments.

-

Simplicity and Readability: The COA ought to be easy and straightforward to know for all customers, together with accountants, managers, and different stakeholders. Clear and concise account descriptions are important.

-

Degree of Element: The extent of element within the COA ought to be applicable for the group’s dimension and complexity. A small enterprise might require a less complicated COA than a big multinational company.

-

Common Evaluation and Updates: The COA ought to be commonly reviewed and up to date to replicate modifications within the group’s enterprise operations and regulatory necessities. This ensures that the COA stays related and efficient over time.

Penalties of a Poorly Designed COA:

A poorly designed COA can have vital destructive penalties, together with:

-

Inaccurate Monetary Statements: This may result in poor decision-making, missed alternatives, and even authorized liabilities.

-

Inefficient Operations: A complicated and disorganized COA could make it tough to trace bills, handle budgets, and monitor efficiency.

-

Regulatory Non-Compliance: This can lead to penalties, fines, and authorized motion.

-

Elevated Audit Prices: A poorly designed COA can considerably improve the time and price related to audits.

Conclusion:

The chart of accounts is way over a easy record of accounts; it’s the spine of a company’s monetary system. Its objective extends past fundamental bookkeeping to embody inside management, administration decision-making, regulatory compliance, and strategic planning. A well-designed COA is crucial for correct monetary reporting, environment friendly operations, and the general success of any group. Investing time and assets in creating and sustaining a sturdy and well-structured chart of accounts is a vital step in guaranteeing the monetary well being and stability of any enterprise. Common evaluation and adaptation are key to sustaining its effectiveness and relevance in a always evolving enterprise atmosphere.

Closure

Thus, we hope this text has offered priceless insights into The Chart of Accounts: The Spine of Monetary Reporting and Enterprise Administration. We thanks for taking the time to learn this text. See you in our subsequent article!